Market Update

Freight Market Update: October 3, 2018

Ocean, trucking, and air freight rates and trends for the week of October 3, 2018.

Freight Market Update: October 3, 2018

Want to receive our weekly Market Update via email? Subscribe here!

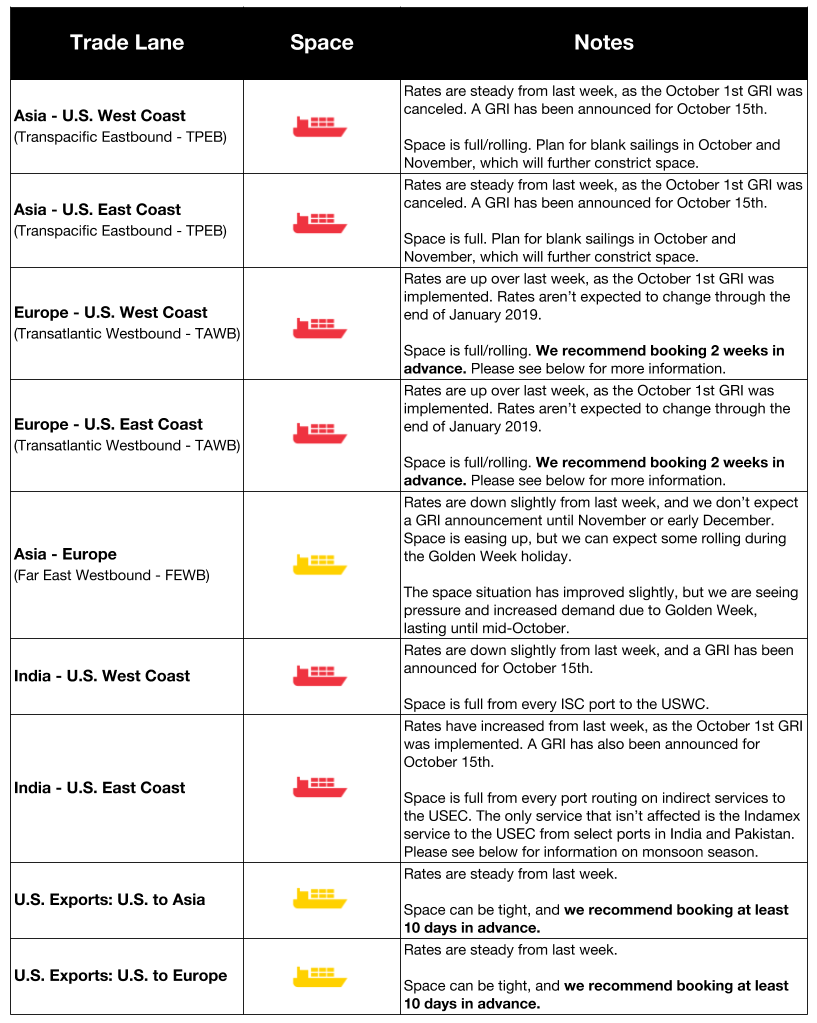

Ocean Freight Market Updates

Transatlantic Westbound (TAWB) Services Booked 2 Weeks Out

UK ports are very congested, which is causing a decline in port productivity and tight trucking capacity. Services are full 14 days out, and we recommend booking in advance to secure space and minimize risk of rolling.

Trucking/intermodal capacity is very tight in North Europe due to a surge in volumes.

Blank Sailings: Expect Ocean Space to Remain Tight as Carriers Cancel Sailings

As we head into a traditional off-peak season, between Golden Week and Chinese New Year, carriers are announcing blank sailings that will impact services for shippers, especially on the high volume Trans-Pacific Eastbound (TPEB) and Far East Westbound (FEWB) lanes.

For a list of upcoming cancellations and information including how blank sailings may impact shipments and how to mitigate issues, check out our new blog post.

Peak Season Sees Highest Ocean Freight Spot Rates in 2 Years

Shippers moving freight from China to the U.S. are seeing some of the highest ocean freight spot rates in over two years, reports Supply Chain Dive. The increased rates are largely attributed to three factors: higher crude oil costs, an earlier peak season, and carriers cutting capacity.

India’s Monsoon Season is in Effect

Monsoon season is in effect from June through October:

- We highly advise shrink wrapping all FCL/LCL pallets and cartons that may be prone to being affected at the time of origin stuffing

- Expect vessel delays/port closures due to weather constraints

- Indian POL’s that receive the most rainfall are Chennai, Tuticorin, and Kochi

**Trans-Pacific Peak Season Sees Higher Rates **

U.S. importers shipping in trans-Pacific should expect higher rates, as peak season has caused very low capacity on most ships. As JOC reports, “Ocean carriers in certain cases are holding the line on weekly minimum quantity commitments (MQC) as they have done in prior periods of tight capacity, meaning that any given shipper will be allocated only one week’s worth of capacity out of its total annual MQC.”

Impact of New IMO ECA Regulations

The International Maritime Organization has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions to 0.5% from 3.5%.

Whether they upgrade their vessels or their fuel, carriers will need to undertake significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Rates may climb between now and 2020 as a result.

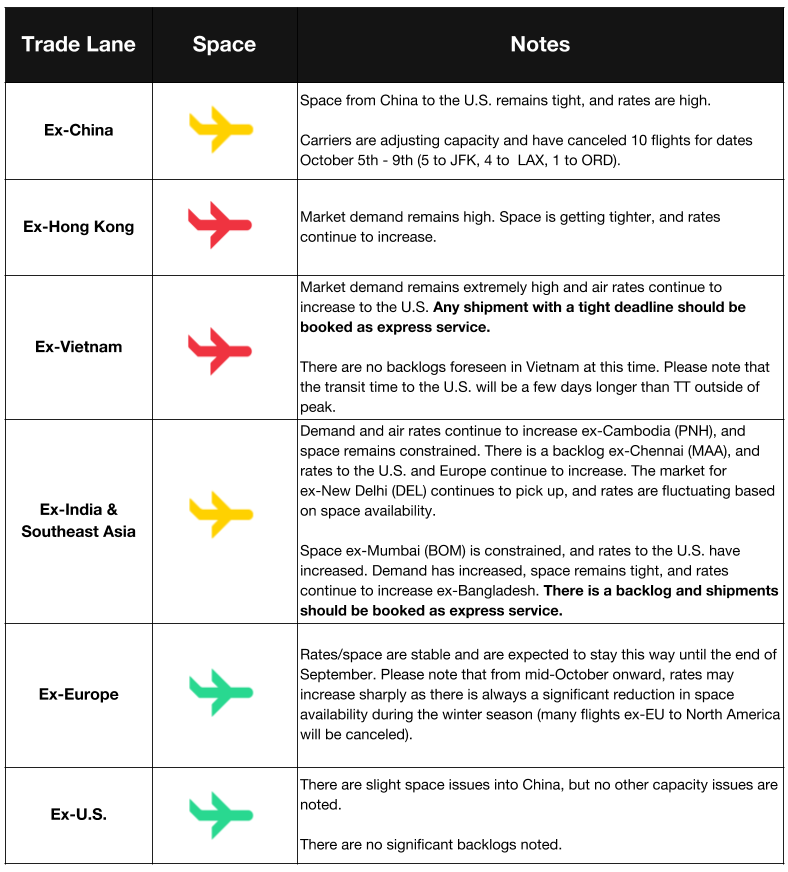

Air Freight Market Updates

Air Freight Peak Season Takes Flight in September

The transpacific air freight sector sees tight capacity and high rates as peak season soars, reports The Loadstar. Aside from standard peak season causes, the threat of a new round of tariffs has motivated many to move up shipments. Europe’s peak season is likely to begin soon, as well.

Trucking Market Updates

UK Road Freight Sector Unable to Respond to ‘Minor Changes’

Minor operational changes are causing large bottlenecks for the UK road freight sector, reports Lloyd’s Loading List. This is attributed to a number of factors, including IT failures, driver shortages, underinvestment, and rising costs. If demand continues to outweigh demand, it’s possible that rates will increase in the near future.

Early trans-Pac Peak Means Higher Truck Rates Ahead

JOC reports that the early peak shipping season could mean earlier-than-usual rate increases for truck and intermodal shipments in the U.S. As capacity tightens and rates increase, we recommend booking shipments as early as possible.

U.S. Businesses Feel the Effects of Low Trucking Capacity

As factories ramp up production to meet the needs of the fast-growing U.S. economy, many businesses report that it’s been very difficult to find trucking capacity in the current market. This is affecting companies to the point of cutting their full-year earnings reports, as they know they won’t be able to move product as previously expected.