Market Update

Market Update: December 20, 2017

Ocean and air freight rates and trends for the week of December 20, 2017.

Market Update: December 20, 2017

Want to receive our weekly Market Update via email? Subscribe here!

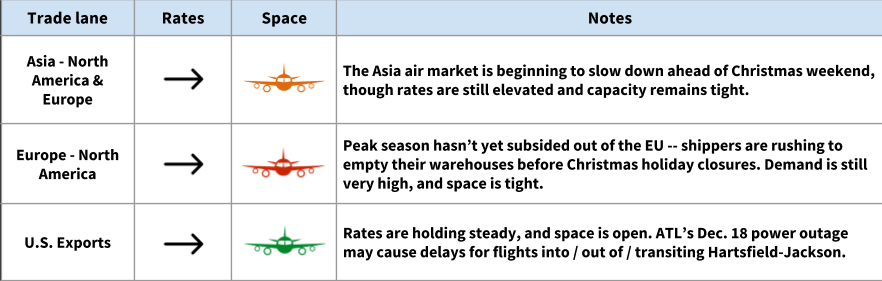

Air Freight Market Updates

Rates are still high, and capacity remains tight

Rates aren’t rising, but they’re holding steady at their previous (high) levels.

Capacity is tight. In Asia, carriers have begun taking freighters offline for end-of-year maintenance checks, which is further constraining space to both the U.S. and the EU.

Out of the EU, space is still extremely tight. Peak season hasn’t slowed down, and shippers are rushing to empty their warehouses before the holidays.

Continued e-commerce demand is expected to keep peak season going into January.

Another fuel surcharge increase out of Hong Kong

As of January 1, 2018, the HKG fuel surcharge will increase to $0.22/kg (up from its current level of $0.16/kg).

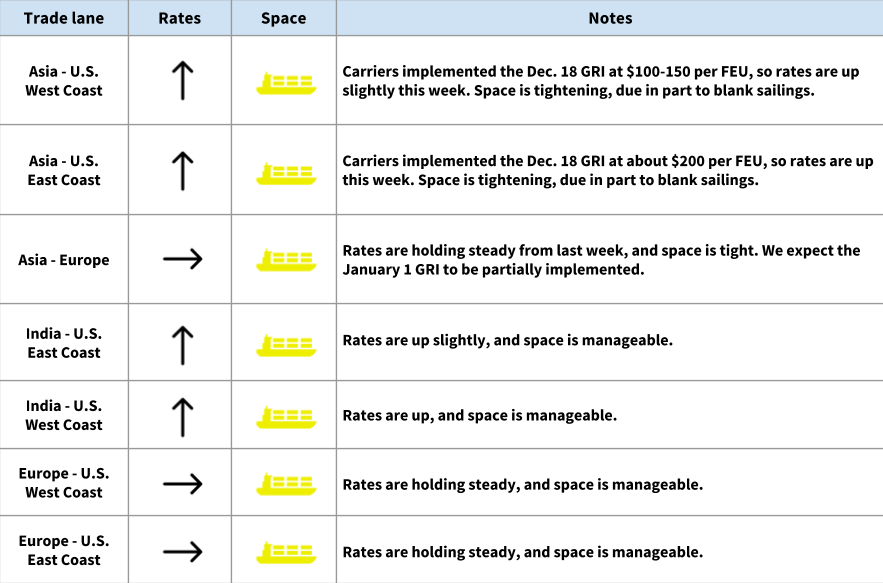

Ocean Freight Market Updates

Dec. 18 GRI was partially implemented

Rates are up from Asia to the USWC and USEC this week, after carriers implemented a GRI. We expect rates to hold steady as space continues to tighten due to blank sailings.

Rates will increase significantly in January due to pre–Chinese New Year demand.

Start preparing for Chinese New Year now

Chinese New Year falls a bit late this year, beginning on February 16. Factories in China will be closed and/or operating at diminished capacity for at least 4 weeks around that time.

In anticipation of Chinese New Year, ocean and air freight rates will rise significantly, and space will become more difficult to secure. Read this article for tips on how to prepare, or ask your Flexport team!

Other Freight Market Updates

Merchandise Processing Fee (MPF) will increase beginning January 1

U.S. Customs has announced that the MPF will increase slightly, beginning January 1, 2018. The new minimum and maximum are:

- Minimum: $25.67 (up from $25.00)

- Maximum: $497.99 (up from $485.00)

The percentage used to calculate the MPF will remain the same, at 0.3464%.

Congestion in Chicago, Savannah, Seattle, Houston, and Charleston

Trucking capacity is stretched very thin in Chicago, Savannah, Seattle, Houston, and Charleston. If you have cargo routing through any of those cities, you may experience delays.

The ELD mandate has taken effect

As of December 18, U.S. truckers are required to use electronic tracking devices to record their driving hours, which will mean strict enforcement of federal hours-of-service rules.

We do know that this will impact deliveries of above 600 or so miles; what a driver could once turn in a day will now require 2 days, which will impact price and overall capacity within the market. Capacity will be further limited by the fact that some small carriers who have not purchased the tracking devices will go out of business.

“That disruption in truck utilization could remove 2 to 5 percent of available capacity, according to most sources,” writes the JOC, “though others believe the impact will be greater.”

Some states have announced that they will delay enforcement.

Trucking rates remain high in California

Over the past few months, we’ve seen a sharp rise in trucking rates out of California (especially Los Angeles).

There’s a combination of factors at play, especially: fuel cost increases, higher demand for trucking to Texas and Florida due to hurricane relief, wildfires, and the general holiday surge.

Rates will go down after Christmas, but due to the ELD mandate and fuel tax increase, rates out of California will remain higher than in previous years.