Logistik-Prozesse, passend zu Ihren Produkten und Anforderungen: die neue Realität auf der Flexport Plattform. Beispiellose Visibility und Kontrolle für Sie, Ihre Partner und Lieferanten – von der Bestellung bis zur Auslieferung.

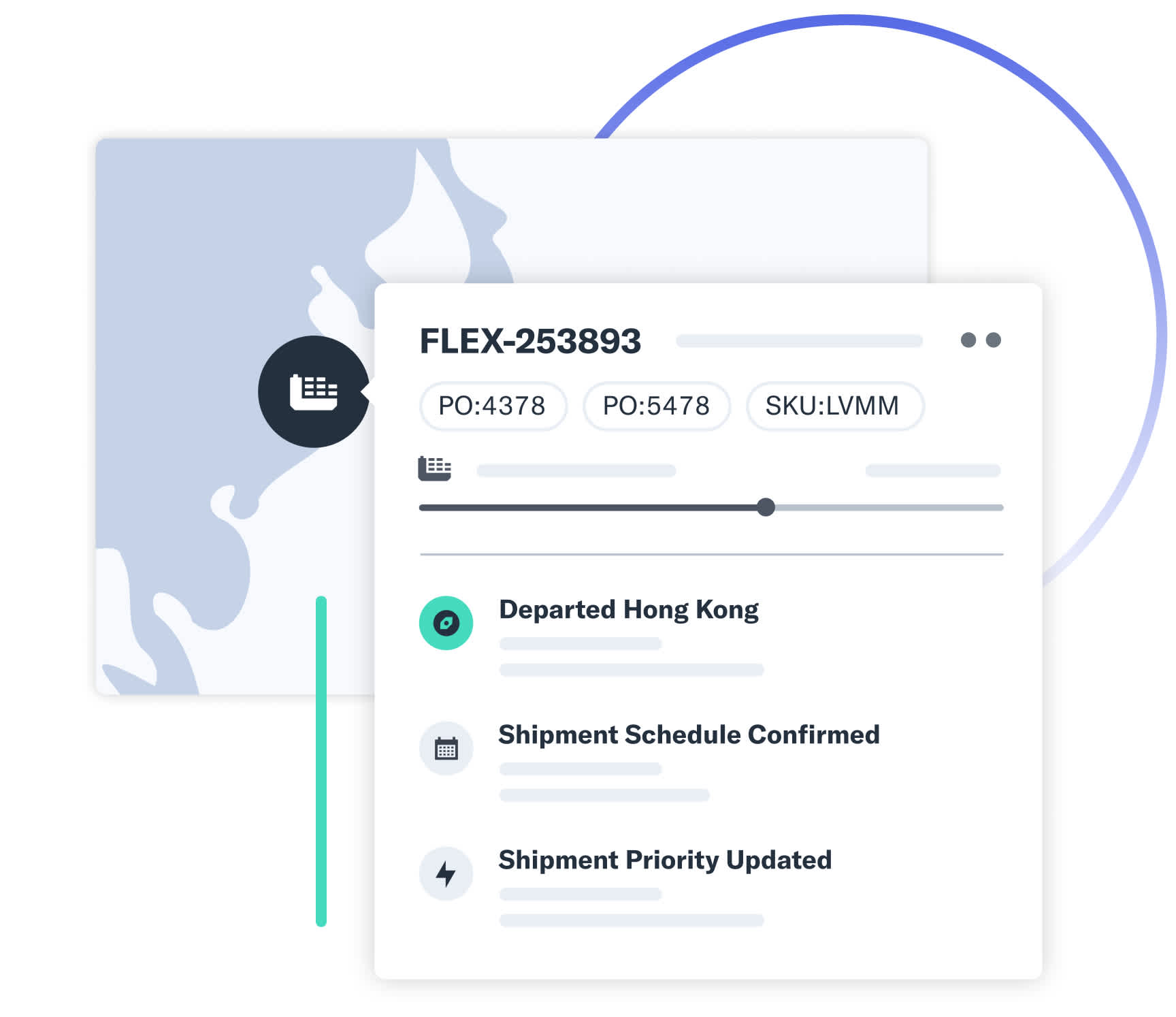

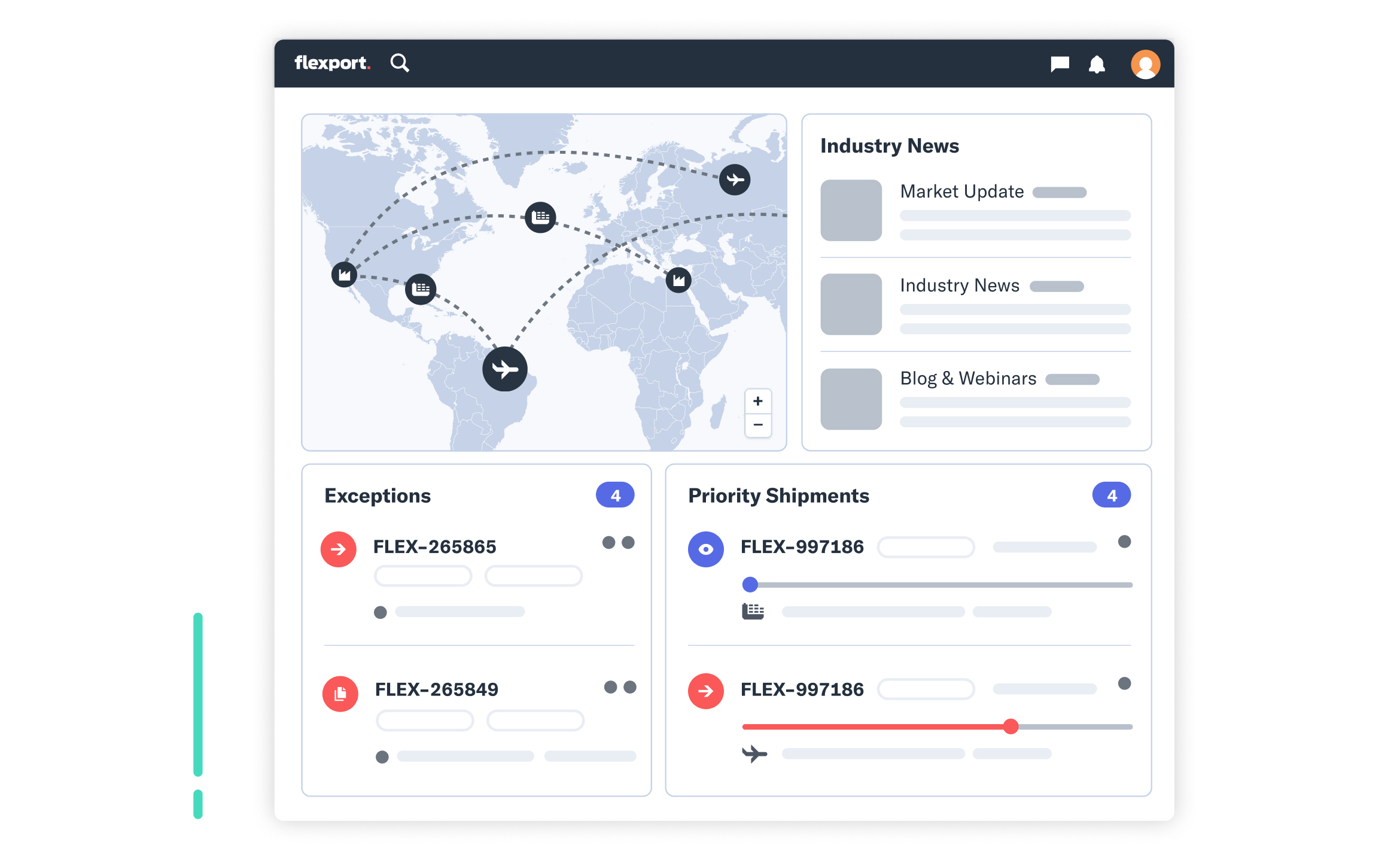

End-to-End Tracking

Verfolgen Sie Ihre Ware auf dem See-, Luft- und Landweg. Sehen Sie wichtige Updates, Ausnahmen, Landed Costs und Ihren Warenbestand auf einen Blick.

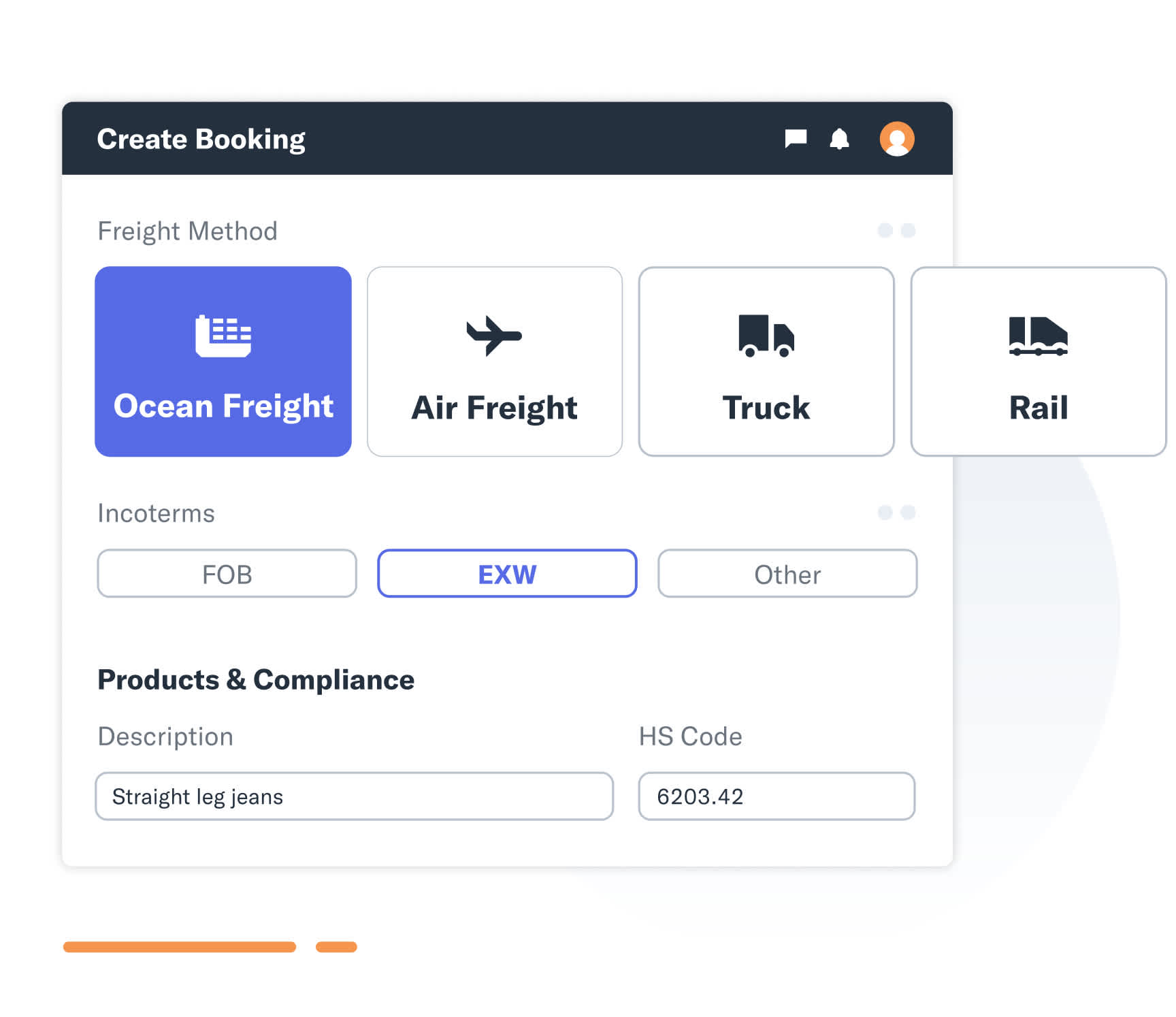

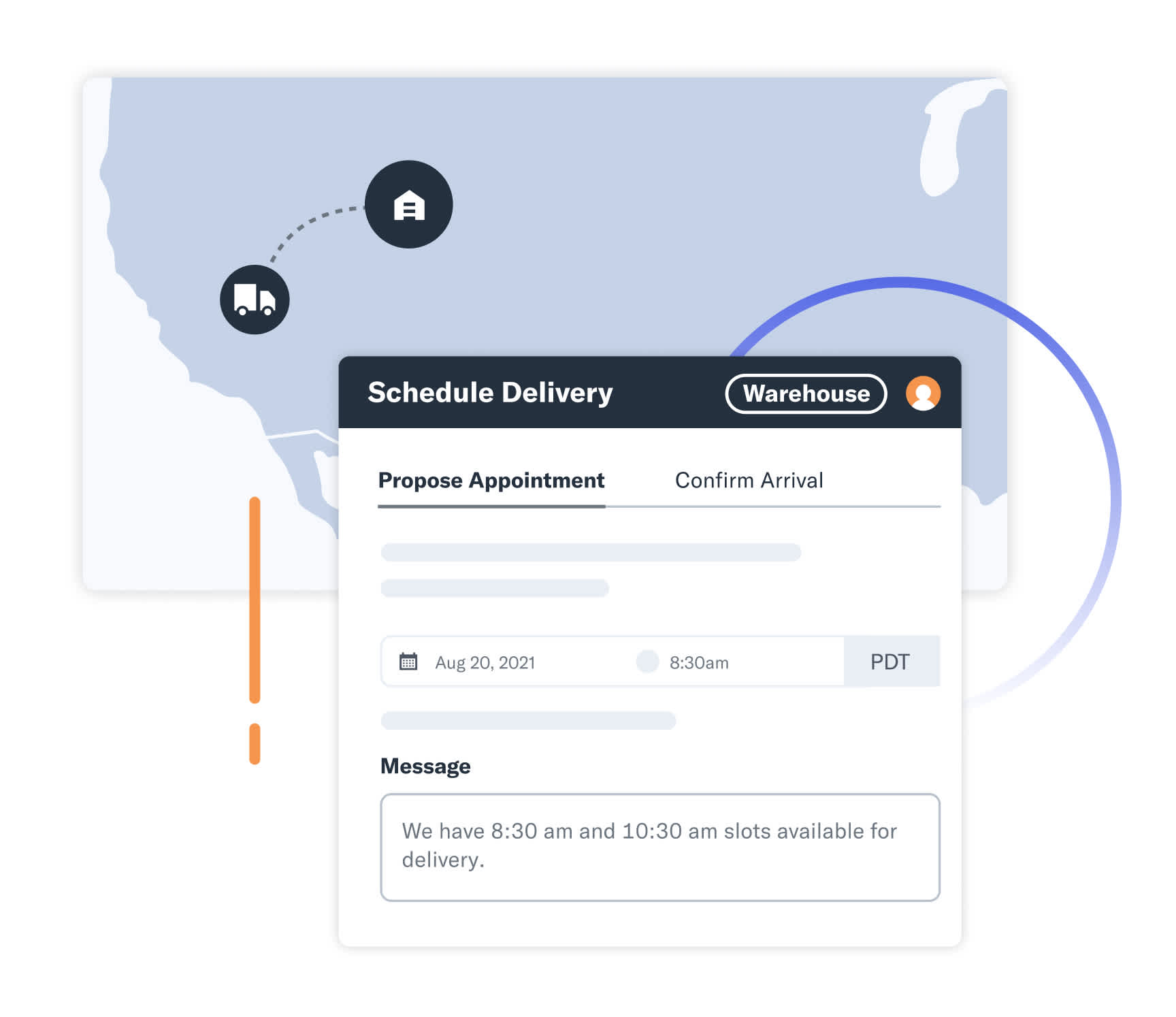

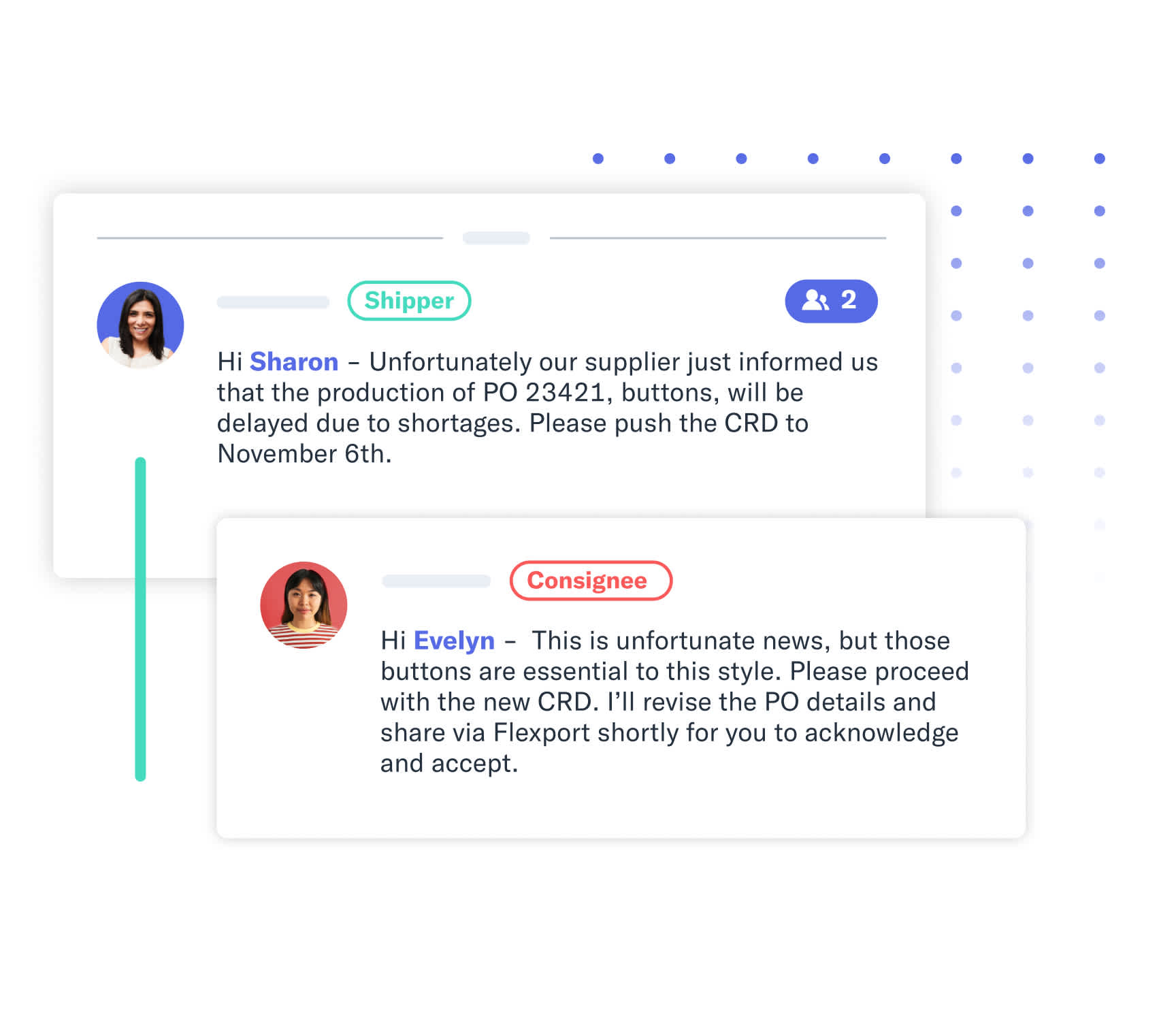

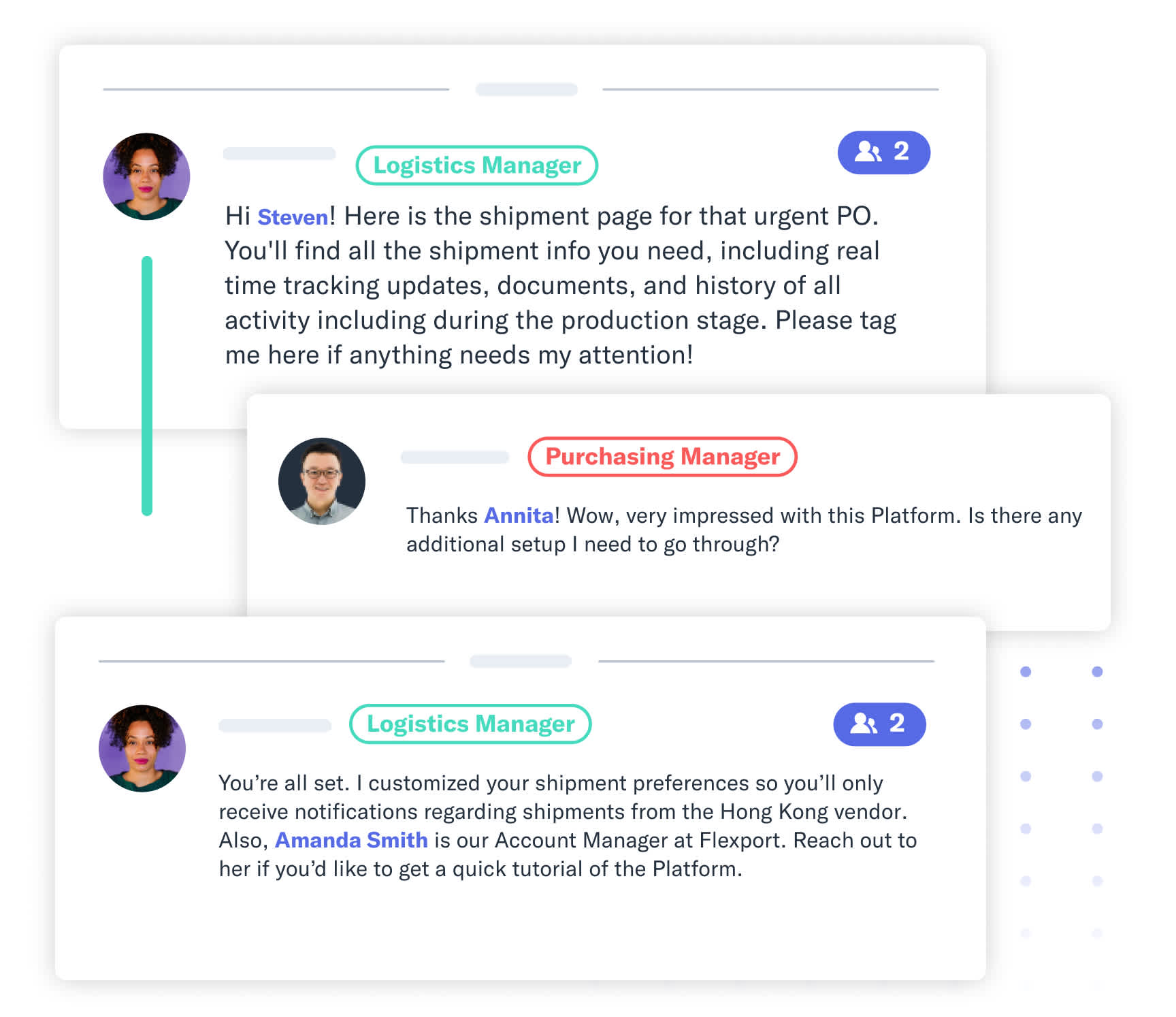

Optimierte Workflows

Arbeiten Sie in Echtzeit mit Ihren Partnern zusammen, bestellen und tracken Sie Ihre Ware oder stimmen Sie sich mit Ihrem Lager ab. Unsere Plattform beschleunigt die Arbeitsabläufe Ihrer gesamten Lieferkette.

Umfassende Insights für Ihre Lieferkette

Unsere Plattform speichert, schützt und strukturiert Ihre Daten. So sehen Sie wichtige Kenngrößen wie Transitzeiten, Landed Costs und Containerauslastung auf einen Blick.

Setzen auch Sie jetzt auf digitale Logistikprozesse

Suche

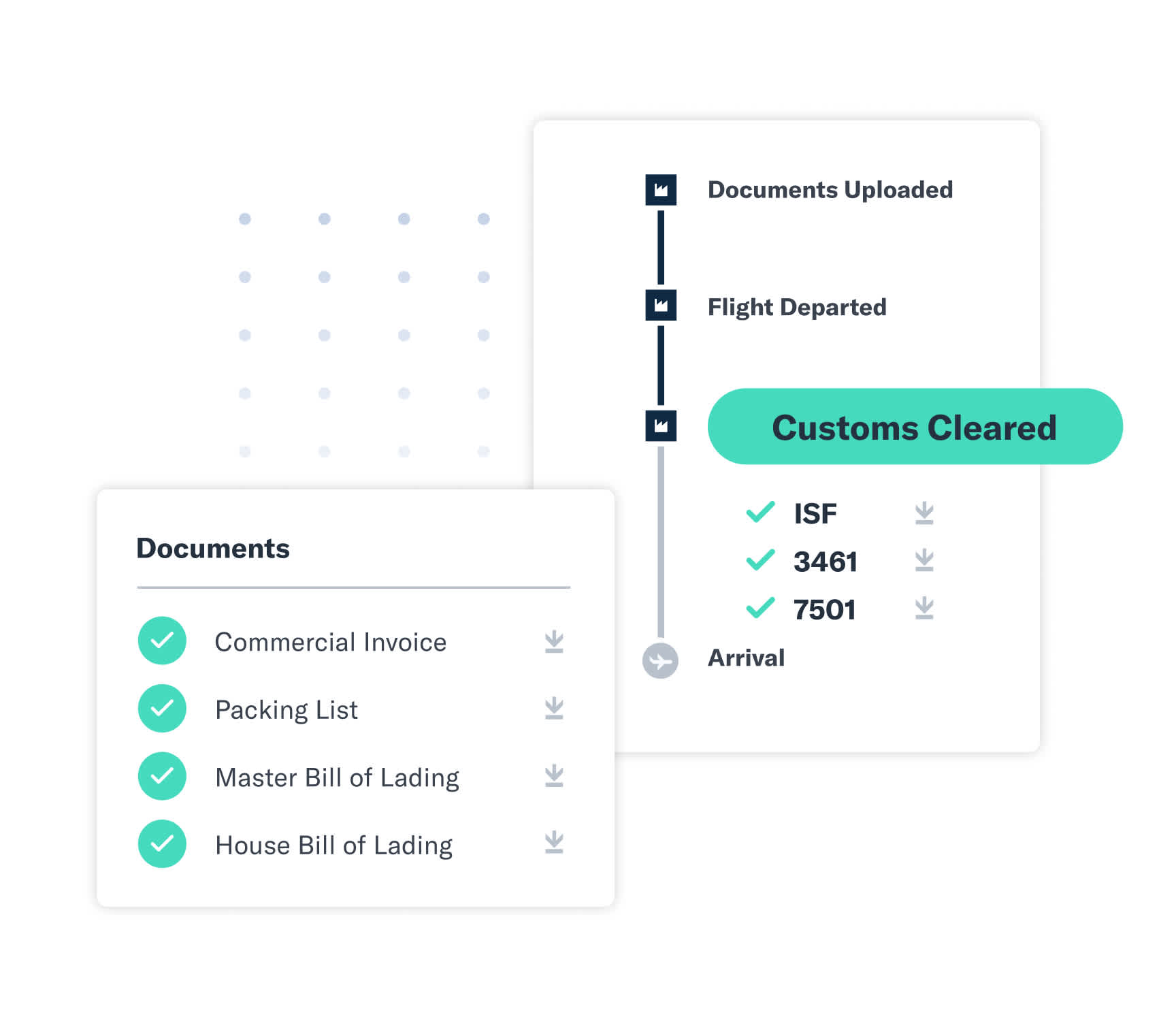

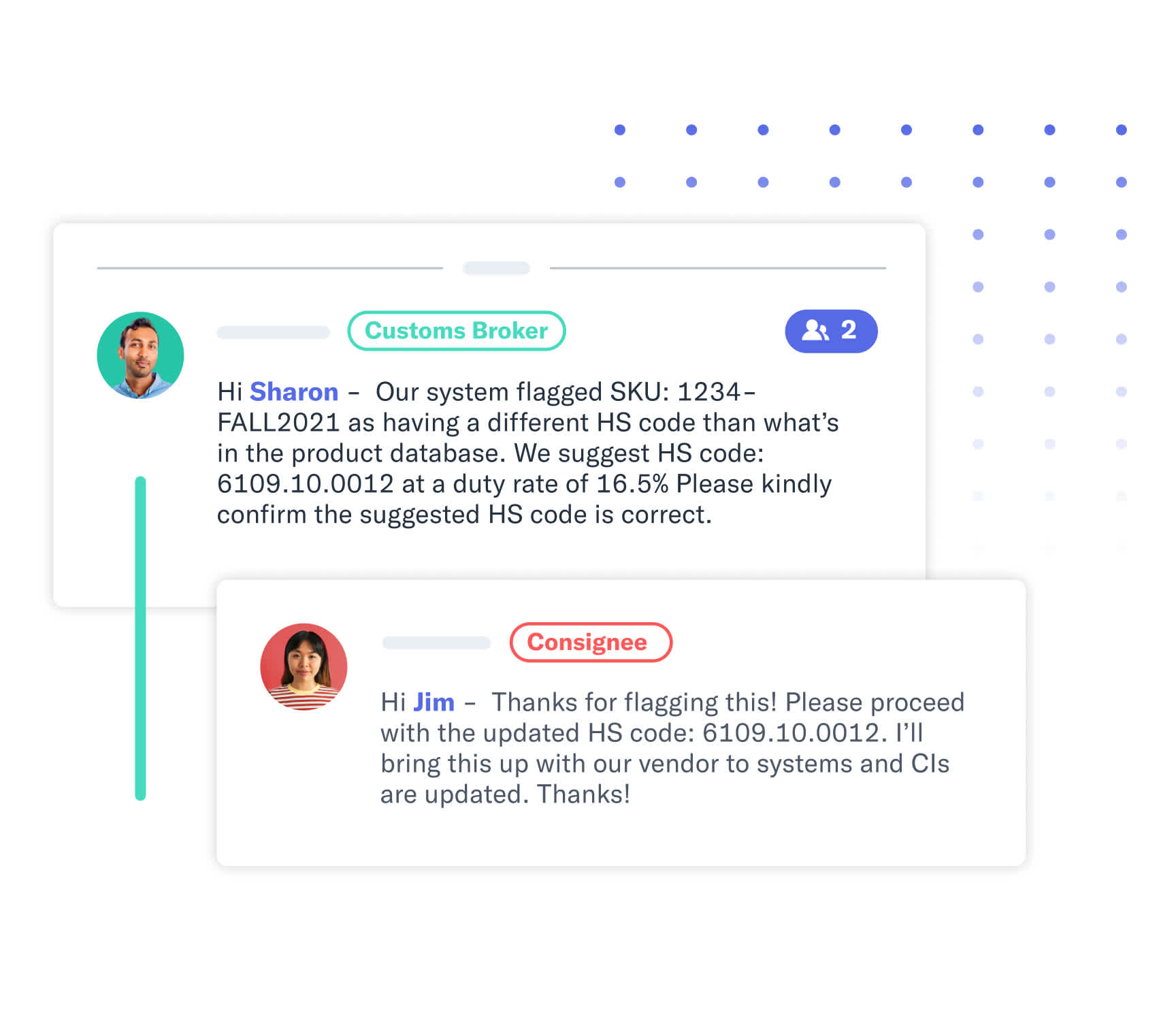

Alle Informationen - zentral an einem Ort

Speichern und digitalisieren Sie alle Handelsdokumente auf unserer Plattform. Suchen Sie nach SKU, HS-Code, PO oder benutzerdefinierten Tags und verlieren Sie keine Zeit mehr damit, in verschiedenen Systemen zu suchen.

91 % der Flexport Kunden bestätigen, dass sich ihre Teams dank der zentralen und von allen Akteuren genutzten Plattform leichter abstimmen können.*

Mit Flexport sparen unsere Kunden durchschnittlich 4 Arbeitsstunden pro Woche ein im Vergleich zu anderen Spediteuren. *Basierend auf einer TechValidate-Umfrage aus dem Jahr 2020 unter mehr als 200 Flexport-Kunden.

Im Durchschnitt haben Flexport Kunden 55 Plattform-Nutzer in ihrem Unternehmen - aus den Bereichen Supply Chain, Kundensupport, Finance und Vertrieb.

Schnittstellen

Verbessern Sie den Informationsaustausch

Unser stetig wachsendes Angebot an APIs ermöglicht eine vollständige Datentransparenz - von der Auftragserstellung bis zur Rechnungsstellung. Sparen Sie Zeit, reduzieren Sie Fehler und treffen Sie bessere Entscheidungen durch die direkte Datenintegration in Ihre Tools.

Optimieren Sie Ihre Prozesse. Einfach. Schnell. Digital.

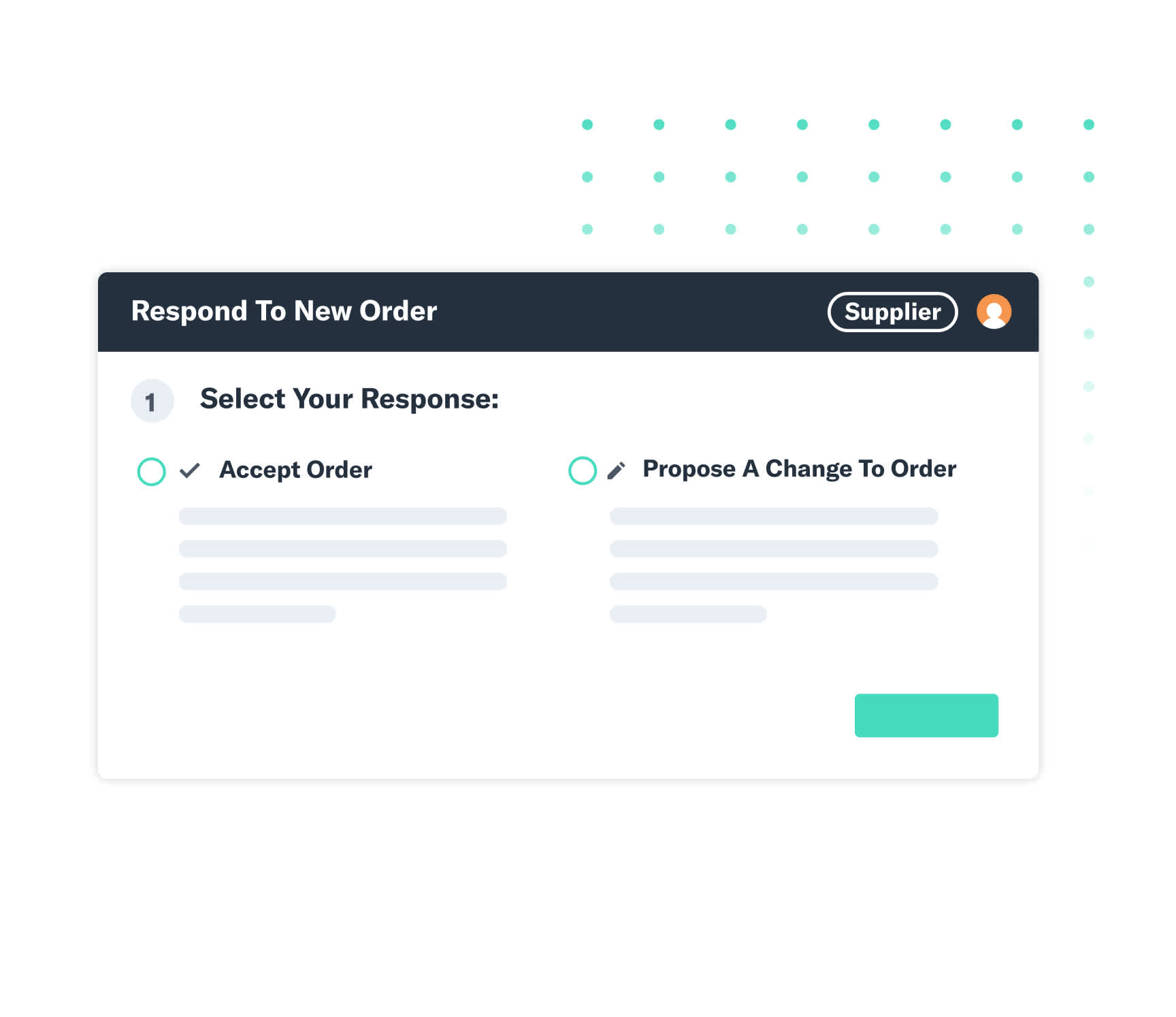

Order Management

Verbessern Sie gemeinsam mit Ihren Lieferanten die Genauigkeit, Transparenz und Abwicklung Ihrer Buchungen.

Klimaschutz

Erreichen Sie Ihre Nachhaltigkeitsziele und transportieren Sie zu 100 % klimaneutral.