Market Update

Freight Market Update: January 16, 2019

Ocean, trucking, and air freight rates and trends for the week of January 16, 2019.

Freight Market Update: January 16, 2019

Want to receive our weekly Market Update via email? Subscribe here!

⚠️Reminder Notice⚠️

LA and NY Trucking Experiencing Congestion

We’re seeing extreme congestion at Los Angeles/Long Beach and New York ports, as a result of the influx of import volume in advance of the tariff hikes, peak season, and Chinese New Year preparations. The large import volume is causing a chassis shortage and long pickup times, so you may experience some shipment delays in the next few weeks. New York’s Newark terminal is particularly crowded, and because NY terminals are not open after hours or on weekends (unlike LA/LB), we expect the NY backlog to take longer to clear.

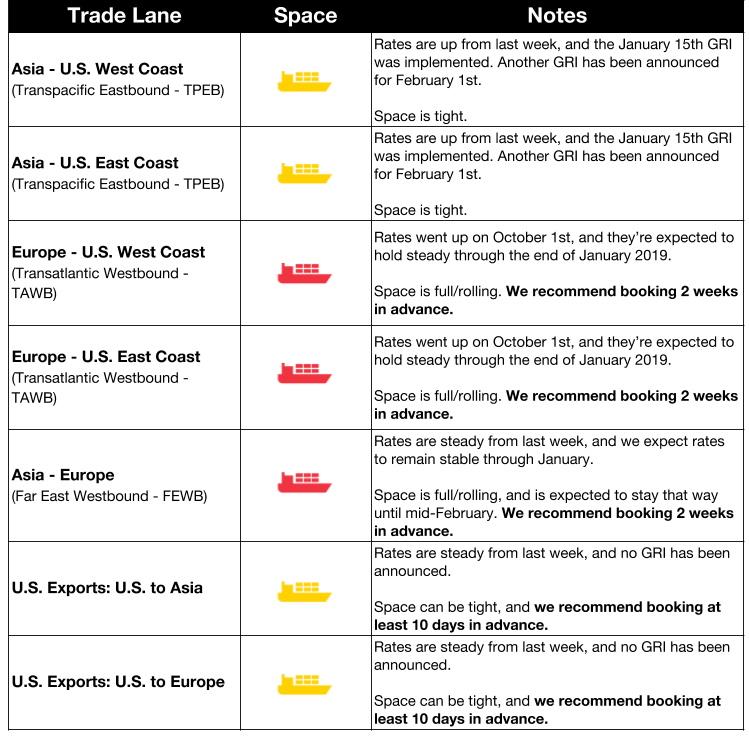

Ocean Freight Market Updates

UK Ports Remain Extremely Congested

UK ports are very congested, which is causing tight trucking capacity and a decline in port productivity. This congestion is expected to continue through late January. Quay side operations have improved, but shortage of haulage capacity restricts movement. Trucking currently needs to be booked 14 days in advance.

Blank Sailings for Asia-Europe and Transpacific Sailings

The 2M Alliance comprised of Maersk and MSC has announced blank sailings during Chinese New Year, typically a low-demand time of year. Sailings on the AE2/Swan loop to Rotterdam and Felixstowe have been cancelled, as well as two sailings to North Europe and two loops between Asia and the U.S.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions from 3.5% to 0.5%.

Whether they install scrubbers, build new vessels, or use higher-quality fuel, carriers will need to make significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Rates may climb between now and 2020 as a result.

Vessel scrapping is expected to pick up in 2019, as it’s too expensive to retrofit older vessels with scrubbers or fill them with higher-quality fuel. This scrapping is predicted to take 300,000 TEU off the market.

For an in-depth look at the regulation and how to prepare, read our blog post: IMO 2020: What Shippers Need to Know Now

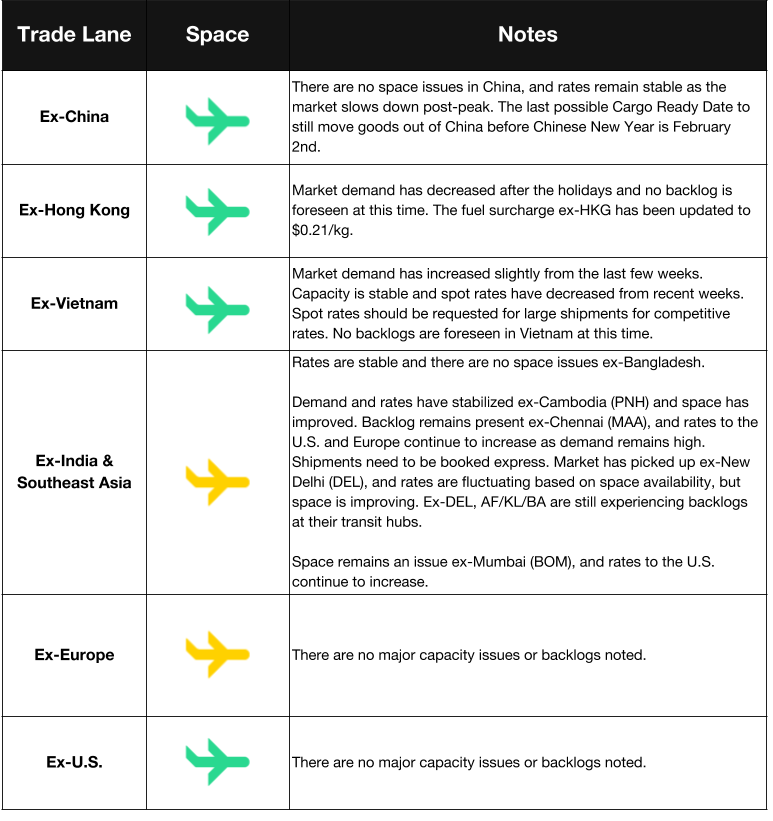

Air Freight Market Updates

Government Shutdown Affecting Air

Passenger transport has started to be affected by the government shutdown, as the lack of paychecks has caused TSA employees to stop showing up for work, and air traffic controllers to file a lawsuit against the government. Air cargo is also starting to see a delay, because the necessary paperwork can’t be filed.

Trucking Market Updates

European haulage capacity remains a challenge, impacted by low water in the river Rhine, reducing intake of barges and increasing moves via rail and truck.

UK Contracts Carriers to Prepare for No-Deal Brexit

The U.K.’s Department of Transport has contracted three carriers to keep freight moving in the event of a no-deal Brexit in March. If the UK leaves the EU without a trade deal in place, vessels will call on the ports of Poole, Portsmouth, and Plymouth to transport cargo across the English Channel. However, officials warn that even with these preparations, significant trade disruptions would be unavoidable.

Calais Port May Be Unprepared for Brexit

The Port of Calais has been accused of being unprepared for Brexit, significant because Calais is a large transfer point for cargo between Europe and the UK. Drivers will need to be prepared with the necessary paperwork that must be completed before arrival at the port. The UK may revert to WTO rules, which means that the documents would be actual paper, in the event of a no-deal Brexit.