Market Update

Market Update: January 17, 2018

Ocean and air freight rates and trends for the week of January 17, 2018.

Market Update: January 17, 2018

Want to receive our weekly Market Update via email? Subscribe here!

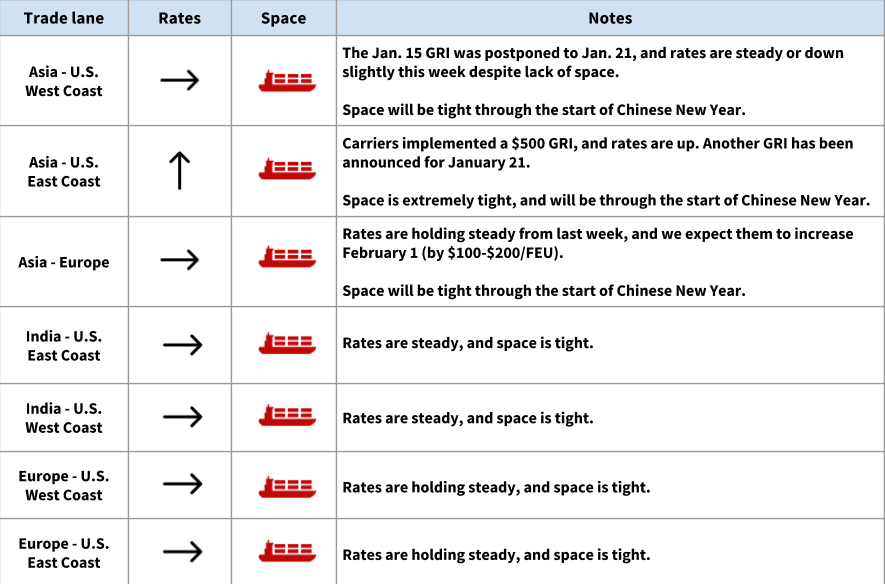

Ocean Freight Market Updates

January 15 GRI implemented for USEC, postponed for USWC

Carriers implemented a January 15 GRI of $500/TEU for Asia <> U.S. East Coast. Another GRI has been announced for January 21.

For Asia <> U.S. West Coast, carriers postponed the January 15 GRI to January 21. We expect this to be partially implemented.

Carriers have also announced a GRI and PSS for February 1.

Space will be constrained through Chinese New Year

Chinese New Year will begin on February 16. Factories in China will be closed and/or operating at diminished capacity for at least 4 weeks around that time.

Because of increased demand, rates will stay up and space will be more difficult to secure -- both trends that will continue through the start of Chinese New Year.

Prepare for Chinese New Year

These strategies can help keep your supply chain moving in advance of Chinese New Year (CNY):

- If possible, share a forecast with your Flexport team.

- Book your shipments at least three weeks prior to CNY.

- Follow up with suppliers on the Cargo Ready Date -- these can shift frequently since factories are running on maximum capacity.

- If you’re shipping multiple containers, split them among several bills of lading (to reduce impact if your shipment is rolled).

- Consider a service with a longer transit time, which is less likely to be overbooked.

- If your cargo is traveling inland, consider an alternate port of discharge -- this will allow for more options when choosing a sailing.

Check out more ways to prepare here.

Air Freight Market Updates

The calm before the Chinese New Year storm

For now, supply and demand are in balance for cargo ex-Asia -- but we expect rates to rise, and space to become more constrained, as we approach Chinese New Year.

Get ready for Chinese New Year

Share a forecast with your Flexport team, so that we can help you secure space. Air capacity is already constrained, and ocean-to-air conversions will exacerbate the issue as we approach Chinese New Year.

Other Freight Market Updates

Port delays at mid-Atlantic / southeastern ports

Ports in the mid-Atlantic and southeast are being impacted by a combination of weather conditions, vessel delays, port congestion, and significant import volumes. This is affecting the ports of Savannah, Norfolk, Charleston, Memphis, Nashville, and Jacksonville.

Note: The Port of Houston, after being closed on January 17, has announced that it will extend free time by two days.

If you have cargo routing through any of these ports this week or next, you can expect delays and, potentially, related fees such as trucking wait fees.

Trucking rates are up due to weather and the ELD mandate

Trucking capacity is tight in many regions, which is typical for this time of year. Currently, rates and capacity are also impacted by winter weather and the recently implemented ELD mandate.