Market Update

Market Update: July 2017

Recent news and updates related to the ocean and air freight market for the month of July 2017.

Market Update: July 2017

We publish a market update at the beginning of every month, and refresh rate predictions every week. Subscribe to these updates here!

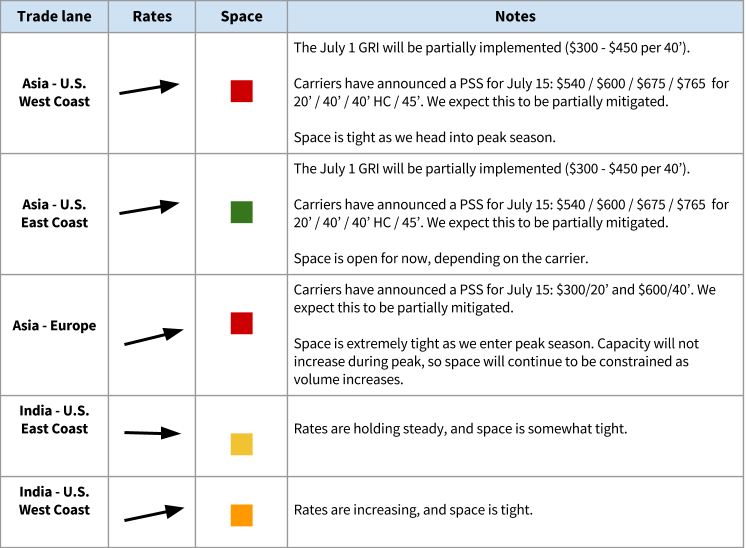

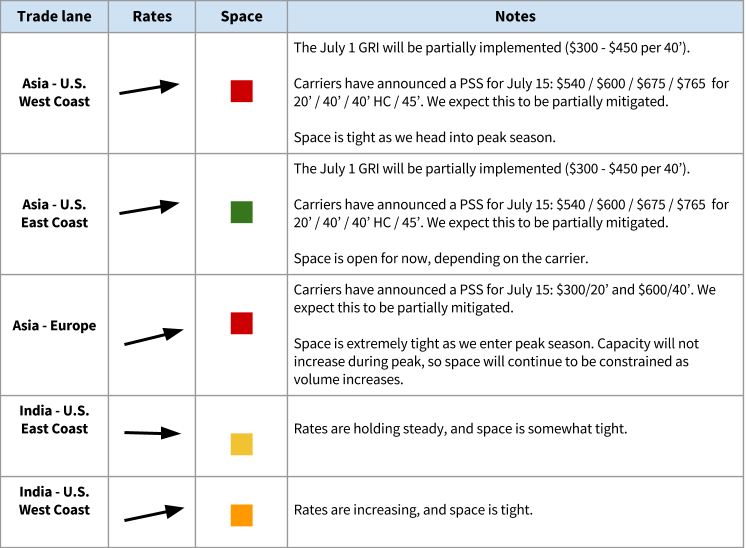

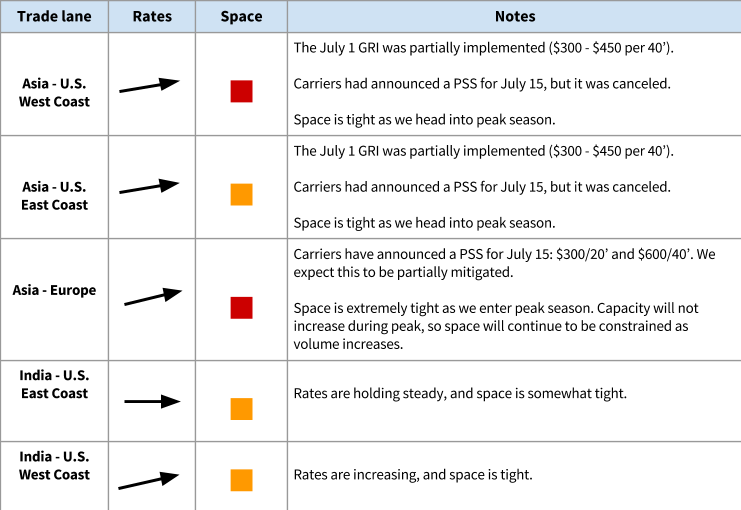

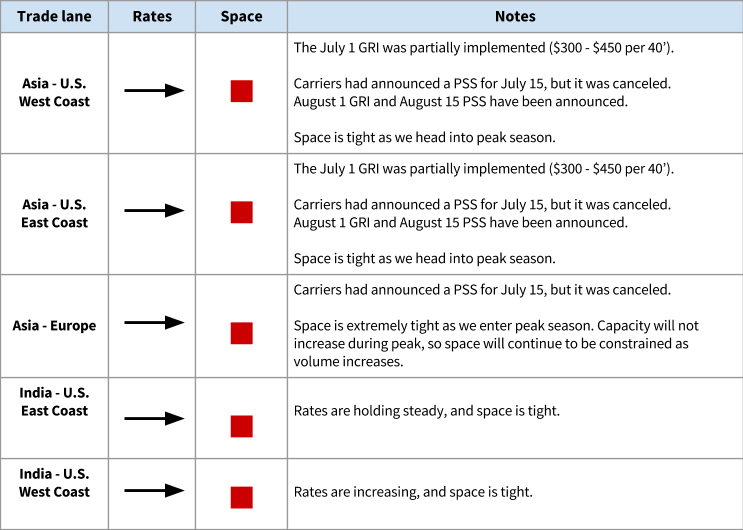

Ocean Freight Rates for July 2017

Updated July 26, 2017

Peak season is coming

We’re heading into peak season, which will tighten capacity and drive rates upward. Carriers had announced a Peak Season Surcharge (PSS) for July 15, but it was canceled.

Space will become tighter, especially from Asia - Europe. Book your shipments as far in advance as possible!

The impact of the Petya cyber attack

We’ll see some lingering fallout from the June 27 “Petya” cyber attack. Because the attack affected both bookings with Maersk and APM terminals, we may see any combination of the following in July:

- Congestion and delays due to the temporary closures of APM terminals -- especially in New Jersey, Los Angeles/Long Beach, Miami, and Mobile

- An increase in volumes to other carriers, and tighter space as a result

- Possible overflow to air, further restricting air capacity (which is already quite constrained)

- Spikes in price due to the above

COSCO will acquire OOCL

The Chinese government–owned shipping line COSCO has announced plans to buy OOCL. The deal is still subject to regulatory approval, but if approved, this merger will continue a larger industry trend of consolidation, which we’ll see more of in the months and years to come.

Both COSCO and OOCL have a lot of container capacity on order (more than 600,000 TEU combined), and with this acquisition, it’s clear that COSCO is angling to become the largest carrier in the world.

The two shipping lines are in the same alliance (The Ocean Alliance), which should make for a smooth transition with minimal service disruptions. They also use the same IT systems, which will make technical integrations easier.

Air Freight Market Updates for July 2017

No slack season for air cargo this year

The air freight market, especially from Asia to North America, is the strongest it has been in the last 6-7 years. This is largely driven by:

- The explosive growth of e-commerce. Airlines are prioritizing space for e-commerce shipments, which are highly volumetric and therefore consume more space than typical hard freight consolidations.

- New product launches and expected quarter-end project shipments have been tying up capacity.

- Residual effects from the ocean alliance shift in April, which boosted air freight volume.

Supply-demand imbalance continues

Demand for international air cargo continues to grow more quickly than capacity, continuing a supply-demand imbalance that began in Q4 of 2016 and has accelerated in 2017. This is most severe in the Asia-Pacific region, which saw 9.4% demand growth but only 3.3% growth in capacity.

Other Freight Market Updates

Delays and extra fees in advance of Amazon Prime Day

We’ve been seeing large increases in the amount of goods being sent to Amazon FBA warehouses in advance of Amazon Prime Day (July 11, 2017).

If you’re shipping to Amazon, you can expect delays and, potentially, extra fees, as warehouses work to keep up with the volume. Read more about the impact here.

Many West Coast port terminals closed on July 5

On July 5, in observance of the 1934 West Coast Waterfront Strike (also known as Bloody Thursday), many terminals at West Coast ports will be closed. Combined with the July 4th holiday, you may experience delays for cargo arriving into West Coast ports.

New taxation system in India may cause delays

If you’re shipping out of India, be aware that the country is implementing a new, unified taxation system -- the Goods and Services Tax -- on July 1. As Indian Customs and businesses work to adjust to the new system, there may be delays.

Flexport LCL updates

A few highlights from Flexport’s in-house LCL service:

- Our LCL service to Seattle/Tacoma now offers a 13-day port-to-port transit time

- Our Matson LCL service from Shanghai to Los Angeles has a 10-day port-to-port transit time, with vessel discharge within 1 day of arrival. This is a great asset as we head into peak season.

- Our Chicago LCL service is now faster -- ask your Flexport team about specific transit times.