Market Update

Freight Market Update: April 10, 2019

Ocean and air freight rates and trends; trucking and customs news for the week of April 10, 2019.

Freight Market Update: April 10, 2019

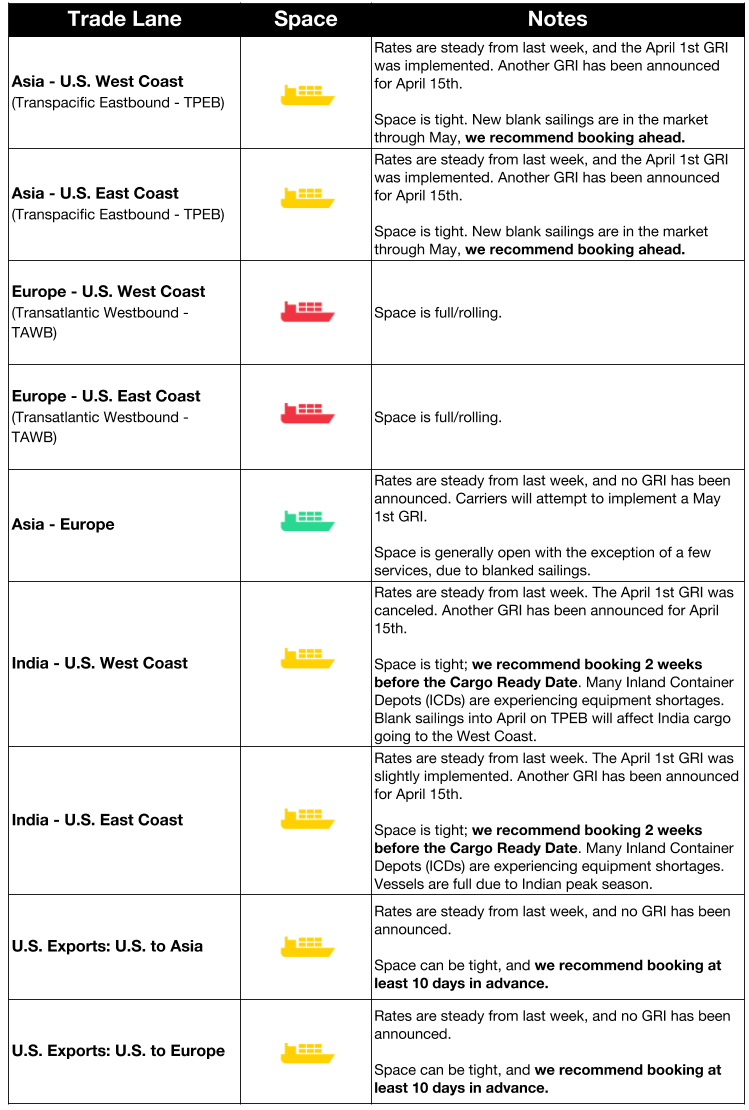

Ocean Freight Market Updates

Capacity to Tighten on Asia <> Europe

Carriers have announced blank sailings for the rest of this month and May in an attempt to tighten capacity and drive up rates. The Ocean Alliance will cancel five Asia-North Europe loops and an Asia-Mediterranean departure during weeks 17-21.

UK Main Ports Remain Congested

Quay side operations have improved, but a shortage of haulage capacity restricts movement. Haulage capacity in Germany remains a challenge, reducing intake of barges and increasing moves via rail and truck. There are no solid plans for Brexit yet from carriers.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions from 3.5% to 0.5%.

Whether they install scrubbers, build new vessels, or use higher-quality fuel, carriers will need to make significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Freight rates may climb between now and 2020 as a result.

For an in-depth look at the regulation and how to prepare, read our blog post: IMO 2020: What Shippers Need to Know Now

Customs and Trade Updates

EU Section 301 Tariffs to be Implemented

The USTR has issued a press release that the World Trade Organization (WTO) found that “European Union subsidies to Airbus have caused an adverse effect to the United States.” The USTR has begun the process with WTO to identify EU products that Section 301 duties will be applied to as a consequence. A preliminary list has been released covering a wide array of goods including agricultural products, apparel, ceramics, metals and kitchen items. France, Germany, Spain and the UK have been identified as the countries causing the U.S. the most harm. The list is not yet finalized and tariffs have yet to be set.

The EU is also seeking authorization from the WTO to apply retaliatory tariffs on U.S. goods through an EU case against the U.S. for giving Boeing similar subsidies.

**Review for Improvements to Counterfeit Goods Policies **

The White House released a statement that they will improve on measures to prevent the circulation of counterfeit goods. The administration will review how different parties (including customs brokers, carriers, vendors, etc) can assist or be held accountable in stopping or catching counterfeit and pirated goods. Alibaba, Amazon and eBay were directly called out and will likely see policy changes aimed towards the estimated 40% of the products offered on the sites that may be counterfeit. The report will be due in 210 days and have recommendations for many areas to improve the protection of intellectual property rights for the rights holders.

Annual Trade Barriers Review

The USTR put out their annual National Trade Estimate report. The report was focused on the trade barriers that affect U.S. exports among 61 countries including the EU, Taiwan, China, Hong Kong and the Arab League. 11 trade barrier categories are reviewed and cover government-imposed measures and policies that restrict, prevent, or impede the international exchange of goods and services. The report covers technical barriers, product standards, testing, labeling, certification, sanitary and phytosanitary barriers, food and beverage safety, plant and animal protection, and technology devices. The China portion of the report will be largely focused on because these were some of the key barriers that led to the implementation of the Section 301 tariffs.

**Trump Backs Off Border Shutdown Talks **

President Trump backed off the border shutdown talk last Friday, saying he’d give Mexico a year to address illegal migration and drugs through its territory. CBP had transferred 750 field officers from ports of entry to border enforcement and processing last week. They are planning to expand that number and transfer another 2,000 officers, continuing to slow processing at the ports of entry. Officers from the Ports of Nogales, Laredo, El Paso and San Diego have already been reassigned and deployed to assist border patrol for the next 30 days. Wait times in El Paso are normally 1-2 hours, but have been taking as long as 12 hours to cross. For more port delay information, see CBP’s website.

ITC Seeks Changes to International HS Tariff Schedule

The USTR posted a proposal in the Federal Register to review major changes to the HS tariff schedule for possible adoption by the year 2027. The proposed changes to the schedule would modify text in chapter notes, headings (4-digit), subheadings (6-digit), statistical (8-10) and rates of duty. The ITC wants to focus on the deletion of some headings based on low trade volume and would support adding new headings that would improve or assist with unifying the classification of goods internationally. The proposals will be reviewed by the ITC, CBP, and Census Bureau before they are submitted to the WCO committee, due by November 2022.

For a roundup of tariff-related news, read our Tariff Insider_. _