Market Update

Freight Market Update: May 30, 2024

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Freight Market Update: May 30, 2024

Trends to Watch

[Ocean - TPEB]

- We have entered peak conditions for Transpacific Eastbound Ocean freight in the month of May. May imports are up +6.8% YoY and we do not expect this increase in demand to subside through the traditional peak season (expect June imports to be 10.7% higher YoY).

- Floating rates: The 1H May $1000 GRI stuck, and we expect another $1000 GRI to be implemented on all Transpacific Eastbound gateways based on the peak conditions we are seeing in May. Carriers expect these rate hikes to stick and accelerate in the short term since vessels leaving Asia are expected to be full through May/June - Pacific Southwest is full, Pacific Northwest is close to full into EOM and into June. Particularly Vietnam + South/East China (Yantian/Shanghai/Ningbo) into the Pacific Southwest is especially tight.

- Fixed rates: Starting June 1, carriers will implement a Peak Season Surcharge (PSS), and it is likely that the PSS will be increased again on June 15th. More updates to come later this month as plans are finalized.

- Importers expect a tough peak season, and are trying to head ahead of uncertainties. For more insights, read this thread by Ryan Petersen, CEO of Flexport on X.

[Ocean - FEWB]

- The market continues to tighten and space is constrained at least up until mid-June. Multiple factors are at play including port congestion, equipment shortages and the continued delays on vessels rerouting via Cape of Good Hope resulting in low reliability and blank sailings reported out of Asia intensifying the situation.

- Demand continues to be stronger than usual and rates rose again for the first half of June followed by another increase for the second half of June ($1,000 increase per 40-foot container). We expect the increase in demand to be driven not only by consumer demand but also by companies building stock due to the longer than anticipated lead times and companies trying to secure space.

- Shippers continue to push cargo for earlier departure to avoid further freight cost increases. Unless space has already been secured, all vessels are full. To push cargo on sooner ETD (estimated time of departure) and avoid delays, more carriers are open to Premium options to get cargo loaded on the first available departure date with higher equipment priority.

- Flexport continues to monitor the situation and we advise to book early, place bookings in smaller slots and pick up empty containers as soon as possible. For urgent cargo with a target delivery date, it is recommended to move on the Premium option as early as possible.

- Read more about the situation in Why Ocean Freight Rates are Surging: A Look at the Supply Shock after the Red Sea Disruptions.

[Ocean - U.S. Exports]

- Container availability for inland U.S. exporters has become much more challenging. This is a result of the global disruptions in container shipping and their subsequent impact to the flow of laden and empty containers.

- The extended transit times seen due to routing around Cape of Good Hope, growing port congestion at key ports, further devolves the container equipment situation for U.S. exporters, especially shippers loading at inland rail points.

- Congestion at key destination transhipment hubs for U.S. exporters include Asia Base Ports and Strait of Gibraltar ports Tanger-Med and Algeciras.

- To ensure the smoothest loading experience, Flexport recommends booking 3-4 weeks in advance for bookings loading at a coastal port, and 4+ weeks in advance for bookings loading at an inland rail point.

[Air - Global] (Data Source: WorldACD)

- Tonnage and Rate Increases: Worldwide air cargo tonnages rebounded by +2% in week 20, following a similar increase the previous week. Average global rates slightly rose to $2.48 per kilo in week 20, up +2% YoY and +40% from May 2019 levels. Tonnages from Middle East & South Asia to Europe increased by +31% YoY in the last two weeks, with Dubai leading at +148%.

- Regional Rate Variations: Middle East & South Asia to Europe rates remain more than double (+119%) YoY. Rates from Bangladesh to Europe reached $4.66 per kilo in week 20, nearly triple (+186%) YoY. India to Europe rates, though slightly eased, are still up +163% YoY at $3.72 per kilo.

- Asia Pacific Dynamics: Tonnages from Asia Pacific origins are up +15% YoY with rates up +10%. China to Europe tonnages increased by +19% and +10% in weeks 19 and 20, while Hong Kong to Europe tonnages rose +31% YoY.

- Market-Specific Developments: Vietnam to Europe rates doubled (+120%) YoY, exceeding $4 per kilo over the last eight weeks. Japan saw the largest 2Wo2W tonnage increase among top destination markets (+16%) post-Golden Week holiday.

Please reach out to your account representative for details on any impacts to your shipments.

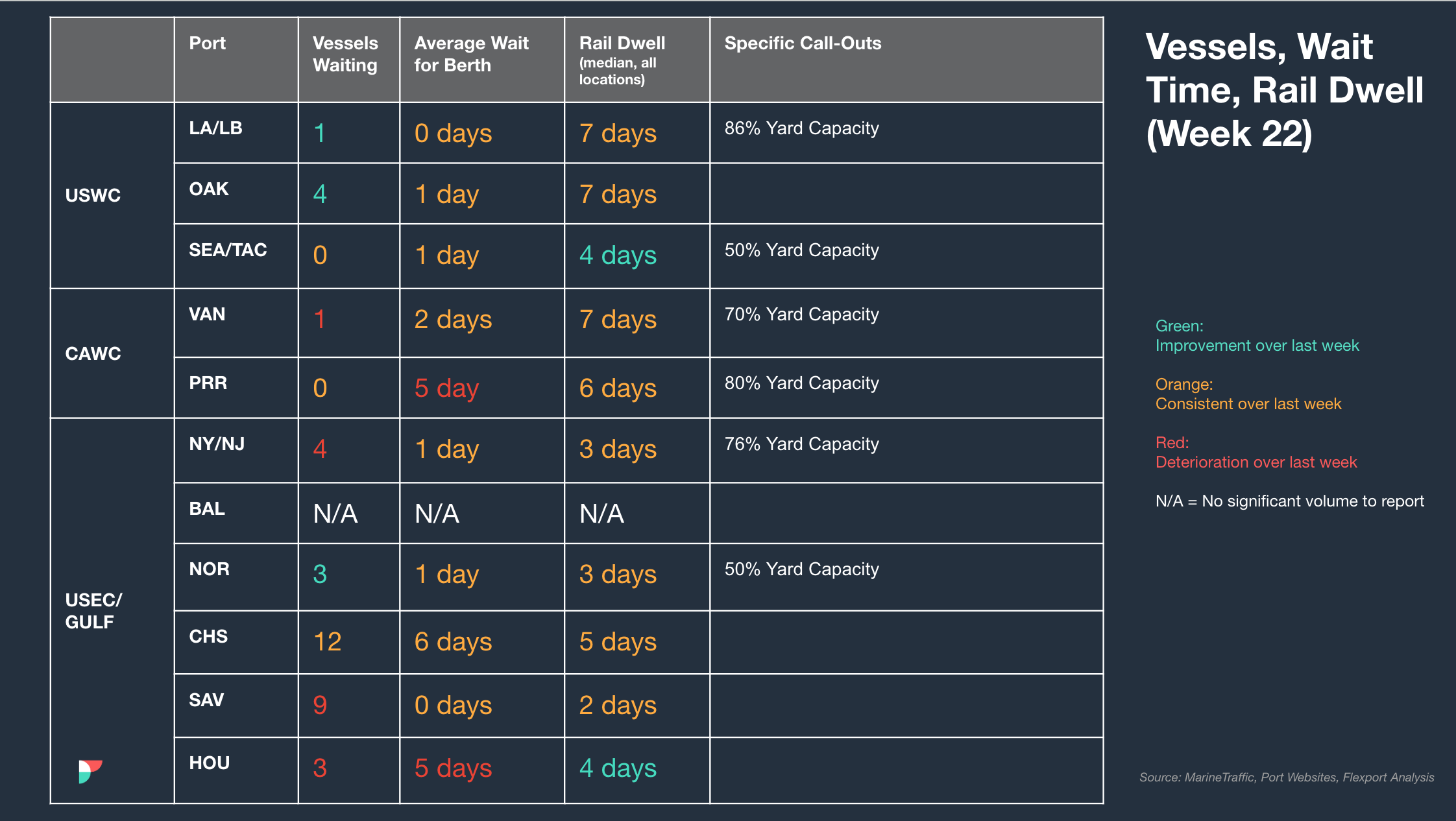

North America Vessel Dwell Times

Webinars

North America Freight Market Update Live

Thursday, June 13 @ 9:00 am PT / 12:00 pm ET

European Freight Market Update Live

Tuesday, June 25 2024 at 16:00 CEST

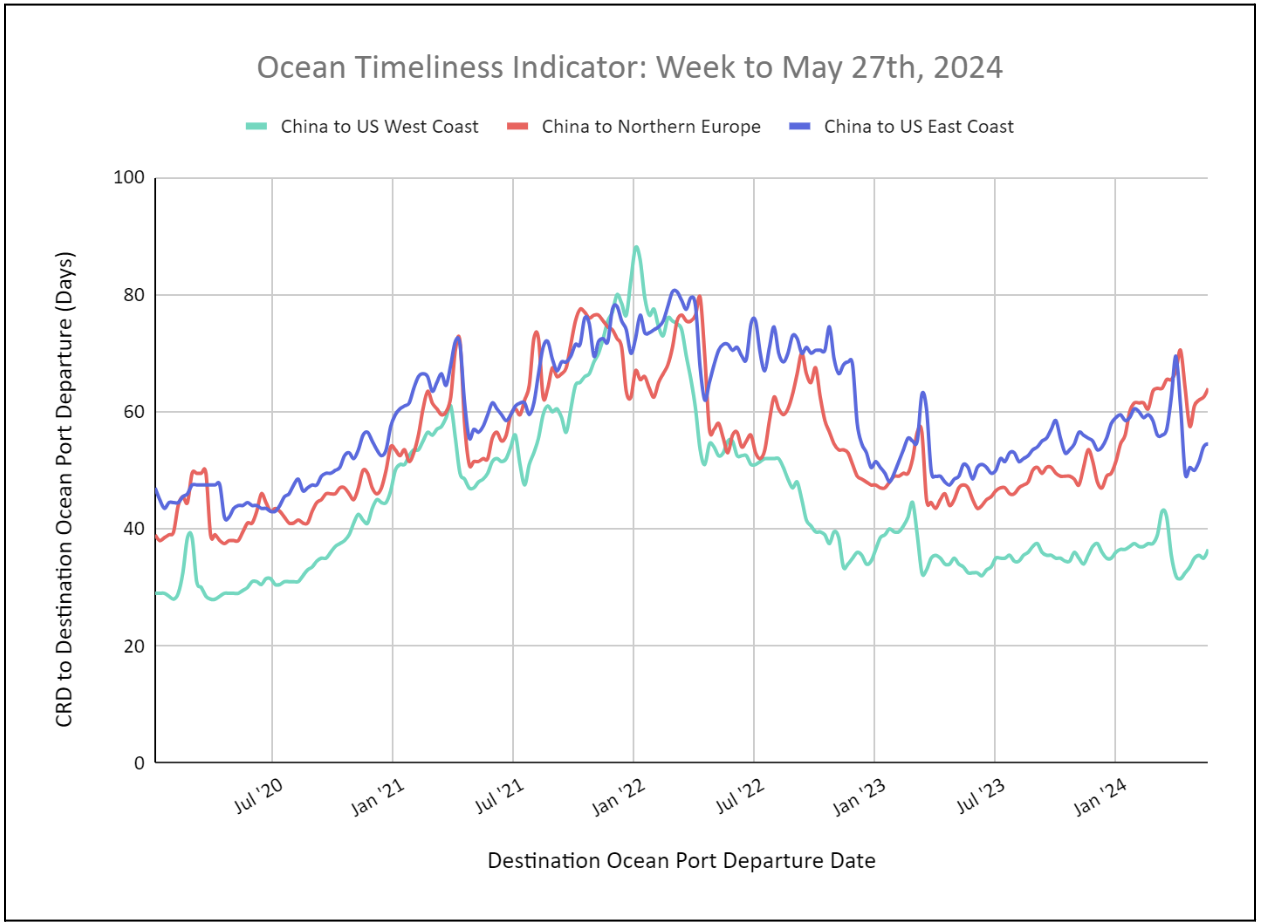

Flexport Ocean Timeliness Indicator

Ocean Timeliness Indicator Across All Major Trade Lanes Increases Again

Week to May 27, 2024

This week, the Ocean Timeliness Indicator for all major trade lanes continued the increasing trend seen throughout May. The China to the U.S. East Coast OTI increased to 55 Days, the China to Northern Europe OTI increased to 64 days due to routing around the Cape of Good, and the China to the U.S. West Coast OTI increased to 36 days

Please direct questions about the Flexport OTI to press@flexport.com.

See the full report and read about our methodology here.

The contents of this report are made available for informational purposes only. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.