Market Update

Freight Market Update: April 15, 2020

0

Freight Market Update: April 15, 2020

How will businesses recover from COVID-19? And how can you ensure your cargo is moving when they do? Visit Flexport’s COVID-19 Trade Insights for information and analysis.

Want to receive our weekly Market Update via email? Subscribe here.

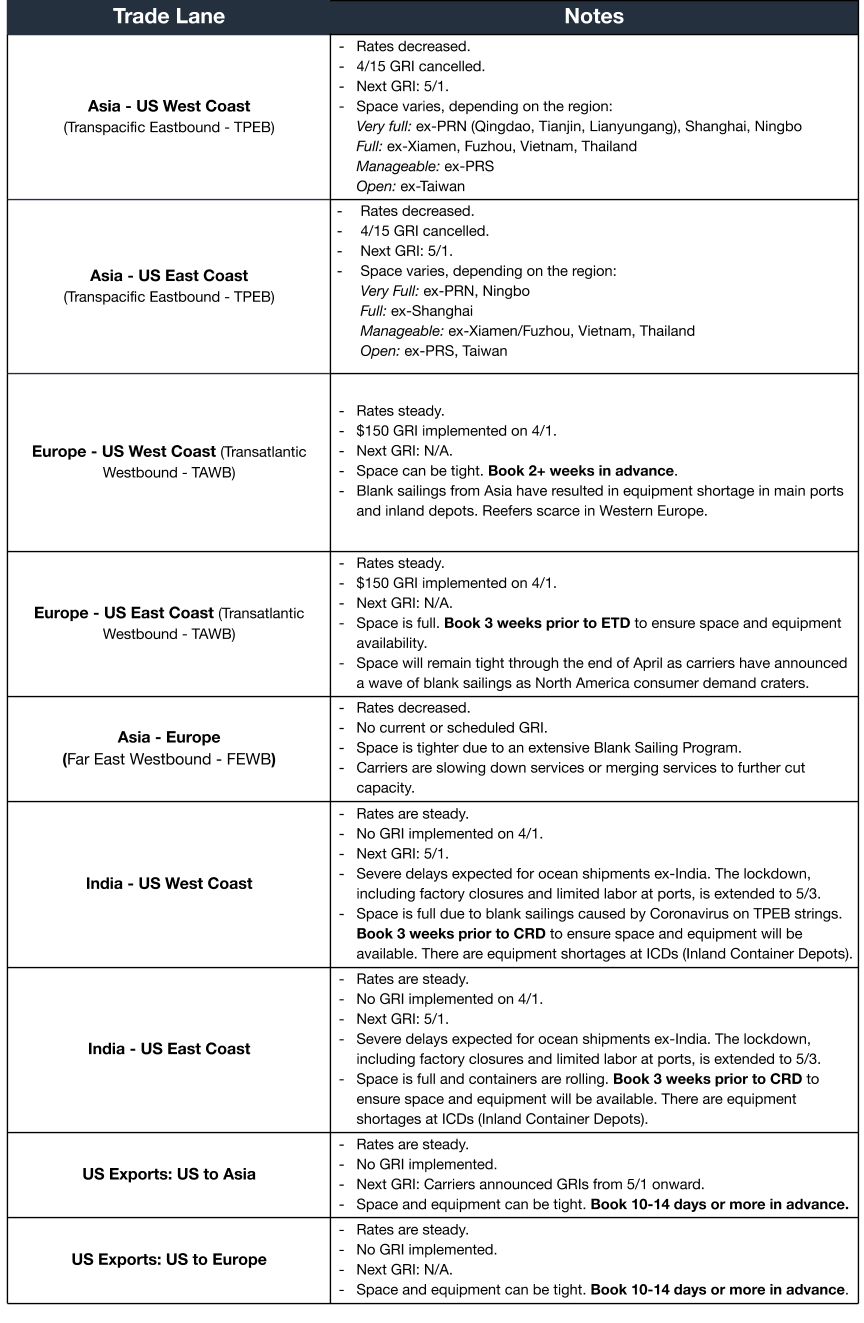

Ocean Freight Market Update

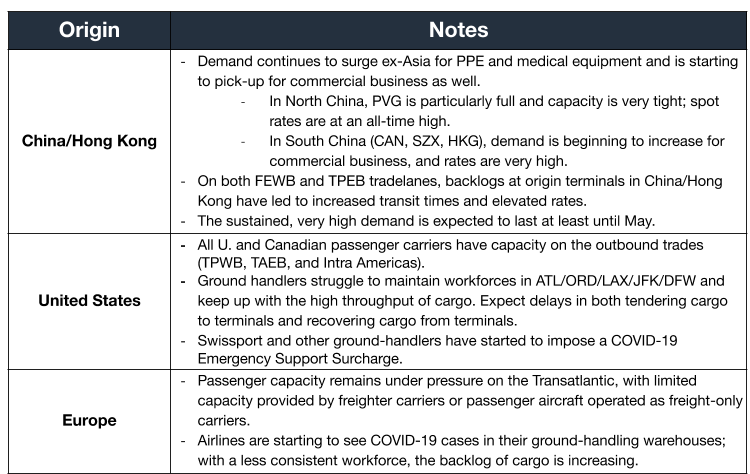

Air Freight Market Update

Freight Market News

Satellite Tracking Increases As companies require new types of information to gauge the health of their supply chains in the era of COVID-19, Bloomberg reports satellite tracking is revealing where food and raw-material suppliers are struggling to meet demand, so that companies can respond with alternatives as quickly as possible.

US Preps New Air Cargo Guidance Following the lead of foreign aviation authorities, US air-safety regulators plan to lift restrictions and provide guidelines for US air carriers to convert passenger areas of airplanes to hold cargo, according to the WSJ.

US-Mexico Trade Could Be Faster A team of researchers is compiling data and making simple suggestions, like truck-only lanes and expansion of pre-clearance programs, reports Freightwaves, in order to expedite freight transport between the US and Mexico. Approximately 85% of goods transported between the two move by truck.

Meanwhile, this week, Flexport Chief Economist Dr. Phil Levy noted the following economic highlights:

- An oil deal was struck after months of a price war spurred by a disagreement between Russia and Saudi Arabia. A broad weekend deal promised to restrain production by 9.7 million barrels per day.

- The initial reaction in oil markets was modest. By some estimates, global oil demand has fallen by 15 million bpd since the start of the year as the COVID-19 pandemic slowed the global economy.

- Brent crude, which traded over $68/barrel in early January was trading just under $33 after touching a low below $25 at the end of March. Such prices put enormous strains on oil producers and have resulted in substantial stockpiling of oil.

- US unemployment claims came in at 6.6m after a revised record 6.9m the week before. This means that more than 10% of the US labor force has filed an unemployment claim in the last three weeks, amid reports that more have tried but been unable to file.

- The French GDP contracted 6% in the first quarter, the worst since WWII, per a report by The Bank of France. The survey showed factories at a record-low 56% capacity, down from 78% in February.

- The WTO foresees a sharp trade decline. After a -0.1% decline in 2019, its new forecast is for a 2020 world trade volume decline between -12.9% and -31.9%. A rebound of 21% to 24% is expected in 2021.

Customs and Trade Updates

USTR Extends Some List 1 Section 301 Exclusions

The USTR issued a notice that it will grant extensions to eight specifically prepared HTS numbers from the first list of Section 301 tariffs scheduled to expire on April 18. The 13 specifically prepared HTS numbers on the original exclusion, but not on this notice, will expire on that date, when the duty rate will return to 25% for Chinese-origin goods.

WCO Revises HTS Guidance Document

The WCO and WHO have amended their document with recommended HTS codes to use for COVID-19 medical supplies. New items have been added to the updated release.

COVID CBP Website

CBP has created a COVID-19 site to help answer questions from importers or brokers on importing PPE or related materials.

For a roundup of tariff-related news, visit Tariff Insider.

Please note that the information in our publications is compiled from a variety of sources based on the information we have to date. This information is provided to our community for informational purposes only, and we do not accept any liability or responsibility for reliance on the information contained herein.