15.06.2023

Stay in the Know With Flexport’s Freight Market Updates Newsletter

Stay in the Know With Flexport’s Freight Market Updates Newsletter

Did you know Flexport is more than a leader in logistics technology, we also have a newsletter full of useful bites of information about the current global freight market and logistics world? It’s called Freight Market Updates (FMU) and it comes out weekly. Below you’ll find a taster of the sorts of information we’re talking about over in the FMU—taken from this week’s edition so it’s all fresh—to get the full buffet you can subscribe using the widget to the right, or you can subscribe to the LinkedIn version from the Flexport LinkedIn page.

Trends To Watch:

- [Ocean - TAWB] Rates continue to decline as demand remains low and capacity open. Expect this trend to continue beyond Q2’23. This situation means that equipment is widely available in all major European ports—congestion has decreased in both US and Europe, speeding the turnaround of containers and leading to wider equipment availability.

- [Air - Asia] An increase in passenger capacity for the summer schedule is keeping overall capacity (freighter + passenger) relatively stable, along with average rates. The spot market is increasing as carriers and forwarders are less desperate to fill their empty space.

- [Trucking - U.S. Domestic] The Outbound Tender Reject Index (OTRI) remains at a record low—consistent with the lows seen during the early COVID-19 lockdowns—indicating sufficient capacity to meet demand and that carriers are prioritizing contract freight.

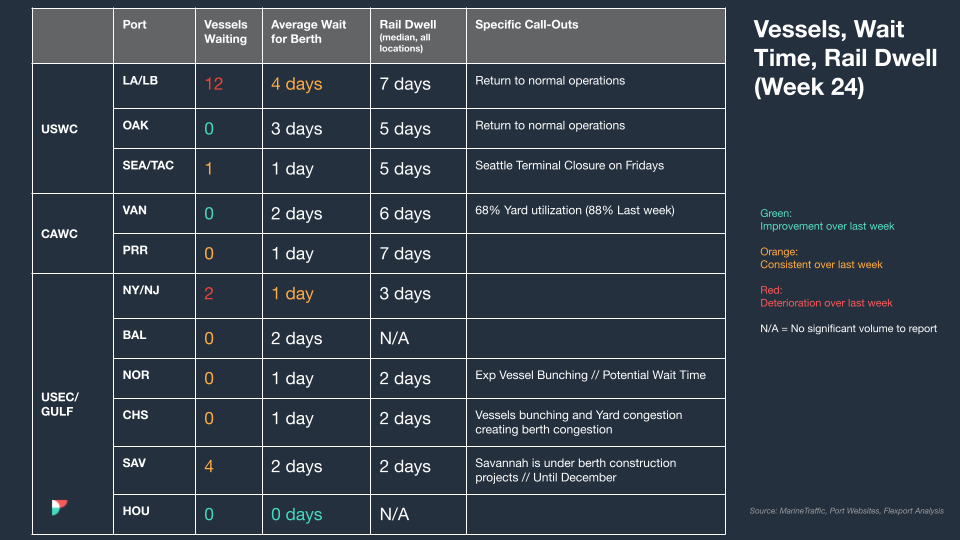

North America Vessel Dwell Times:

This Week in News:

Unsnarled Supply Chains Appear To Help Ease Goods Inflation

Using updated data from the White House Council of Economic Advisors, this brief article dives into the supply chain forces involved in the current inflation situation. Drawing on the Federal Reserve Bank of New York’s Global Supply Chain Pressure Index (GSPCI), among other sources, their conclusion is that American consumers can likely look forward to having some economic breathing room in the coming months. For another dive into the GSPCI, see Flexport Research’s recent commentary piece, Are We There Yet? Tracking the Recovery in Global Supply Chains.

Read more news summaries like this in our weekly Supply Chain Snapshots

Past editions of FMU are available on our Market Updates page, to subscribe to FMU to get weekly doses of market info direct to your inbox, use the widget over on the right side of this page, or you can follow the newsletter on LinkedIn via our page. There’s a link at the bottom of every edition to send us feedback, so if there’s a piece of supply chain data that’s critical to your business, send us a note, we’d love to hear from you.