Market Update

Freight Market Update: May 8, 2019

Ocean and air freight rates and trends; trucking and customs news for the week of May 8, 2019.

Freight Market Update: May 8, 2019

Want to receive our weekly Market Update via email? Subscribe here!

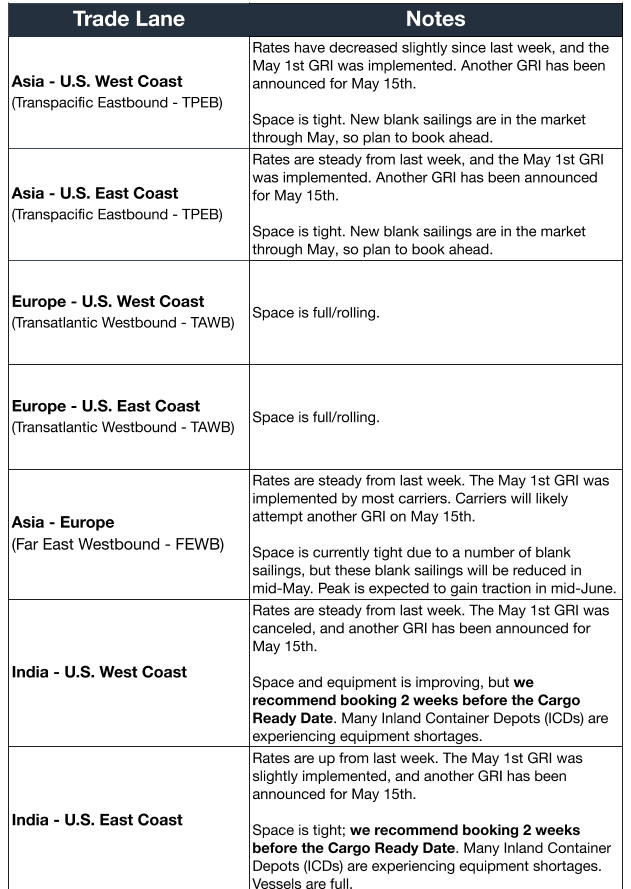

Ocean Freight Market Updates

Weight Restrictions on Panama Canal Shipments

The Panama Canal restricts the draft (how deep the hull goes into the water) of vessels based on the amount of water available in Gatun Lake, which varies based on rainfall, amount of vessels and other factors. Ships must be lighter to meet the draft requirement, so they need to carry less cargo/ballast/fuel or offload cargo to the Panama Canal Railway.

The Panama Canal Authority has announced a further reduction to allowable vessel draft for the Neopanamax locks. A draft restriction has also been announced for the legacy, Panamax, locks. These new draft restrictions will take effect on May 28th, 2019.

Vessel Overcapacity Okay with U.S. Regulators

A top policy analyst at the Federal Maritime Commission (FMC) has assessed that the high capacity and low rates the market is currently seeing does not pose a bankruptcy threat to international ship lines. IMO 2020 is also not expected to have detrimental negative effects, although a ripple effect through supply chains is anticipated.

**Port of Rotterdam Completes Digital Operations Trial **

The Port of Rotterdam has successfully completed its trial of Pronto, a digital operations platform that is the “single point of truth” for port-related data. The platform decreases the chance for miscommunication, and allows for more reliable vessel unloading time predictions, reducing costly quayside and ship downtime. The port is considering rolling out the platform across terminals and potentially other North European ports.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions from 3.5% to 0.5%.

Whether they install scrubbers, build new vessels, or use higher-quality fuel, carriers will need to make significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Freight rates may climb between now and 2020 as a result.

For an in-depth look at the regulation and how to prepare, read our blog post: IMO 2020: What Shippers Need to Know Now

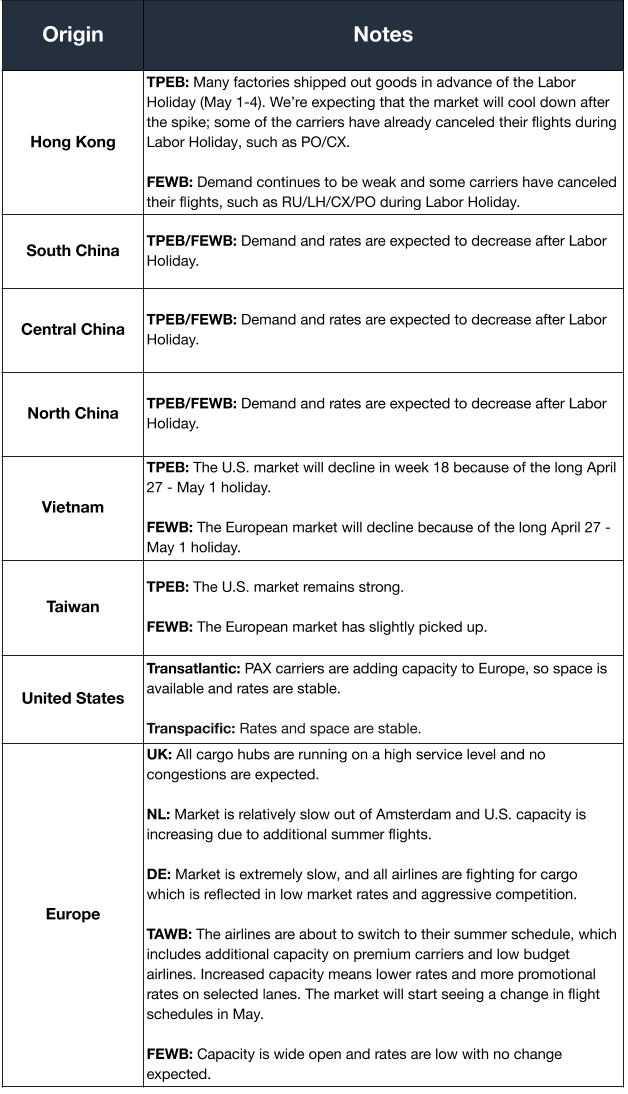

Air Freight Market Updates

Airline Rate Volatility Expected Through May

Airline rates are expected to be volatile through May because of the varying strategies that forwarders have to secure space. Analysts say the soft market may be an opportunity to change how capacity is bought, contributing to the introduction of more prevalent dynamic pricing.

Airlines Introducing Dynamic Pricing

Fluid pricing in air freight may become more prevalent in the future as seasonality and day-to-day variability of air demand invites a pricing system that reacts in real time. Spot rates have always been available in the industry, but the introduction of fluctuating base rates may shake business stability and prediction accuracy.

Trucking Market Updates

European Capacity Increasing Due to Weak Economies

Trucking capacity in Europe is increasing, but it’s because of weakening demand, not because the truck driver shortage has been alleviated. Haulage prices will continue to increase as operational costs continue to rise.

U.S.-Mexico Border Congestion Eases

At the time of the border’s worst congestion, trucks were experiencing seven to eight-hour delays, but these have now been reduced to three to four hours. Full recovery to normal wait times is not expected for another four to six weeks.

Customs and Trade Updates

U.S. Appears to Have Hiked Chinese Tariffs

Ahead of formal notice, Flexport found tariff hikes on Chinese goods applying to shipments arriving in the U.S. May 10th or later. Read more on our blog.

New AD/CVD Possible for Metal File Cabinets from China

The International Trade Commission (ITC) posted a new proposal that alleges vertical file cabinets from China are being sold at less than fair market value in the U.S. The Department of Commerce (DOC) and ITC will decide whether to launch duty and injury investigations.

AD/CVD Investigation Initiated on Ceramic Tile from China

CBP posted a CSMS message that they have initiated an investigation on ceramic tiles including flooring, wall, paving, hearth, porcelain, mosaic, flags and finishing tiles. All ceramic tiles are subject, regardless of whether they are finished or in raw form, their end use, surface area, weight, glaze, or backing.

CTPAT Updates Minimum Security Criteria

CBP has finalized the minimum security criteria for the participants in the CTPAT program. These measures are not likely to be implemented until 2020, but members should start to work on the changes in 2019 so their facilities are ready for possible inspections next year. The process to identify these security criteria took two years, and has adopted criteria in cybersecurity, protections from agricultural contaminants and pests, money laundering prevention, and management of security technology. The booklets for each business type will be released shortly in the CTPAT portal.

For a roundup of tariff-related news, read our Tariff Insider.