Market Update

Market Update: June 13, 2018

Ocean, trucking, and air freight rates and trends for the week of June 13th, 2018.

Market Update: June 13, 2018

Want to receive our weekly Market Update via email? Subscribe here!

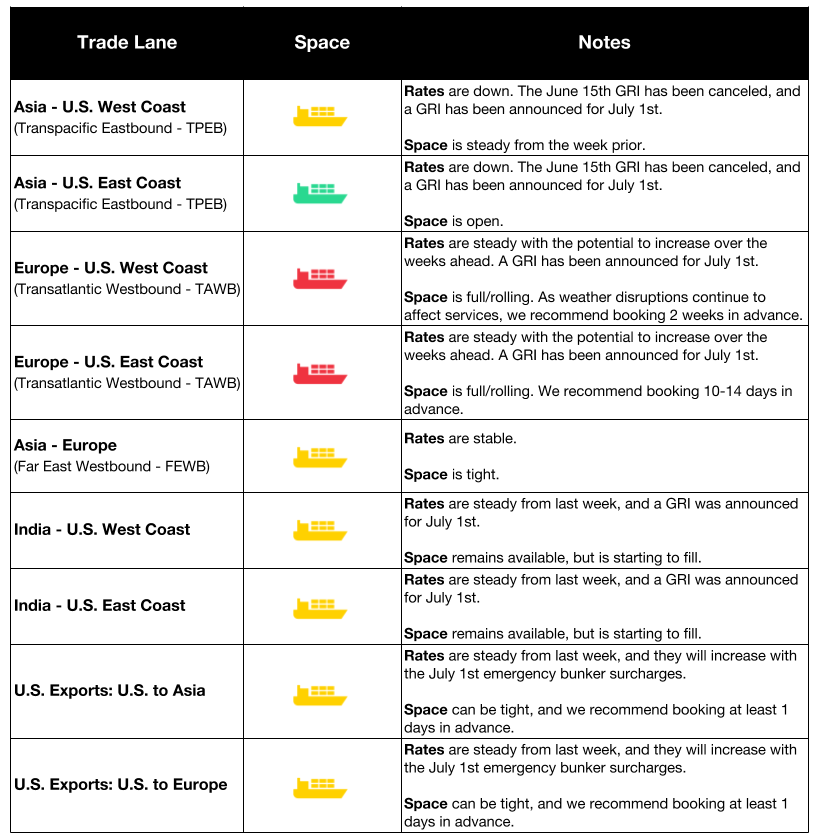

Ocean Freight Market Updates

**Container Lines Worry About Repercussions of Sulphur Cap **

The International Maritime Organization (IMO) decided to implement a 0.50% sulphur cap on marine fuel, effective January 1, 2020. The move to cut sulphur oxide emissions has many container lines worried, as the decision translates to an estimated extra cost of $50bn.

To comply with the IMO’s decision, vessels will have to either equip themselves with exhaust gas cleaning systems (known as scrubbers) or burn a compliant bunker fuel. Ocean carriers worry that they won’t be able to recover the additional costs from shippers.

China Customs Advanced Manifest requirements

The General Administration of Customs of the People’s Republic of China (GACC) is changing its China Customs Advanced Manifest (CCAM) requirements for imports and exports according according to GACC Announcement No. 56. The new requirements include data that must be electronically shared with the GACC for all inbound and outbound imports and exports from China.

The following elements are now mandatory:

- Shipper's Enterprise Code must be shown on the paper AWB and in the OCI line of the FWB/FHL message

- Consignee's Uniform Social Credit Identifier (USCI) must be shown on the paper AWB and in the OCI line of the FWB/FHL message

- Consignee's contact person, name and contact number must be shown on the paper AWB and in the SHP and CNE data items of the FWB and FHL message

- Shipper and consignee's telephone number must be present as part of their addresses

**Bunker Surcharges Not Embraced by Shippers **

New emergency bunker surcharges (EBSs), which started last week with announcements from MSC, Maersk, and CMA-CGM, are sparking anger among shipping and 3PL customers, reports The Loadstar. Carriers implementing the charge have said the fees are non-negotiable.

Maersk to Add Trans-Atlantic Loop

Beginning July 2nd, Maersk Line will launch a new trans-Atlantic service. This will connect four ports in the Mediterranean with two in Canada. Aided by two new trade deals, the Comprehensive Economic and Trade Agreement (CETA) and the Comprehensive and Progressive Agreement for Trans-Pacific partnership (CPTPP), Maersk believes maritime container volume will grow by 7% in 2018.

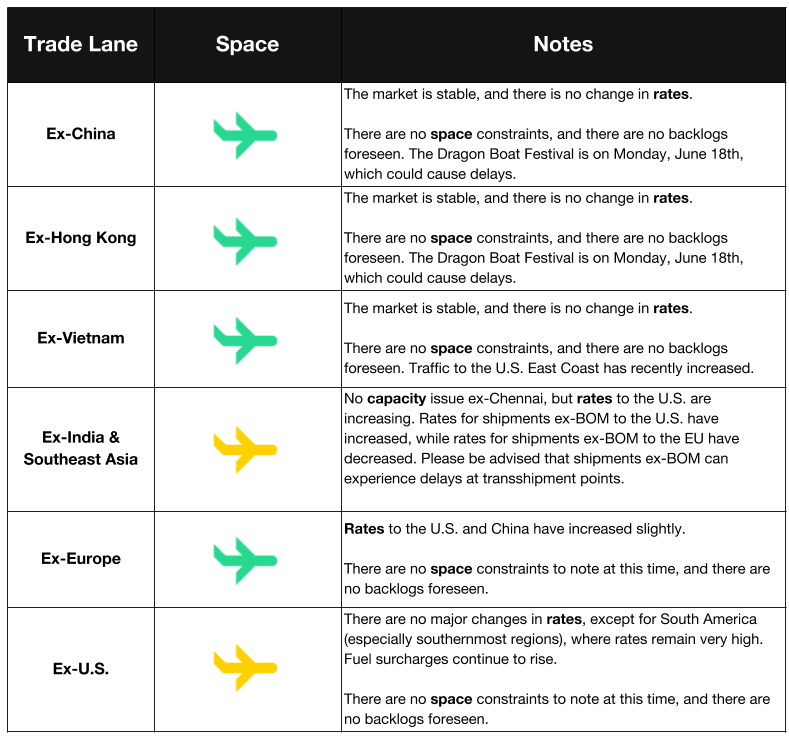

Air Freight Market Updates

**Forwarders & Shippers Prepare for Low Air Capacity **

The 2017 capacity constraints for air freight aren’t forgotten in the minds of shippers and forwarders. In response to last year’s shortages and higher-than-usual rates, shippers are looking for guaranteed space throughout the year for their products, and some are looking for their own planes. Forwarders are chartering more flights to guarantee space, and reserving planes for select shippers.

The Loadstar reports that demand growth is at 4-5%, and that April, which is usually the beginning of slack season, was stronger than expected.

Related blog post: Investing in Service, Flexport to Charter its Own Aircraft

Air Freight Demand Increases With E-Commerce Trend

According to a recent UPS study, online shoppers are increasingly looking to international vendors when shopping. The e-commerce trend places pressure on air freight, as shoppers look for fast delivery times. The increase in demand could lead to rate increases and capacity shortages.

Trucking Market Updates

Strikes Over Rising Fuel Prices Hit China’s Truck Market

Responding to rising fuel prices, truckers across China have staged mass protests and refused to work over the weekends. Fuel costs have increased by approximately 8.5% over the last 12 months.

According to The Loadstar, strikes have been recorded in Anhui, Chongqing, Guizhou, Henan, Hubei, Jiangxi, Shandong, Shanghai, Sichuan, and Zhejiang.

LA-LB Terminals Agree to Restructure PierPass Program

Agreeing to restructure the 13-year-old PierPass program, Los Angeles-Long Beach marine terminal operators will reduce the traffic mitigation fee to $31.52 per TEU, a 55% reduction.

Assuming the Federal Maritime Commission approves the restructuring, the new pricing will take effect in August 2018.