Market Update

Freight Market Update: November 28, 2018

Ocean, trucking, and air freight rates and trends for the week of November 28, 2018

Freight Market Update: November 28, 2018

Want to receive our weekly Market Update via email? Subscribe here!

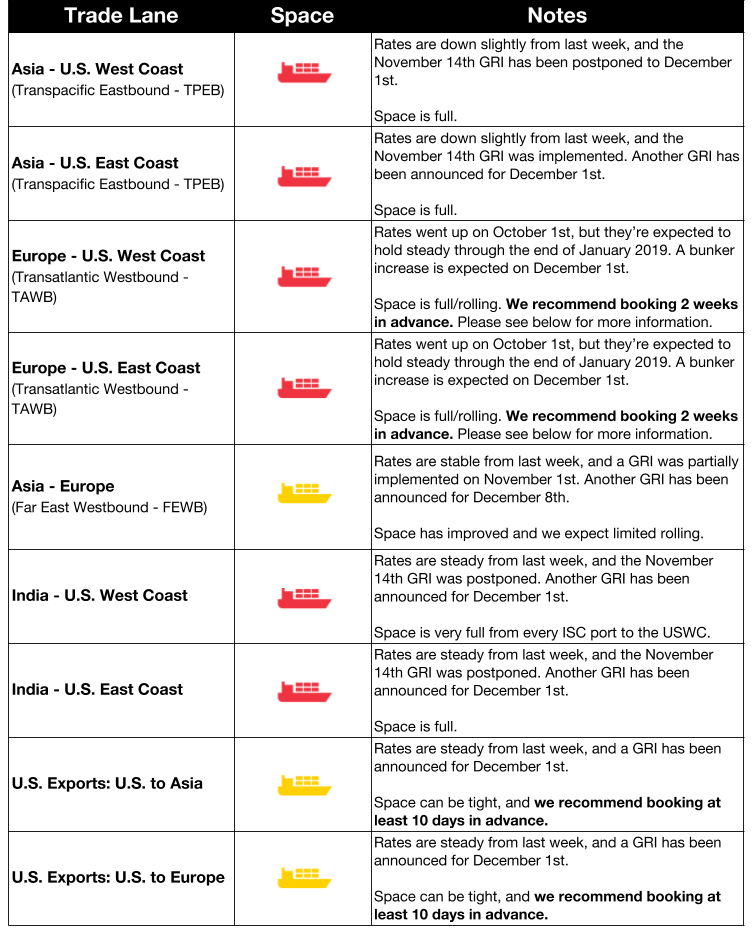

Ocean Freight Market Updates

UK Ports Remain Extremely Congested

UK ports are very congested, which is causing tight trucking capacity and a decline in port productivity. The tight congestion is expected to continue through late January when Chinese New Year cargo will arrive.

Low water levels on European waterways are also making barge transportation difficult, forcing cargo to move via truck and rail which further constricts those services. A Sunday driving ban may be waived in an effort to avoid fuel shortages.

Hapag-Lloyd to Add Premium Offerings

Hapag-Lloyd will begin to offer a choice between standard and premium products on some of its service offerings as part of their 2023 strategy. Customers have not taken advantage of premium product offerings in the past, but the carrier has collected market research that suggests customers will now be willing to pay more for better service.

Maersk to Add Feeder Vessels

A.P. Moller-Maersk will add 10 small container vessels to their fleet, adding capacity for about 2,200 containers. These feeder vessels will operate at ports that are either too small or don’t have enough volume for full-size container vessels.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions to 0.5% from 3.5%.

Whether they upgrade their vessels or their fuel, carriers will need to undertake significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Rates may climb between now and 2020 as a result.

Beginning on March 1, 2020, IMO is banning vessels from carrying high-sulfur fuel (fuel with a sulfur content higher than 0.5%) unless the vessel has a scrubber to clean the fuel. Taiwan’s seaports will begin enforcing this regulation in 2019, ahead of the IMO.

Scrubbers have begun to sell out in preparation of IMO 2020, and current estimations say that only 1,550 of 60,000 vessels in the global shipping fleet will have them installed.

Carriers may also choose to practice slow-steaming (reducing vessel speed) to reduce fuel consumption, but this practice reduces carrier capacity by approximately 4%, according to one study.

Inefficient container vessels are being scrapped now in preparation of the 2020 regulations, which will necessitate changes to the charter market.

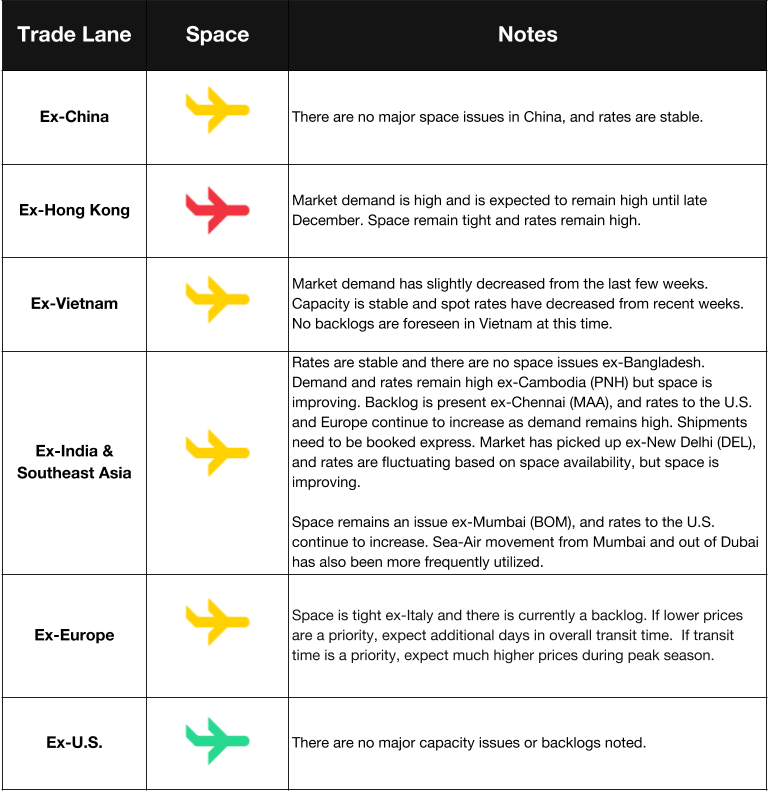

Air Freight Market Updates

Severe Congestion at Frankfurt Airport Calls for Innovation

The Board of Airline Representatives in Germany met to discuss how to address the congestion and high prices at Frankfurt airport during last year’s peak season. The German air freight community has called for more digitization and innovation at all German airports to make them more competitive, with a focus on Frankfurt.

Air Market to Benefit from Trade War

The air freight market stands to benefit from the trade war, as shippers tend to use more air in chaotic trading environments. Manufacturers are also looking to move out of China ahead of the looming 2019 tariffs, and will need to use air instead of ocean to shorten that created gap in their supply chain.

Trucking Market Updates

**FedEx and UPS to Electrify Fleet **

FedEx will add 1,000 electric delivery vans to its fleet over the next two years as a response to continued pollution regulations and volatile fuel costs. UPS is also planning to roll out 1,000 electric and hybrid vehicles in the future.

Trailer Demand Outpaces Supply

New trailer orders have set all-time records in the past couple months as ecommerce boosts delivery demand and tariff threats increase volume. Retail dealers are currently selling out, and manufacturers are facing tariffs on production materials like aluminum and steel in 2019, further complicating the future of the business.

UK Trucking Faces Number of Critical Issues

The Road Haulage Association (RHA) warns that ignoring the current trucking problems will lead to disaster for the market in the future. A shortage of truck drivers, high costs to train new and younger drivers, and constricting regulatory practices are stifling the UK trucking market and will lead to a “catastrophic cocktail of disaster” if not addressed. Trucking currently needs to be booked 15 days in advance.