Market Update

Global Logistics Update: November 7, 2024

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Global Logistics Update: November 7, 2024

Trends to Watch

This week’s global logistics market update starts with a new era for America — As President-elect Donald Trump prepares to impose new tariffs on imports, learn what to expect under the new U.S. administration in 2025, what’s at stake for U.S. trade policies, and our advice for Flexport customers in our latest blog.

[Canada Operations]

- Labor disputes have halted operations at major Canadian ports, including those in British Columbia and the Port of Montreal.

- On November 4, the BC Maritime Employers Association (BCMEA) locked out over 700 members of the International Longshore and Warehouse Union (ILWU) Local 514.

- Meanwhile, nearly 1,200 dockworkers at the Port of Montreal, represented by CUPE Local 375, went on strike on October 31.

- Most cargo will not be diverted to the Canadian East Coast as Montreal terminals are also facing strike action impacting 40% of inbound volumes. We may see vessels shift around their port of destination string stops to prioritize U.S. West Coast ports first to try and wait out the BC lockout.

- Read our blog for the latest developments, and to learn more about the impact on various modes of transport across North America.

[Ocean - TPEB]

- Demand volume remains elevated post-Golden-Week and has now stabilized at a higher level.

- The East Coast continues to experience tighter space availability compared to the West Coast, with rates from China-based ports to the West Coast showing a decrease, while East Coast rates remain steady.

- Fixed rates and Peak Season Surcharges (PSS) remain unchanged as we move into the first half of November.

[Ocean - FEWB]

- The first half of November sees tight space availability due to blank sailings and roll pools carried over from late October. Void sailings will continue into the second half of November, with carriers planning a General Rate Increase (GRI) of $5,400-$5,500 per FEU for this period.

- Some shipments are being postponed to avoid arrivals during the Christmas and New Year holidays in Europe. Should it persist, this trend could significantly impact the GRI and market dynamics in the latter half of November.

- The Shanghai Containerized Freight Index (SCFI) rose by $215/TEU for week 45, reaching $2,442/TEU. Another increase is anticipated for week 46, reflecting the GRI for early November.

- While major Chinese ports have reported occasional equipment shortages, the situation remains manageable. For those requiring firm space with an earlier estimated time of departure (ETD) or specific service and transit times, premium options are still available.

[Ocean - TAWB]

- Demand in Northern Europe remains stable, with good utilization levels. However, some carriers are still seeking cargo for specific destinations. New York continues to be the top port in demand, with most carriers having overbooked vessels heading to this port.

- In the East Mediterranean, demand is stabilizing. Some carriers who implemented rate increases for November have either reduced or canceled them to align with market trends.

- In the West Mediterranean, demand is on the rise, with vessels fully utilized. Carriers have applied increases to floating rates for November.

[Air - Global] Mon Oct. 21 - Sun Oct. 27, 2024 (Week 43):

- Spot rate growth: Global air cargo spot rates experienced a +5% increase week-on-week (WoW) during the final week of October (week 43), driven by significant gains from key regions: Asia-Pacific (+3%), Europe (+7%), and Central and South America (CSA, +8%). The worldwide average spot rate reached US$2.93 per kilo, reflecting a +22% rise compared to last year. Combined spot and contract rates also climbed by +2% to US$2.67. Notable year-on-year (YoY) growth in spot rates included a +27% jump from the Asia-Pacific and a substantial +78% increase from the Middle East and South Asia (MESA), signaling strong demand and limited capacity in these markets.

- Tonnage patterns: Global air cargo tonnages remained relatively flat WoW, but were +4% higher than the same period last year, showing steady recovery after disruptions from China’s Golden Week. Preliminary October data shows a +7% YoY increase in tonnages. Though this is a solid rise, it falls short of the double-digit growth seen earlier in the year, partly due to a strong October 2023, which was driven by a surge in ecommerce.

- Regional market dynamics: Performance in the Asia-Pacific was mixed. While tonnages from the Asia-Pacific to Europe saw a slight +1% WoW rise in week 43, chargeable weight from China to Europe declined by -4% WoW, returning to levels seen in the same period last year. In contrast, Hong Kong to Europe tonnages were +29% higher YoY, despite a small -1% dip WoW. Taiwan (+32%) and Thailand (+30%) also posted strong growth in tonnages to Europe, reflecting robust demand across the region. Spot rates from Hong Kong to Europe rose to US$5.33 per kilo in week 43—their highest level this year, up +18% YoY, indicating sustained demand.

- Transpacific market trends: The transpacific market (Asia-Pacific to the USA) rebounded to pre-Golden-Week levels in week 43, except for China to USA routes, which remained weak. Tonnages from China to the USA were -20% below pre-Golden-Week levels and -19% lower than last year’s equivalent week, indicating softer demand from China. However, spot rates in the region increased significantly, with Asia-Pacific to USA rates averaging US$6.14 per kilo in week 43, up +39% YoY. China to USA spot rates also rose to US$5.13 per kilo, a +14% YoY increase, showing strong pricing despite lower volumes.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

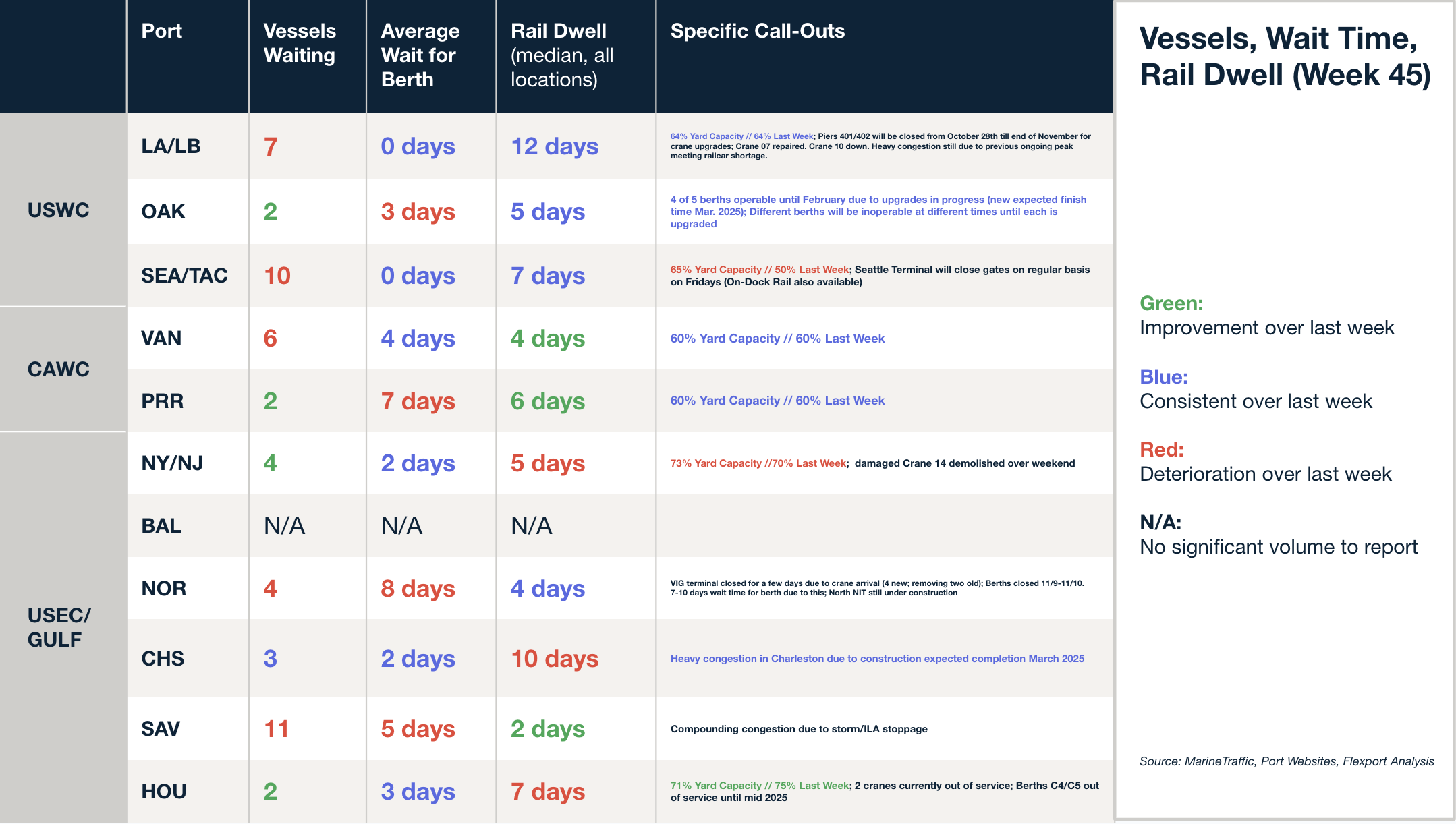

North America Vessel Dwell Times

Webinars

North America Freight Market Update Live

Thursday, November 14 @ 9:00 am PT / 12:00 pm ET

This Week in News

Trade Sector Eyes a New Wave of Tariffs Under Trump

Under a second Trump administration, new tariffs could reshape global supply chains and accelerate shifts away from China. Trump has proposed tariffs of 10-20% on all imports and 60% on Chinese goods, potentially raising prices for U.S. consumers. Flexport CEO Ryan Petersen noted that in the past, businesses have stockpiled goods ahead of tariffs, driving up shipping rates. While many companies are moving production to countries like Vietnam and Mexico, Petersen emphasized that China’s manufacturing capabilities remain hard to replicate, making it likely that many will continue sourcing from there despite tariffs.

Carriers revamp services amid port congestion in Mexico, Central America

Ocean carriers are experiencing major delays at ports in Mexico and Central America due to high trade volumes and congestion. In response, CMA CGM and Maersk are adjusting service routes and implementing surcharges to maintain reliability. Key ports like Acajutla, Corinto, and Manzanillo face severe delays, prompting carriers to reshuffle operations and revise transit times. Other carriers, including Hapag-Lloyd and ONE, also report disruptions, with reduced productivity and extended wait times impacting schedules.

U.S. Chip Toolmakers Move to Cut China From Supply Chains

The U.S. semiconductor industry is cutting ties with Chinese suppliers due to government directives aimed at limiting China's role in critical technology. Major chip toolmakers like Applied Materials and Lam Research are urging vendors to find non-Chinese alternatives, which could raise costs. This move aligns with broader efforts by the U.S., Japan, and Europe to reduce dependency on China, while China is pushing out U.S. technology in response.

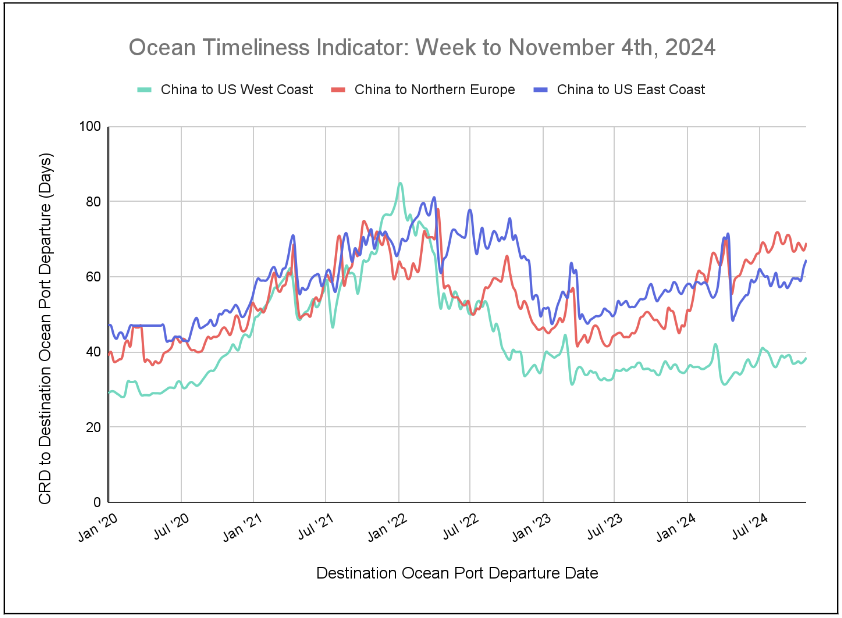

Flexport Ocean Timeliness Indicator

This week, the Flexport OTI has shown increases across all trade routes.

Week to November 4, 2024

This week, the Ocean Timeliness Indicator (OTI) has shown increases across the board: by one day for China to the U.S. West Coast, rising from 37.5 to 38.5 days, and by two days for China to North Europe and China to the U.S. East Coast, shooting up from 67 to 69 days and 62.5 to 64.5 days, respectively.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.