Market Update

Global Logistics Update: November 21, 2024

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Global Logistics Update: November 21, 2024

Trends to Watch

[Ocean - TPEB]

- Space tightness: Space availability on the West Coast, particularly in the Pacific Southwest, has improved due to additional loader capacity expected by the end of November. However, East and Gulf Coast rates remain stable as most service strings stay fully utilized through November.

- Rate trends: Floating rates on the West Coast remain manageable, while East Coast rates are holding steady. Carriers are beginning to focus on the upcoming General Rate Increase (GRI) for East Coast routes, with rates expected to adjust around December 1, pending final confirmation.

- Negotiation pressures: ILA negotiations and potential tariff actions remain the key sources of pressure on rates and capacity.

- Fixed rates and Peak Season Surcharges (PSSs): Fixed rates and PSSs are stable for the remainder of November.

[Ocean - FEWB]

- Space tightness: Space remains constrained in the second half of November due to blank sailings and a growing roll pool. Carriers have announced another GRI for December, with rates projected at $6,000–$6,200.

- Shanghai Containerized Freight Index (SCFI) trends: The SCFI dropped slightly by $29/TEU in Week 47, reflecting the extended FAK rates for 2H November. Another slight decline is expected before an increase aligned with December’s GRI.

- Equipment availability: While occasional equipment shortages persist at China’s main ports, the situation remains manageable. For shippers who need firm space on earlier estimated times of departure (ETDs) or specific service/transit times, premium options are available.

[Ocean - TAWB]

- Space constraints: Space remains tight in November and December across most carriers for both North and South Europe. New York remains the port in highest demand.

- Blank sailings: Planned blank sailings are expected in Weeks 47–52, primarily targeting the US Gulf and the US East Coast (USEC), with departures from both North Europe and the East Mediterranean.

- Equipment availability: Overall equipment availability looks good, with some shortages reported in Southern Germany.

- Rate trends: December rates are tracking in line with November trends.

[Air - Global]

- Capacity: Global air cargo capacity remained stable compared to the previous week, with no significant changes reported.

- Chargeable weight/tonnage: Worldwide chargeable weight flown in Week 45 was stable week-on-week (WoW), with small increases from Europe, Africa, and Central and South America (CSA) origins offset by decreases from North America and Middle East and South Asia (MESA) (both -4% WoW). Compared to last year, worldwide tonnages were up year-on-year (YoY) by just +2% in Week 45.

- Rates: Average global spot rates recorded a further +5% WoW rise in Week 45, taking them +24% above their levels at this time last year. Spot prices from the Asia-Pacific rose by +6% WoW to US$4.43 per kilo, Europe also exhibited a +6% WoW increase to $2.49 per kilo, and CSA rates rose by +10% to $2.04 per kilo. North America recorded a +5% increase to $1.83 per kilo, while Africa and MESA saw WoW falls of -4% and -2%, respectively.

- Year-on-year rate changes: Compared to the equivalent week last year, spot prices this year remain significantly elevated, notably from the Asia-Pacific (+25%), MESA (+70%), Europe (+14%), and CSA (+14%), with Africa also +10% higher and North America recording a +5% increase YoY.

Source: worldacd.com

Please reach out to your account representative for details on any impacts to your shipments.

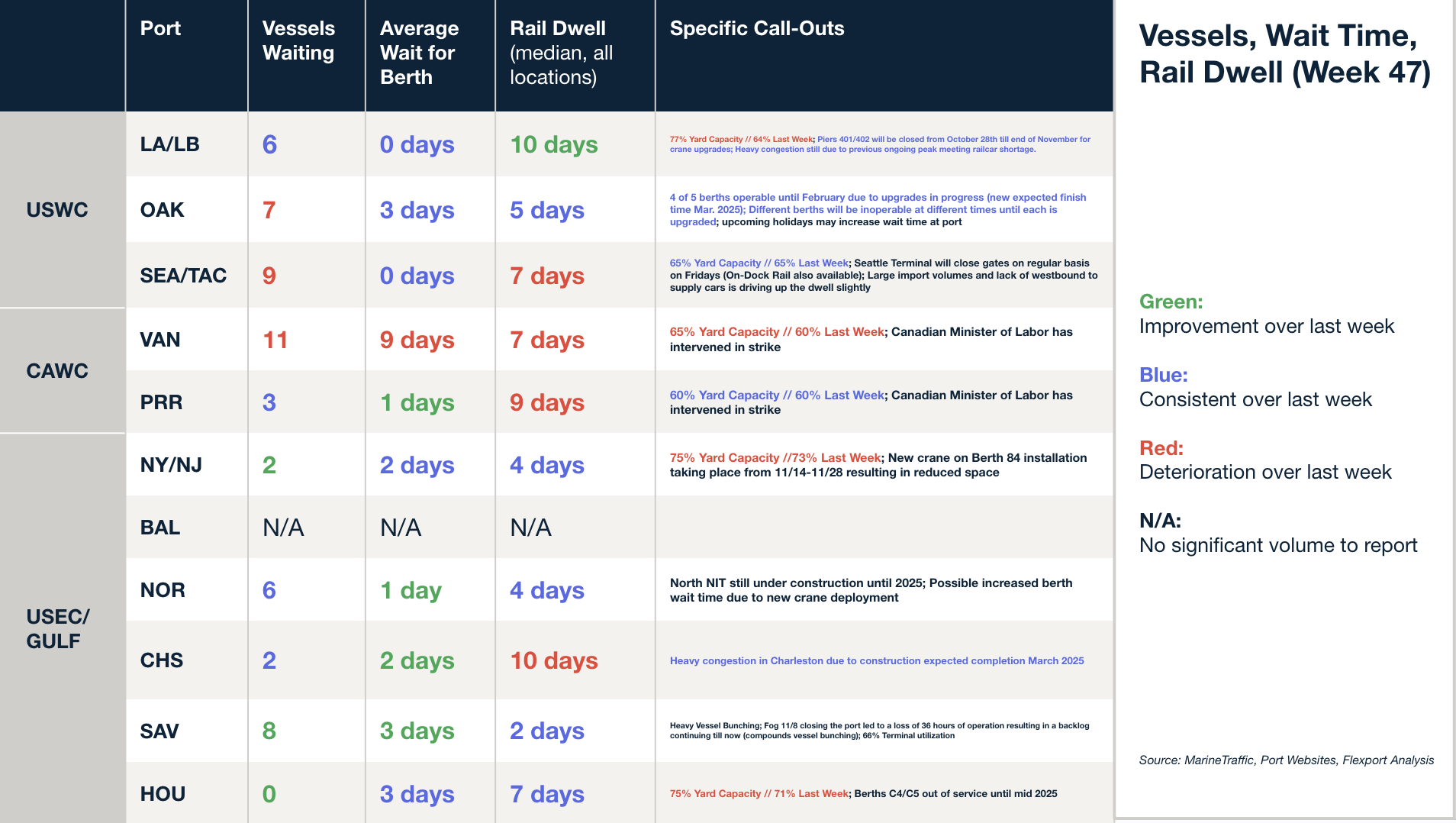

North America Vessel Dwell Times

Webinars

Air Market Predictions for 2025

Tuesday, December 3 at 8:00 am PT / 11:00 am ET / 16:00 GMT / 17:00 CET

Global Logistics Outlook: Key Trends, Technology, and Strategies for 2025

Wednesday, December 4 at 8:00 am PT / 11:00 am ET / 16:00 GMT / 17:00 CET

North America Freight Market Update Live

Thursday, December 12 @ 9:00 am PT / 12:00 pm ET

This Week in News

American Companies Are Stocking Up to Get Ahead of Trump’s China Tariffs

Businesses are preparing for potential sweeping tariffs on Chinese goods under Donald Trump’s proposed trade policies, with some rushing to stockpile inventory and others seeking long-term alternatives to Chinese suppliers. This mirrors the response to the 2018 U.S.-China trade war, when companies front-loaded imports, leading to a temporary surge in Chinese exports. Despite some efforts to diversify supply chains to countries like Vietnam and Cambodia, China’s established infrastructure and competitive pricing remain unmatched, making full replacement challenging.

NVOs eager to get past carriers’ tight grip on unexpectedly favorable market

In 2024, ocean carriers tightened control over NVO contracts, demanding more spot cargo/freight-all-kinds (FAK) and closely monitoring compliance with named account contracts (NAC). This forced NVOs to secure more FAK cargo and adhere strictly to NAC terms. Looking ahead, increased vessel capacity in 2025 could ease pressure on NVOs as carriers compete to fill space. However, carriers are expected to maintain strict monitoring of contract compliance, leveraging technology to enforce terms regardless of market shifts.

How shippers can navigate West Coast rail congestion

A surge in container volumes on the U.S. West Coast, driven by peak season, strike mitigation efforts, and tariff concerns, is straining rail operations. Dwell times at the Port of Los Angeles have reached eight days, while Long Beach remains more fluid at four days. Rail operators like BNSF and Union Pacific are addressing congestion through staging yards and capacity expansion, but disruptions persist. Shippers are turning to costly alternatives like cross-docking, air freight, and trucking to bypass delays. Diversions to ports in Mexico, Canada, and the U.S. East Coast are also on the rise. Experts predict rail congestion may ease by Q1 2025, barring additional disruptions such as labor disputes.

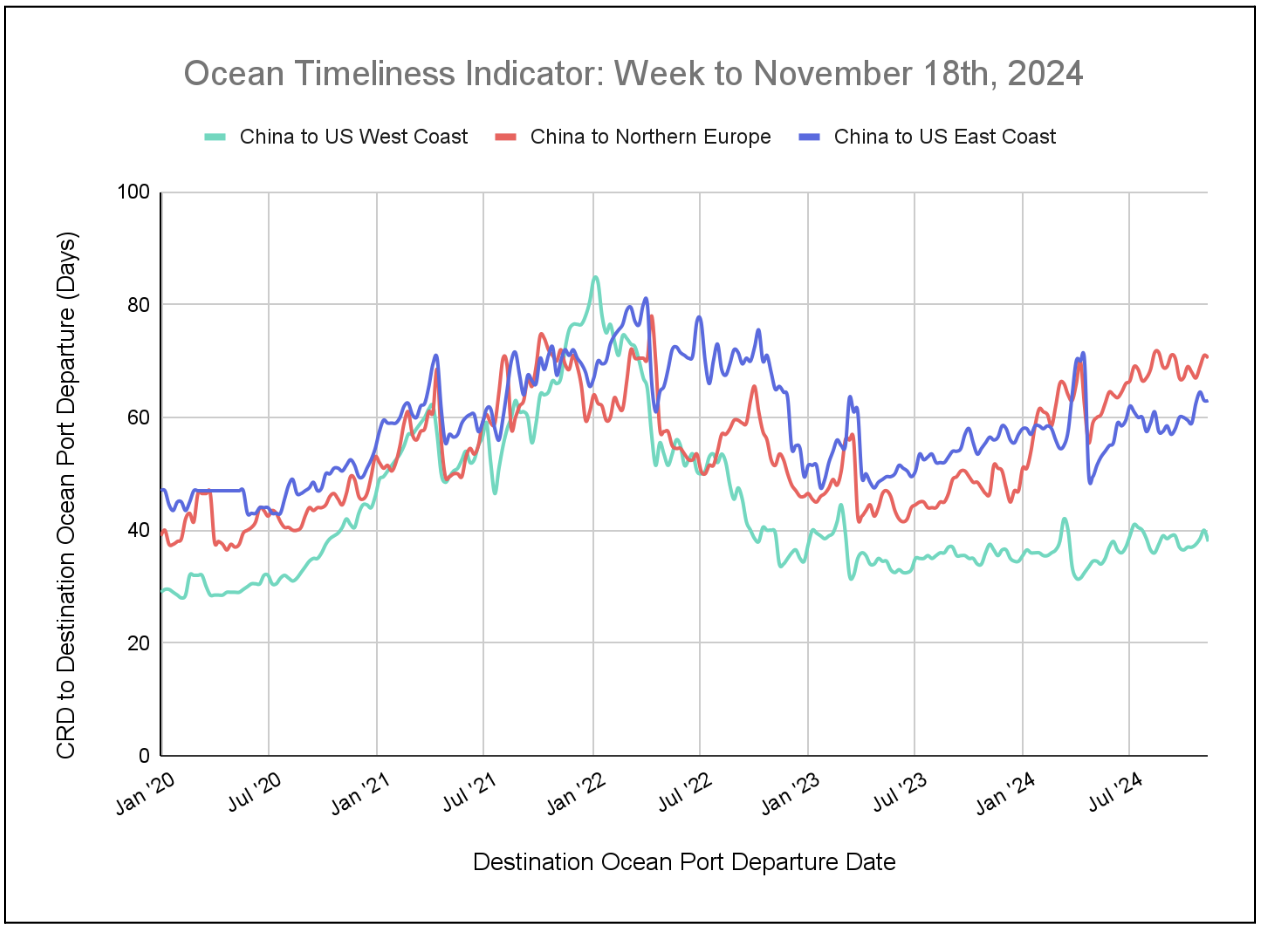

Flexport Ocean Timeliness Indicator

This week, the Flexport OTI has decreased from China to the U.S. West Coast and China to Northern Europe, and remained stable from China to the U.S. East Coast.

Week to November 18, 2024

This week, the Ocean Timeliness Indicator (OTI) has decreased from China to the U.S. West Coast and from China to Northern Europe, moving from 40 to 38 days and 71 to 70.5 days, respectively. Meanwhile, the OTI from China to the U.S. East Coast has plateaued at 63 days.

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.