Market Update

Freight Market Update: April 22, 2020

0

Freight Market Update: April 22, 2020

How will businesses recover from COVID-19? And how can you ensure your cargo is moving when they do? Visit Flexport’s COVID-19 Trade Insights for information and analysis.

Want to receive our weekly Market Update via email? Subscribe here.

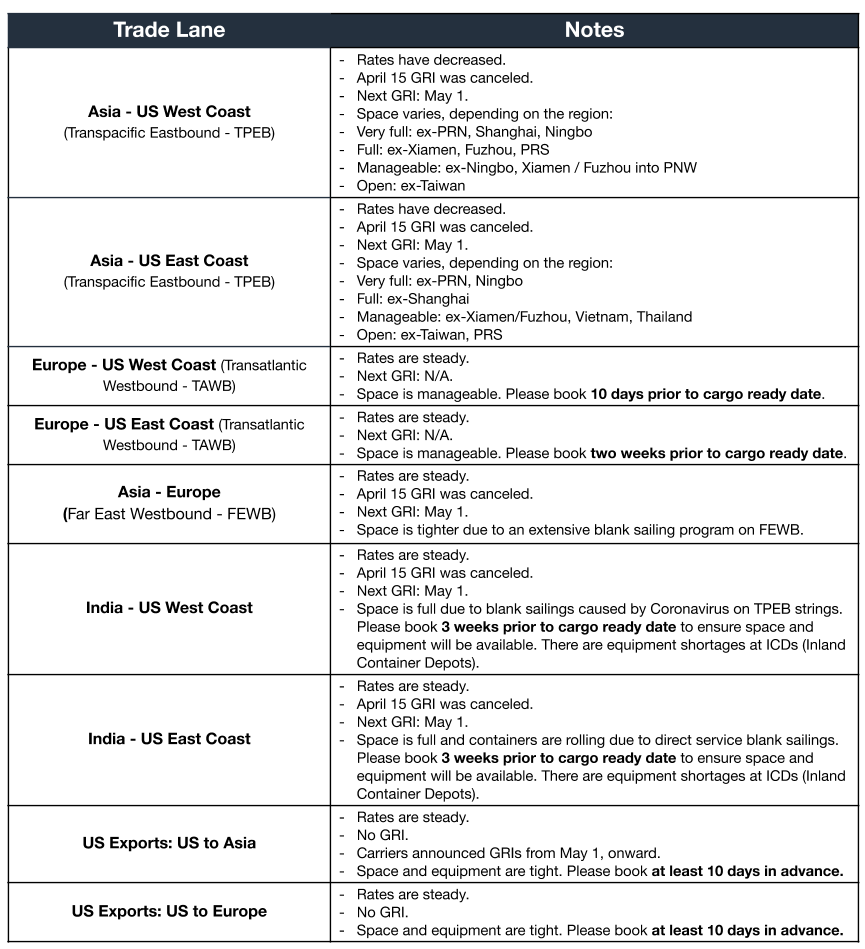

Ocean Freight Market Update

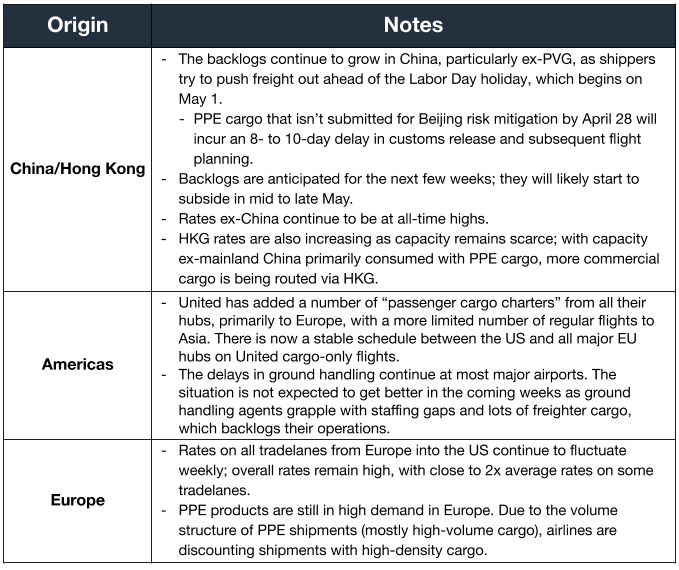

Air Freight Market Update

Freight Market News

COVID Won’t Cancel Zero-Carbon The EU is proposing to increase its current 2030 target of reducing greenhouse gas emissions by at least 40%, based on 1990 levels, to at least 50%, reports JOC. That’s despite COVID-related trade shifts that include sailing around Africa now that marine fuel oil prices make the longer route cheaper than Suez Canal fees. The IMO and individual carriers also confirmed their environmental commitments, just ahead of Earth Day.

Oil Glut Creates Super-Contango Despite hard-bargained agreements to reduce oil production, the world is struggling with how to store crude oil, causing a super-contango situation where spot pricing is more favorable than futures. A combination of travel bans, shelter orders, and blank sailings have caused prices to hit historic below-zero levels this week, according to WSJ.

Businesses Seek Infected Package Tracking With evidence indicating Coronavirus can live on cardboard and plastic, Freightwaves reveals supply-chain automation technologists are seeking ways to adapt available tech to track potentially infected packages that sick workers may touch.

Meanwhile, this week, Flexport Chief Economist Dr. Phil Levy provided a special report on the COVID-19 pandemic’s impact on economics and business:

- This is the week of the IMF-World Bank Spring Meetings. The meeting was virtual, but the IMF still used the occasion to release its outlook for the global economy.

- The IMF’s leader put it succinctly: “We anticipate the worst economic fallout since the Great Depression” of the 1930s.

- Their forecast predicts significant GDP drops in the United States, the Euro Area, Japan, Latin America, and elsewhere.

- China reported a decline of 6.8% in the first quarter, the first such drop since it started reporting quarterly GDP in 1992.

- The IMF estimated that world trade volume would shrink by 11.0% in 2020, after growing 3.8% in 2018 and 0.9% in 2019. It is forecast to rebound by 8.4% in 2021, but that would still leave trade volume down from end-2019 to end-2021.

- Only China is expected to end 2021 ahead of where it finished 2019.

- While the US will not see GDP numbers reflecting the depth of the downturn for months, currently available data is alarming:

- Jobless claims have totaled 22 million over the last four weeks, a weekly average of 5.5 million, when the previous record for weekly jobless claims was 637K, set in 1982.

- Retail sales dropped 8.7% in March, the worst monthly decline since that data series started in 1992.

- A key oil price (WTI) has fallen more than 70% just since the beginning of the year.

- A historic amount of uncertainty exists between economists’ predictions for the rest of the year.

- A flash survey of 45 economists by the National Association of Business Economists revealed a range of forecasts for Q3. The five lowest forecasts for Q3 averaged 12.6% annualized growth; the five highest averaged 20.7%.

- The World Trade Organization, in its recently-released report, offered two possibilities for world trade volume growth in 2020: an “optimistic” scenario with -12.9% growth, and a “pessimistic” scenario with -31.9% growth.

What is clear is that we are embarking upon an extraordinary and tumultuous time. The rapid changes in economies will put a premium on agility and efficiency. Taking stock of the Coronavirus pandemic’s economic impact, this is anything but business as usual.

Customs and Trade Updates

Duty Deferral Available for Some March and April Imports This past weekend, there was a flurry of duty deferral releases that included two Cargo Systems Messaging Service (CSMS) messages (one stating process and another stating what is included), a Presidential Proclamation, and a temporary final rule. In these notices, CBP stated they are extending the deadline for duty payments on imports from March 13-30 and all of April by 90 days for shipments that have not yet been paid. As long as the importer can prove financial hardship (based on required specifications) and the items in question are formal entries that are not subject to ADD/CVD or any of the Section 232/301/201 duties, then the importer qualifies for the deferral. CBP also posted an FAQ on its site.

COAC Recommendations

The Commercial Customs Operations Advisory Committee (COAC) released a document from its April 15 meeting, which among other things, discussed ways to improve the process for intellectual property rights (IPR) and forced labor practices.

IPR Monitoring A new platform for IPR was proposed, which would automatically record a trademark with CBP once registered with the patent and trademark office. Brokers would also have access to this data to help vet and automate for importers. COAC also proposed a systematic function that utilizes blockchain, allowing IPR holders to exchange messages with CBP when seizures take place. Also noted was the "proof of concept" that was done on blockchain in late February. When someone is importing with a trademark, the IPR holder will have the ability to "approve" whether that import is valid on an encrypted blockchain only visible to customs and the IPR holder.

Forced Labor The COAC Committee is also suggesting that CBP update its prior disclosure guidelines to include forced labor. One suggestion aims to have CBP create guidelines that importers should follow when there is an issue with forced labor. Currently, importers can disclose forced labor violations, but there aren't enough guidelines for what the statements should say and how they should be presented. COAC also proposed that a new section be added in the 19CFR, along with recommendations on how CF28s can be issued on forced labor inquiries.

For a roundup of tariff-related news, visit Tariff Insider.

Please note that the information in our publications is compiled from a variety of sources based on the information we have to date. This information is provided to our community for informational purposes only, and we do not accept any liability or responsibility for reliance on the information contained herein.