Market Update

Global Logistics Update: October 3, 2024

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Global Logistics Update: October 3, 2024

Trends to Watch

[ILA Strike Watch]

- The International Longshoremen’s Association (ILA) has officially launched a coast-wide strike, shutting down major ports from Maine to Texas. Carriers have already started declaring force majeure for certain vessels.

- The ILA is seeking a $5-an-hour pay raise for each year of the new six-year contract, which would amount to a 77% pay increase over the new contract’s duration. The union is also firm in its opposition to automation.

- President Joe Biden released a statement on October 1, urging the USMX “to present a fair offer to the workers.”

- Get real-time updates on our live blog, and register for our upcoming webinar tomorrow (October 4) featuring CEO Ryan Petersen. He will discuss the latest developments on the ILA strike, its implications for global shipping and the U.S. economy, and strategies businesses can employ to swiftly adapt to this rapidly evolving situation.

- Flexport will continue to provide timely updates and work closely with our customers to minimize disruptions.

[Customs]

- U.S. Customs and Border Protection is continuing its normal operations.

- The CBP expects the trade community to comply with regulations despite the ongoing work stoppage and will process diversions as necessary due to cargo disruptions.

- To address issues related to the affected ports, CBP has also established an emergency operations command center in DC.

- For the latest alerts and updates, please refer to the CSMS page.

- CBP officials also recommend that trade members direct any specific inquiries to the Office of Trade Relations at tradeevents@cbp.dhs.gov.

[Ocean - TPEB]

- In response to the ILA strike, some beneficial cargo owners (BCOs) are shifting some of their volume to the U.S. West Coast (or via the U.S. West Coast) as a contingency plan. A few carriers are also considering implementing East Coast and Gulf Coast port surcharges for mid-October, should the ILA strike continue.

- Carriers have announced port congestion surcharges, detention and demurrage (D&D) indications, and terminal status updates post-Golden-Week. This could lead to further disruptions to operations, increased port congestion, and vessel deployment challenges for East Coast and Gulf Coast schedules. There may also be equipment shortages at origin, depending on the duration of the work stoppage.

- Floating rates have been extended to mid-October. Terminals have announced constraints on bookings to East Coast terminals via Los Angeles, leading to booking pauses by carriers.

- Fixed rates: Peak Season Surcharges (PSS) will remain unchanged through October, covering Golden Week.

[Ocean - FEWB]

- Demand is trending downward as China observes holidays, leading to increased vessel availability and carriers actively seeking cargo.

- Floating rates have continued to decrease in the first half of October. Spot pricing has remained steady for the past two weeks, influenced by the holiday slowdown. Carriers are now more proactive in adjusting rates to optimize vessel utilization.

- While equipment shortages are nearly resolved, some ports of loading (POLs) with fewer direct calls may still experience occasional shortages due to rerouting via the Cape of Good Hope.

[Ocean - TAWB]

- All carriers have announced disruption charges that will take effect if the work stoppage persists.

- Most carriers will implement these charges if the work stoppage continues through October 10, although Mediterranean Shipping Company (MSC) already implemented the charge on October 1st.

- Additionally, the Canadian Union of Public Employees (CUPE) Local 375 initiated a 72-hour strike at the Port of Montreal, which concluded on the morning of October 2nd. It impacted alternative routing through Canada.

- Meanwhile, U.S. West Coast services are continuing.

[Air - Global] Mon 16 Sep - Sun 22 Sep 2024 (Week 38):

- Global tonnage decline: In week 38 (16-22 September 2024), global air cargo tonnages dropped by -3% week on week (WoW), largely due to autumn festivals and national holidays in key markets such as China, South Korea, and Chile.

- The Asia-Pacific's major impact: The Asia-Pacific region saw a -6% WoW decline in tonnages, responsible for 73% of the global drop. This was driven primarily by a -33% WoW decline from South Korea (50% of the region's fall) and -6% WoW from China (30%), both impacted by mid-autumn festival holidays.

- Holidays in Central and South America: Central and South America (CSA) tonnages fell by -6% WoW, with Chile’s Independence Day holidays (18-20 September) driving a near -50% WoW drop in tonnages, contributing 12% to the global decline.

- Rates remain strong: Despite the tonnage drop, global rates stayed flat WoW, with notable increases from the Asia-Pacific (+1%) and the Middle East and South Asia (MESA, +4%). Spot rates from MESA surged +96% YoY, and Bangladesh-to-USA rates rose +213% YoY due to political and logistical challenges.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

North America Vessel Dwell Times

Webinars

Flexport Customs: Duty Optimization Through Tariff Engineering and HTS Classification

(Today) Thursday, October 3 @ 9:00 am PT / 12:00 pm ET

Navigating the ILA Strike: How to Stay Ahead of Disruptions

Friday, October 4 @ 8:00 am PT / 11:00 am ET

North America Freight Market Update Live

Thursday, October 10 @ 9:00 am PT / 12:00 pm ET

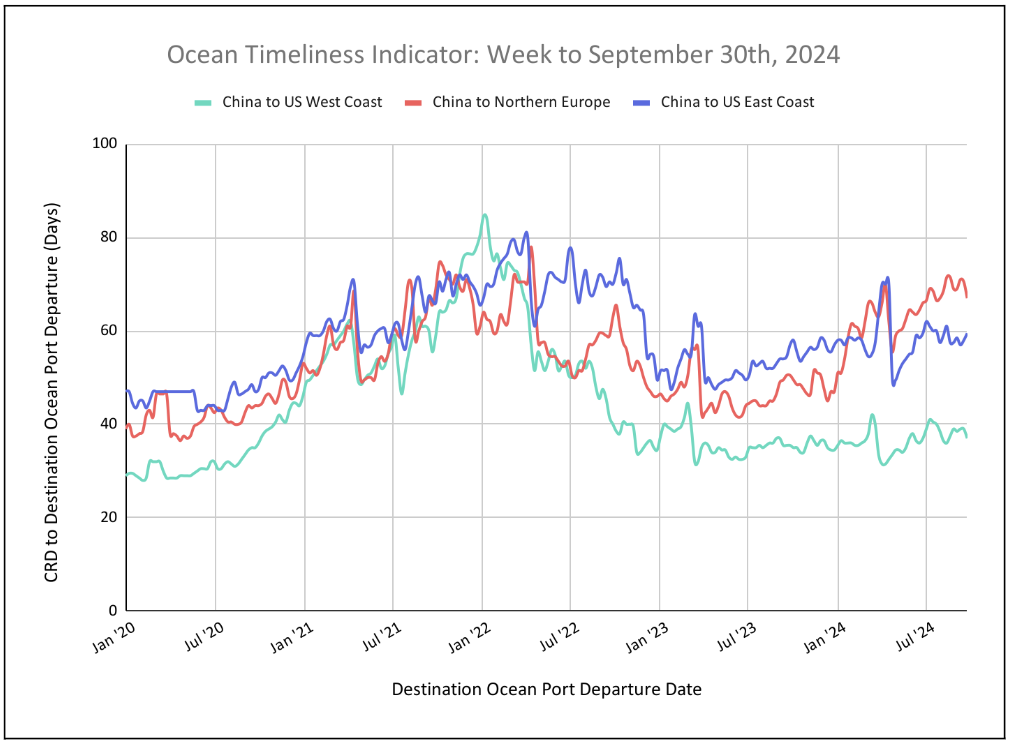

Flexport Ocean Timeliness Indicator

OTIs from China to the U.S. West Coast and China to North Europe have dropped significantly, while China to the U.S. East Coast increased.

Week to September 30, 2024

This week, the Ocean Timeliness Indicator (OTI) for China to the U.S. West Coast and China to North Europe have dropped from 39 to 37 days and 70.5 to 67 days, respectively. Meanwhile, China to the U.S. East Coast has increased from 58 to 59.5 days, with port strikes possibly leading to further increases in the coming weeks.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.