Market Update

Freight Market Update: February 14, 2024

North America vessel dwell times and other updates from the global supply chain | May 17, 2023

Freight Market Update: February 14, 2024

Trends to Watch

[Ocean - TAWB]

- Various rate indices are starting to show levels jumping by around $500 per TEU as of Feb. 1. This was expected due to carriers introducing surcharges related to the Red Sea situation (Contingency Surcharges, Emergency Surcharges, PSS, etc.).

- Rates are expected to increase further in March due to equipment becoming limited in most parts of Europe (mainly south of Germany, Poland, and Western Mediterranean areas).

- Capacity remains relatively stable even though we have seen blank sailings and vessels redeployed on other trade lanes in order to help with the Red Sea situation.

- Panama Canal drought issues had minimal impact on container vessels transiting in January year-over-year.

[U.S. Exports]

- Inland rail yards and export loading points are dealing with increasingly spotty equipment (EQ) levels. Please place bookings four weeks in advance of Cargo Ready Date (CRD). If that’s not achievable, consider loading trucks and transload at a coastal port to avoid ongoing EQ concerns.

- For shipments loading at a coastal port, please book an additional 2-3 weeks or more ahead of CRD to ensure loading is optimized to avoid blank sailings and ensure equipment is available in a timely manner.

- For Transatlantic Eastbound, capacity is available from base port to base port.

[Air - Global](Data Source: WorldACD/Accenture)

- Increased Rates from China: Air cargo rates from China to North America and Europe surged by more than 14% and more than 8%, respectively, in the week before Lunar New Year, although still below early December peaks.

- Impact of Red Sea Disruptions: Disruptions in container shipping in the Red Sea may have contributed to the rate surge, prompting some sea freight from China to Europe to convert to sea-air shipments.

- Strong Traffic Demand: There is strong ongoing air cargo demand from China to both Europe and North America, despite current disruptions and the seasonal impact of the Lunar New Year.

- Rising Global Demand and Rates: Global air cargo demand and rates have continued to rise due to Lunar New Year, with significant year-on-year tonnage increases supported by strong ecommerce traffic.

- Substantial Yearly Increases: Worldwide tonnages saw a more than 25% increase in weeks 4 and 5 compared to the previous year, with significant rises from Asia Pacific, the Middle East, and South Asia, partly due to the conversion of sea freight to sea-air shipments.

- Rates trend at over 32% compared to Feb 2019.

[LATAM North Bound]

- The Port of Navegantes in Brazil is undergoing civil works to adapt pier infrastructure for the upcoming two years, which started on Jan. 5, 2024. This will be done in two phases. While one side will be under construction, the other will continue to operate normally. The work will begin on the east side, and when this stage is completed, it will move to the west side.

- While the port is currently operating without restrictions, we will likely see operational challenges and higher wait times for all services through Navegantes during this period. Some shippers may choose to switch to nearby ports (Itapoá and Paranaguá).

- CMA announced they will be switching to Imbituba on their BRASEX service. MSC, on the other hand, is committed to serving customers ex Navegantes. MSC has two main services from Brazil and will optimize these services to service USEC, USGC, and USWC/ CA.

Please reach out to your account representative for details on any impacts to your shipments.

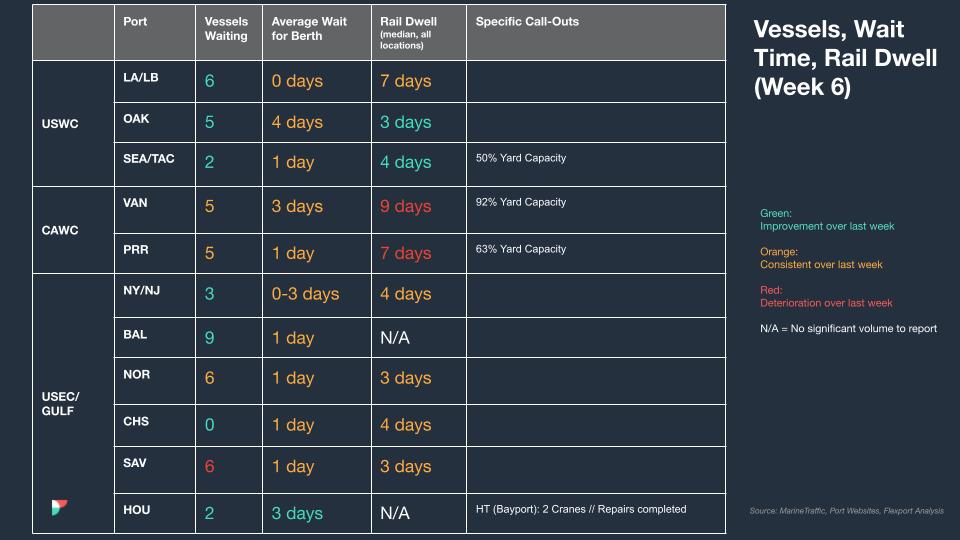

North America Vessel Dwell Times

Upcoming Webinars

North America Freight Market Update Live

Thursday, February 15 at 9:00 AM PT / 12:00 PM ET

European Freight Market Update Live

Tuesday, February 20 at 15:00 GMT / 16:00 CET

This Week In News

Major Delays In Cross-Border Cargo Flow After Glitch In Mexican Customs System

A series of persistent glitches in Mexico’s National Customs Agency (ANAM) computer system severely disrupted freight movements across the U.S. border and caused delays at ports and airports. The glitches, occurring over several days, affected the agency’s ability to process import and export documents electronically, prompting ANAM to operate in “contingency” mode.

Upcoming Indo-Pacific Trade Deal Adds To U.S. Supply Chain Priorities

The Indo-Pacific Economic Framework for Prosperity (IPEF) supply chain agreement is set to go into effect on Feb. 24, to strengthen supply chain resilience among Pacific Ocean trading countries. Signed by partner countries such as the U.S., Australia, and Japan, the agreement emphasizes data sharing, warehousing near ports, and collaboration on policy best practices to build resilient and inclusive supply chains.

Despite Dim Outlook, January Imports Grew At Fastest Pace In 7 Years

Despite geopolitical tensions and challenges at the Suez and Panama Canals, U.S. imports surged unexpectedly in January, rising 7.9% from December and 9.9% year-over-year, according to Descartes. This growth, driven by a rush of Chinese imports ahead of the Lunar New Year, saw West Coast ports benefiting the most, with Long Beach and Los Angeles experiencing significant increases.