30.11.2023

The Carbon Border Adjustment Mechanism: What Is It and How To Stay Compliant

The Carbon Border Adjustment Mechanism: What Is It and How To Stay Compliant

On October 1, 2023, the European Union (EU)’s new Carbon Border Adjustment Mechanism (CBAM) came into effect. If you are importing products into the EU, especially those with steel, iron, or aluminum, then read on to learn what your obligations are and how to meet compliance.

What Is CBAM?

The CBAM is an environmental policy designed to account for the greenhouse gas emissions of goods that are produced outside the EU and then imported into the region. It addresses “carbon leakage,” thereby creating a more level playing field for EU companies that produce locally and must comply with stringent emissions regulations. CBAM complements the EU’s broader Emissions Trading Scheme (ETS) and currently applies to a limited set of energy-intensive, high-emission industries.

During the CBAM transitional period, importers of certain products must disclose the embedded emissions of each product that falls under CBAM as well as any carbon price paid in the locale where the good was produced. After the transitional period is the definitive period, in which importers will need a CBAM obligation for each product in the form of certificates. These certificates are purchased at the average price of EU ETS allowances for every CBAM good imported into the EU.

What Products Are Impacted by CBAM?

CBAM-relevant products are goods currently imported into the EU that fall under the following categories as designated by the products Common Nomenclature (CN) code:

- Cement

- Iron and steel

- Aluminum

- Fertilizers

- Hydrogen

- Electricity

Not all goods under these categories are subject to CBAM, so it’s important to refer to the specific CN codes.

Important Dates To Remember

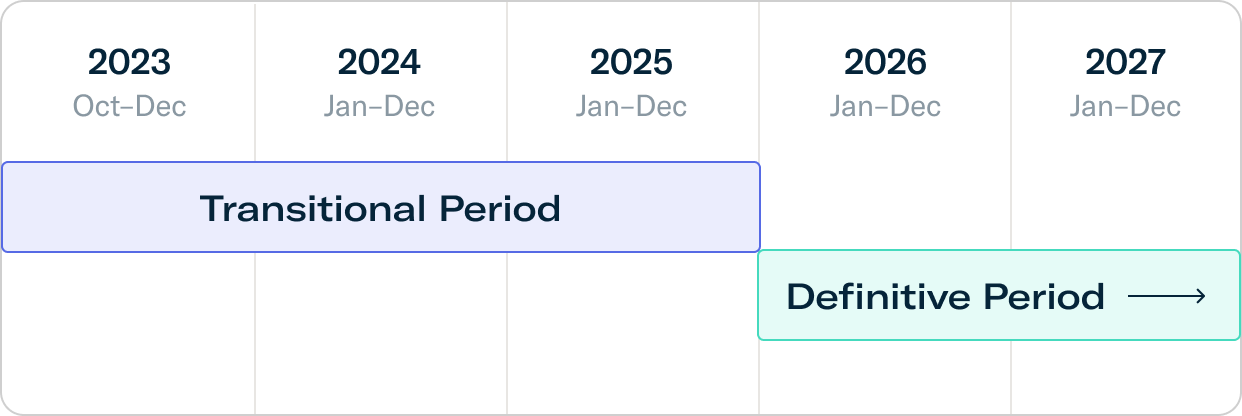

CBAM is split into two phases, the transitional phase and the definitive phase.

Transitional period: October 1, 2023 to December 31, 2025

Designed as a “learning phase,” CBAM importers will report quarterly on emissions embedded in their goods. No certificate purchases are required during this time, however, penalties may be imposed for failure to comply with reporting.

Definitive period: January 1, 2026 onwards

From 2026 to 2033, the embedded emissions for CBAM goods will be gradually covered by the CBAM obligation and require purchasing certificates.

What Do I Need To Report During the Transition Period?

EU Importers of CBAM-relevant goods must submit a report quarterly. This report will include information on the goods imported during that quarter of the year and should be submitted no later than one month after the end of that quarter. The report must include the following, inter alia (see Article 35 of the CBAM Regulation):

- Quantity of imports per customs procedure

- Combined Nomenclature (CN) codes of goods

- Country of origin

- Installation where goods were produced

- Production methods and qualifying parameters

- For steel goods, the ID of the steel mill for the batch of steel goods

- Direct and indirect embedded emissions pertaining to the goods imported (at both a product and installation level)

- Carbon price due in the country of origin, including reference to the legal act governing the carbon price and the number of emissions covered by any free allocations, rebates, or other forms of compensation

Reporting must be done via the Transitional Registry. See the European Commission’s CBAM website for additional guidance and templates for reporting.

Flexport and CBAM

CBAM reporting requires emissions data and familiarity with material sourcing and manufacturing methods for each unique product imported into the EU. Upstream production and manufacturing emissions are out of scope for Flexport’s emissions calculator, which measures transportation emissions for your shipments. To assist you in your reporting, we’ve compiled resources available below. If you have other concerns relating to customs on your imports, please get in touch with one of our dedicated Customs Brokers.

For further information on CBAM reporting, see the resources below. Flexport assumes no responsibility when using these resources and does not endorse or receive commission from any of the companies below:

- European Commission - Carbon Border Adjustment Mechanism: Questions and Answers

- European Commission - Carbon Border Adjustment Mechanism Fact Sheet

- European Commission - Taxation and Customs Union - Carbon Border Adjustment Mechanism (contains guidance, templates, and useful links for reporting)

- European Commission - CBAM Transitional Registry

- Cbamboo - organization assisting with reporting obligations

The contents of this report are made available for informational purposes only and should not be relied upon for any legal, business, or financial decisions. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

Related Content

![UNHCR header GettyImages 1600x800]()

Blog

How Flexport.org and USA for UNHCR Provide Life-Saving Assistance to Displaced People Around the World