Market Update

Freight Market Update: November 21, 2018

Ocean, trucking, and air freight rates and trends for the week of November 21, 2018.

Freight Market Update: November 21, 2018

Want to receive our weekly Market Update via email? Subscribe here!

Ocean Freight Market Updates

Expect Delays Due to Holidays

Truckers, rail, and barge operators will have days off during Christmas and New Year’s Eve, so all services will be fully booked up to that point. Low water levels on European waterways are also making barge transportation difficult, forcing cargo to move via truck and rail which further constricts those services.

UK Ports Remain Extremely Congested

UK ports are very congested, which is causing tight trucking capacity and a decline in port productivity. The tight congestion is expected to continue through late January when Chinese New Year cargo will arrive.

Maersk is planning on transferring its UK port of calling from Felixstowe to London Gateway on 2M’s AE7/Condor service at the end of November in an attempt to relieve pressure on the UK’s haulage situation.

Rail and road capacity are also limited in Germany due to a surge in volume.

Maersk Signals Slowing Industry Growth

Carriers including Maersk and Hapag-Lloyd have issued profit warnings this year, so logistics managers should start preparing for a slowing trade economy next year. Rising fuel costs and the China-U.S. trade war are expected to make 2019 another challenging year.

Thames May Be Leveraged for More Water Transport

Trucking is the only growing freight industry in London, so London’s mayor is pushing for more use of water transport in the city to reduce traffic congestion. Seven tons of cargo are already being moved via barge with the development of the Tideway sewerage system, with hope that this route will continue to grow.

Five Major Carriers to Standardize Information Technology

AP Moller-Maersk, CMA CGM, ONE, Hapag-LLoyd, and MSC will form a container shipping association to align on industry digitization and standardization. The focus of this association, expected to begin in early 2019, will be to increase interoperability, not to discuss any operational or commercial matters.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions to 0.5% from 3.5%.

Whether they upgrade their vessels or their fuel, carriers will need to undertake significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Rates may climb between now and 2020 as a result.

Beginning on March 1, 2020, IMO is banning vessels from carrying high-sulfur fuel (fuel with a sulfur content higher than 0.5%) unless the vessel has a scrubber to clean the fuel.

The short-term effects of these new regulations are expected to be disruptive, but long-term they could help alleviate the over-capacity that has plagued the industry in recent years.

U.K. Warehousing Shortage in Advance of Brexit

Similar to how U.S. import volume is up in anticipation of 2019 tariffs, U.K. warehouses are seeing a surge in demand in anticipation of continuing Brexit negotiations. With the short-term and long-term effects to trade practices still unknown, buyers are importing goods and storing them in the U.K. to avoid potential delays later. Primark, manufacturer of Twinings tea and Patak’s sauces, is one of these companies planning to stockpile goods in anticipation of Brexit.

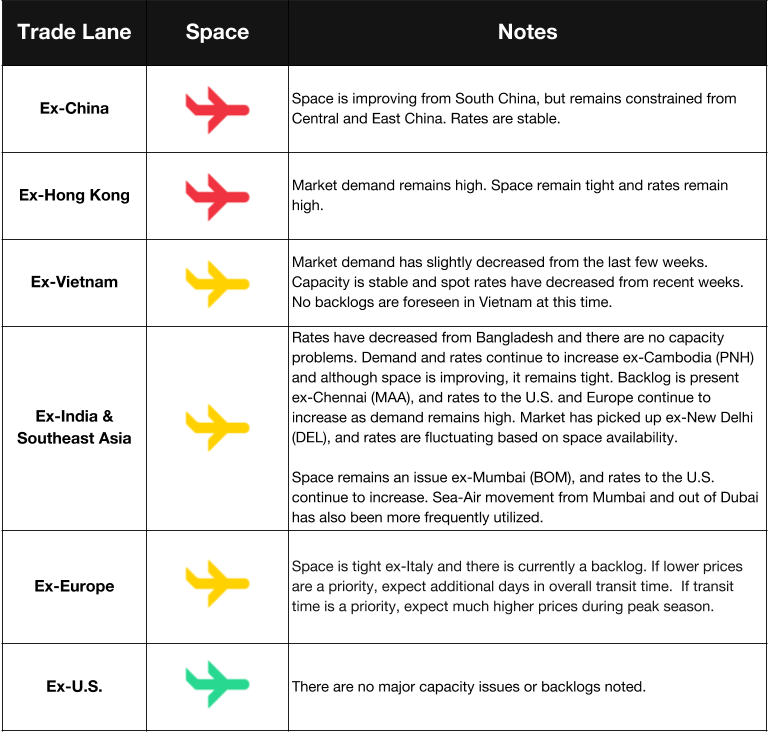

Air Freight Market Updates

Air Market to Benefit from Trade War

The air freight market stands to benefit from the trade war, as shippers tend to use more air in chaotic trading environments. Manufacturers are also looking to move out of China ahead of the looming 2019 tariffs, and will need to use air instead of ocean to shorten that created gap in their supply chain.

High Jet Fuel Costs to Continue

Airlines are continuing to raise jet fuel surcharges to pass the rising cost of fuel to shippers, and are expected to continue doing so through peak season. Fuel surcharges have caused controversy in recent years as shippers question whether the practice is a revenue source for carriers, but you can expect them to continue to rise either way.

Trucking Market Updates

UK Trucking Faces Number of Critical Issues

The Road Haulage Association (RHA) warns that ignoring the current trucking problems will lead to disaster for the market in the future. A shortage of truck drivers, high costs to train new and younger drivers, and constricting regulatory practices are stifling the UK trucking market and will lead to a “catastrophic cocktail of disaster” if not addressed. Trucking currently needs to be booked 15 days in advance.

Truckers Support Nationwide Emissions Standards

Truckers are pushing for the EPA to implement nationwide nitrogen oxide standards, as opposed to individual state standards. California wants to impose strict emission restrictions that truckers fear would put too much pressure on the industry, and truckers say that nationwide standards would be a better investment.