Market Update

Freight Market Update: January 22, 2020

Ocean and air freight rates and trends; customs and trade industry news for the week of January 22, 2020.

Freight Market Update: January 22, 2020

Want to receive our weekly Market Update via email? Subscribe here!

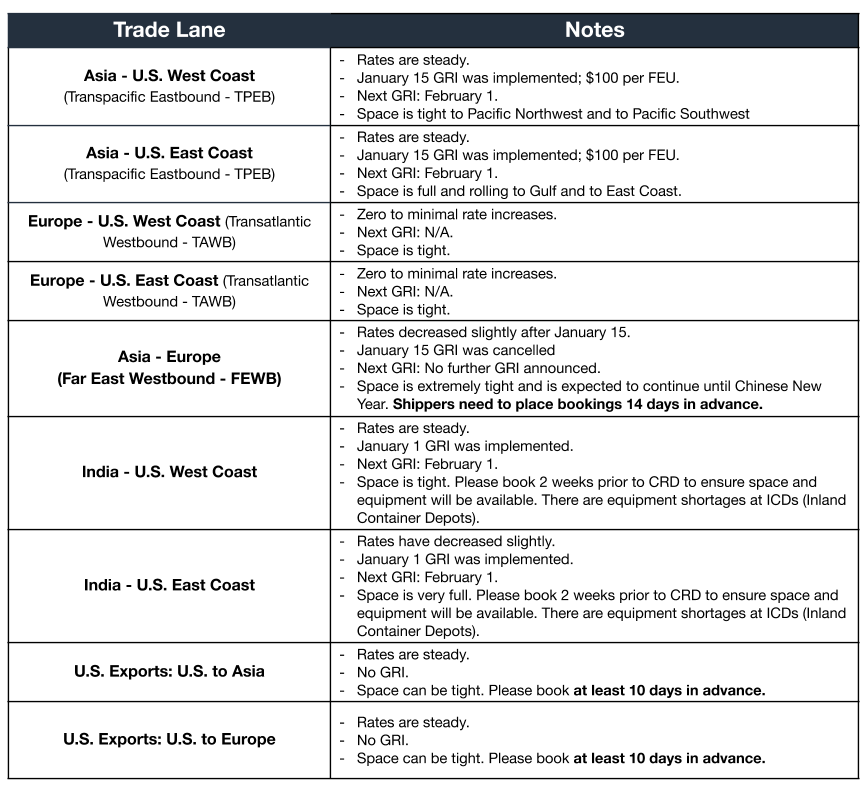

Ocean Freight Market Update

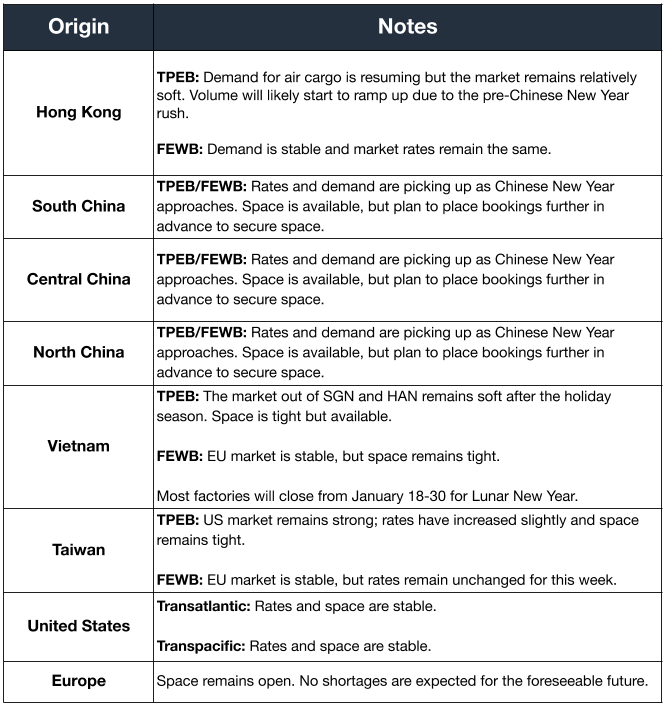

Air Freight Market Update

Freight Market News

Coast Guard Updates IMO Enforcement

The US Coast Guard has issued updated guidance signifying its intent to seek out noncompliance and prosecute violators of IMO 2020’s low-sulfur fuel regulations. Despite requirements to maintain fuel oil non-availability reports (FONAR), FreightWaves reports that noncompliance is likely to be viewed as “a failure of preparedness, not a failure of accessibility of resources.”

Panama Canal Combats Drought with Fees

The Panama Canal is running out of water after several years of below-average rain and above-average evaporation due to rising temperatures. To replenish water levels, Supply Chain Dive reports, the Panama Canal Authority is charging two new fees at fixed and variable amounts and requiring use of a new booking system.

Meanwhile, this week, Flexport Chief Economist Dr. Phil Levy noted the following economic highlights:

- Trade deals move forward with a Phase One agreement between the United States and China signed last week. The core of the deal involved Chinese commitments to purchase $200bn of US goods over the next two years, coupled with US promises to skip List 4b tariffs and, on February 14, to cut the 15% tariffs on List 4a to 7.5%.

- The USMCA passed the Senate last week on an 89-10 vote and appears headed toward implementation.

- Unlike most trade deals, neither of these two seems likely to boost GDP much.

- Global Foreign Direct Investment (FDI) fell in 2019 according to the UN Conference on Trade and Development—from 1% to $1.39 trillion, its lowest level since 2010. A substantial fraction of international commerce takes place between parent companies and their foreign subsidiaries and is thus spurred by FDI.

- German GDP growth fell to 0.6% in 2019, its lowest rate in six years. The car industry and manufacturing were weak, while private consumption and construction fared better.

- Chinese GDP growth of 6.1% in 2019 was the slowest in 30 years, though December numbers showed stronger industrial output and investment growth.

- US import prices rose 0.3% in December, but were unchanged if fuel is excluded. On an annual basis, import prices rose just 0.5% in 2019 after falling 1% in 2018.

- US industrial production fell 0.3% in December, while housing starts hit their highest level in 13 years, perhaps boosted by relatively warm weather.

Customs and Trade Updates

Phase One Deal with China Signed but Issues Linger

With the Phase One deal signed last week with China, the issues with intellectual property rights (IPR), counterfeit controls, agricultural purchases, and technology transfers are in wait and see mode. How they play out will affect future actions and retaliations. President Trump hinted that a Phase Two deal wouldn't likely happen until after the 2020 election.

France Delays Digital Excise Tax

France has agreed to delay the implementation of its 3% Digital Service Tax that is meant to tax big US tech companies like Google, Facebook, and Amazon. The US had scheduled retaliatory tariffs which will also be delayed with the recent truce between Trump and Macron. Both sides have agreed to table these taxes/tariffs until next year in hopes they can come to a better agreement for both countries and to prevent the escalation of a trade war.

**For a roundup of tariff-related news, visit Tariff Insider