Market Update

Freight Market Update: July 25, 2018

Ocean, trucking, and air freight rates and trends for the week of July 25, 2018.

Freight Market Update: July 25, 2018

Want to receive our weekly Market Update via email? Subscribe here!

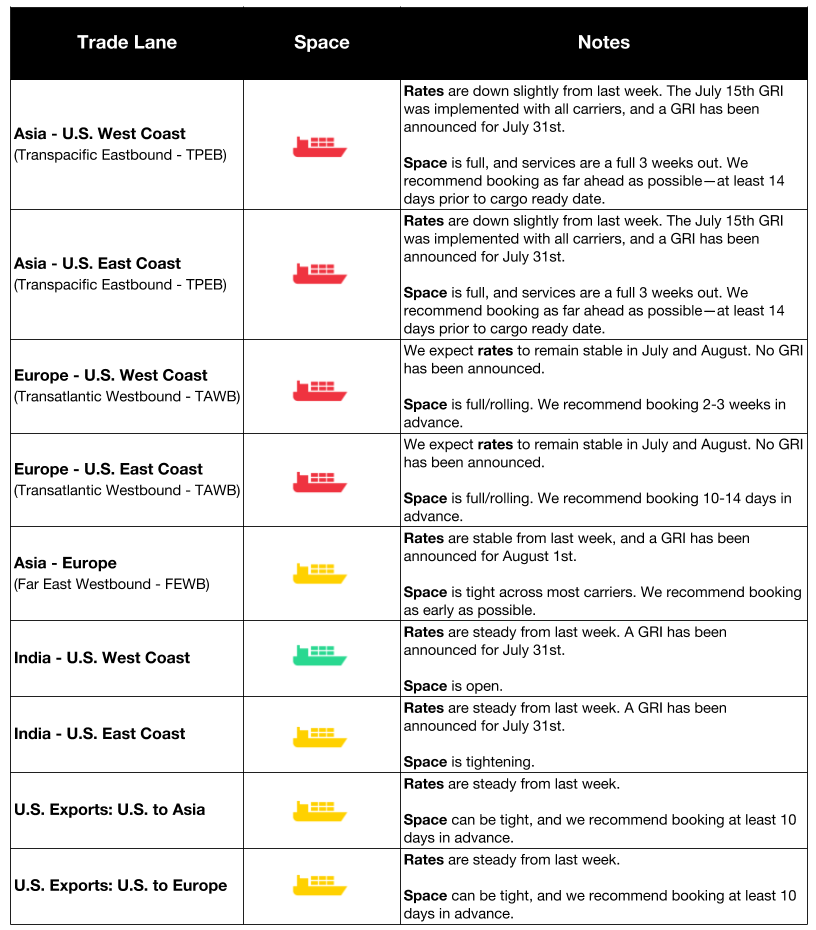

Ocean Freight Market Updates

**TPEB Services Are a Full 3 Weeks Out **

Services on the TPEB lane are three weeks out, and we recommend booking at least 14 days in advance of the cargo ready date. The EBS is expected to go up for some carriers on August 1st.

Carriers are continuing to announce blank sailings and canceling services, which will likely lead to a tightening of the market and an earlier onset of peak season.

**Cosco Shipping Hit With Cyber Attack **

On Tuesday, Cosco’s U.S. operations were the target of a cyber attack, which affected its ability to communicate with its vessels, customers, and marine terminals. This follows the cyber attack that targeted Maersk in June 2017 and cost the company as much as $300 million in revenue.

The attack on Cosco only slowed operations, as the carrier had “work-arounds” in place via phone and hard-copy transmissions. Cosco said it’s unsure of when operations will be fully restored.

Impact of New IMO ECA Regulations

The International Maritime Organization has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulphur emissions to 0.5% from 3.5%.

Whether they upgrade their vessels or their fuel, carriers will need to undertake significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Rates may climb between now and 2020 as a result.

June Sees Spike in U.S. Seaborne Imports

Anxiety over trade tensions contributed to an 8.4% increase in container imports at the ports of Los Angeles and Long Beach in June, reports The Wall Street Journal. The ports are the largest U.S. gateway for seaborne trade.

This increase in volume is early, as the seasonal shipping surge typically runs from July to September.

**U.S. Warehouse Supply at its Lowest Since 2000 **

Warehouse supply in the U.S. has fallen for a record 32 quarters in a row. The lowest since the dot-com boom, the diminishing warehouse availability is attributed to the rapid increase in online shopping.

Trans Pacific Carriers Announce Emergency Bunker Surcharges for July

The rising price of oil, which is set by the Brent Crude Oil price, has led many carriers to raise their prices. OPEC oil cuts are expected to continue through the end of 2018, with U.S. sanctions against Iran also expected to contribute to rising oil prices.

A number of carriers have announced an Emergency Bunker Surcharge (EBS), which will begin on July 1st.

Related blog post: What you need to know about the Emergency Bunker Surcharges

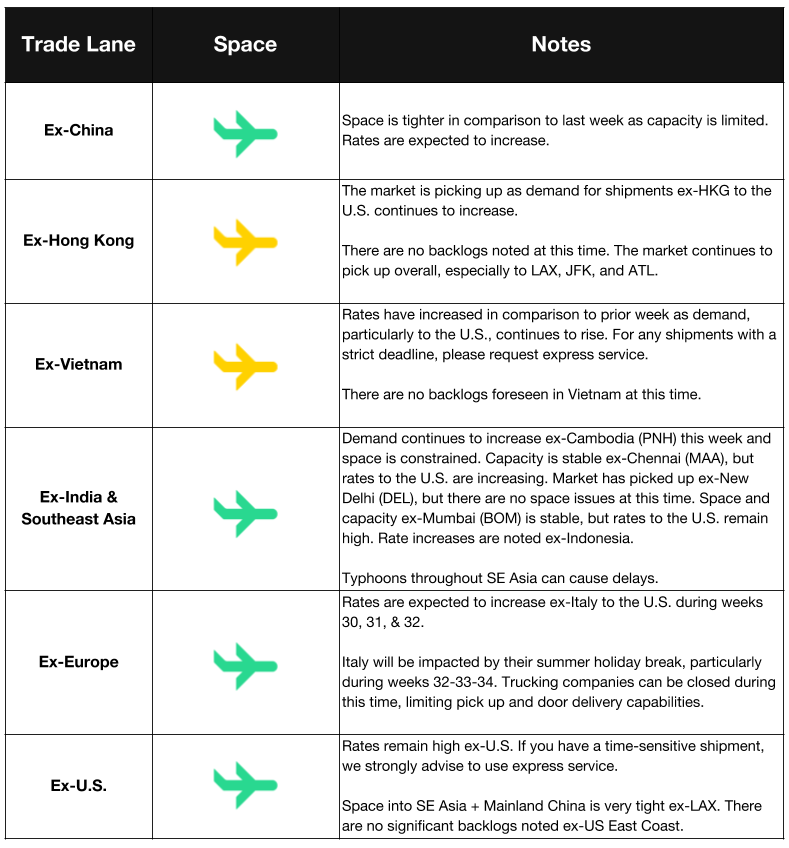

Air Freight Market Updates

Trade Dispute Hasn’t Yet Affected Peak Season Expectations for Air Freight

Air cargo expectations are still high for the “second half and into the end-of-year peak season” as the strong demand seen in the first six months is expected to continue. According to the JOC, volume has been steadily increasing in the east-west trades.

While trade relations may affect how goods move in the near future, there hasn’t yet been any change in consumer behavior.

**ELD Mandate Negatively Impacts Air Cargo **

The electronic logging device (ELD) mandate’s repercussions move far beyond the road, as air cargo providers are citing negative consequences. Higher trucking rates, delays, and even modal switches are some of the negative consequences for air cargo.

Related: The Electronic Logging Device (ELD) Mandate -- What You Need to Know

**Forwarders & Shippers Prepare for Low Air Capacity **

The 2017 capacity constraints for air freight aren’t forgotten in the minds of shippers and forwarders. In response to last year’s shortages and higher-than-usual rates, shippers are looking for guaranteed space throughout the year for their products, and some are looking for their own planes. Forwarders are chartering more flights to guarantee space and reserving planes for select shippers.

The Loadstar reports that demand growth is at 4-5%, and that April, which is usually the beginning of slack season, was stronger than expected.

Related blog post: Investing in Service, Flexport to Charter its Own Aircraft

Trucking Market Updates

**Big Rigs Get an Update Aimed at Efficiency **

Trucks are getting “smarter” as companies upgrade to new technology. From new tires to advanced navigation and communication systems, companies are looking for avenues to improve efficiency and lower the cost to serve.

Heavy-duty trucks are leveraging the internet to pull data from trucks with the goal of improving transit times and reducing the rate and impact of human errors. While the cost of upgrades can seem high, companies report that they’re saving money in the long run.

Trucking Analysts Expect Strong Earnings Reports in the Weeks Ahead

As capacity remains tight, truckers are able to set higher prices for shippers. Pair this with the high transportation demand and trucking companies’ investment in more efficient processes and systems, and it becomes clear why analysts expect strong earnings reports from the trucking industry.

According to The Wall Street Journal, “June marked the 16th straight month in which prices increased on an annual basis on trucking’s spot market, where shippers book last-minute transportation.”

Trucking Strike in India May Affect Your Shipments

Private trucking companies in India are refusing trucking orders between states, and the situation is worsening as another major state, Maharashtra, is joining the strike. All operations are shut down in the state as of July 25th.

Orders that don’t cross state boundaries are still being fulfilled, and cargo is still moving from CFS to port. There has been no update on when the strike will end.

Updated PierPass OffPeak System to Start in Fourth Quarter

On June 26th, members of the West Coast MTO Agreement (WCMTOA) announced that the program for providing extended gate hours (PierPass 2.0) has a planned start for the fourth quarter of 2018. A Q&A on the revised OffPeak program is available here.

LA-LB Terminals Agree to Restructure PierPass Program

Agreeing to restructure the 13-year-old PierPass program, Los Angeles-Long Beach marine terminal operators will reduce the traffic mitigation fee to $31.52 per TEU, a 55% reduction.

Assuming the Federal Maritime Commission approves the restructuring, the new pricing will take effect in August 2018.