Market Update

Market Update: May 9, 2018

Ocean, trucking, and air freight rates and trends for the week of May 9, 2018.

Market Update: May 9, 2018

Want to receive our weekly Market Update via email? Subscribe here!

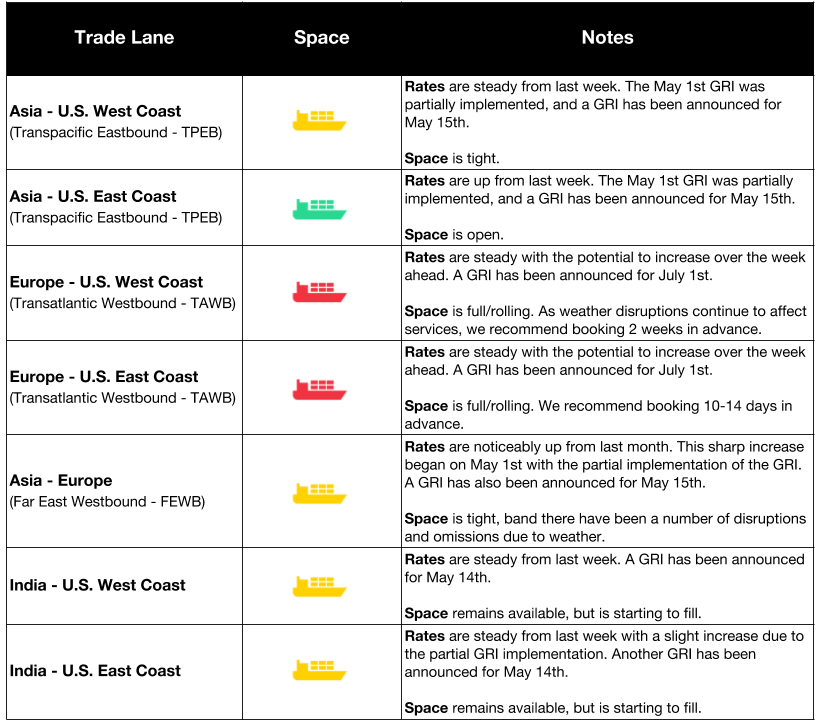

Ocean Freight Market Updates

GRI Announcements for May 14th, May 15th, & July 1st

A General Rate Increase (GRI) has been announced for the following lanes and dates:

- Transpacific Eastbound (TPEB): May 15th

- Transatlantic Westbound (TAWB): July 1st

- Far East Westbound (FEWB): May 15th

- India-US: May 14th

- US Exports - U.S. to Asia: May 15th

India - U.S. East Coast: New Service in June

Pacific South Loop (PS3), the first direct service from Northern India to the USWC, will begin in June.

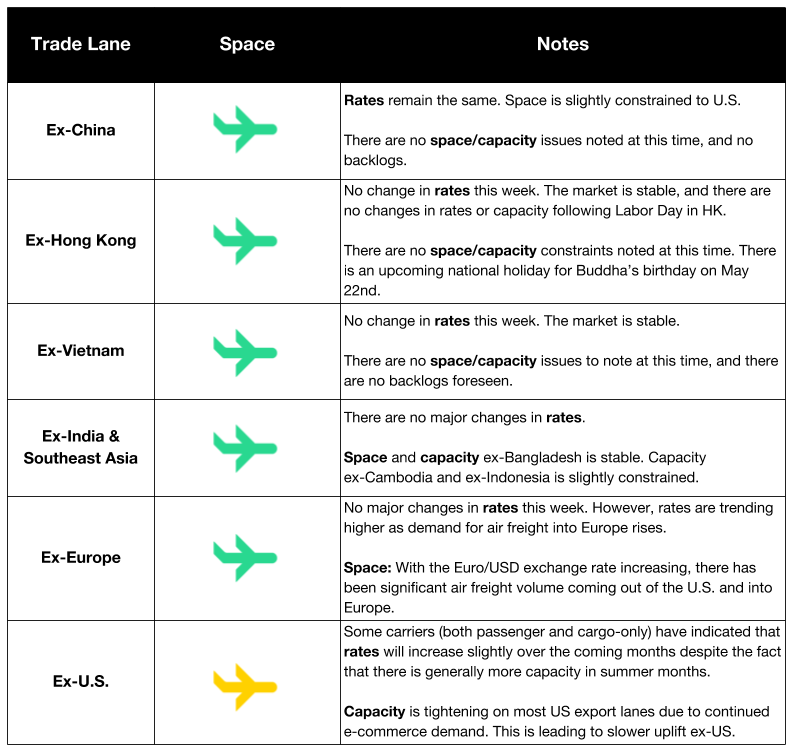

Air Freight Market Updates

Boeing Plans to Ramp Up Production of 767s

Betting on the air freight market, Boeing plans to increase production of 767s from 2.5 to 3 a month, starting in 2020. In a recent earnings call, Boeing's CEO Dennis Muilenburg said, “We do see long-term strength in the (air cargo) market.”

Air freight demand is growing at its fastest rate since 2010, the International Air Transport Association reports. The growth of e-commerce and temperature-sensitive goods has also benefited passenger planes, as they’re “filling their bellies with more cargo.”

Ex-U.S. Rates Expected to Increase

Select carriers (both passenger and cargo-only) have indicated that rates will increase slightly over the coming months. This is despite the fact that there is typically increased capacity heading into summer months due to additional seasonal flights for holiday travelers.

Air Freight Demand Increases With E-Commerce Trend

According to a recent UPS study, online shoppers are increasingly looking to international vendors when shopping. The e-commerce trend places pressure on air freight, as shoppers look for fast delivery times. The increase in demand could lead to rate increases and capacity shortages.

Trucking Market Updates

Shipments Move From Highways to Rails

As trucking companies struggle to recruit and retain drivers, businesses are turning to railroads to move their products.

While rail is typically cheaper, it is also slower, which means it can’t be used for many time-sensitive goods. But with spot-market trucking prices up, shippers with costs on their mind are using rail to move goods that aren’t time-sensitive.

In an attempt to keep up with the rapidly growing demand in U.S. freight, trucking companies are seeking new drivers, and ordering big rigs at a record pace.

High Freight Costs Affect Earnings at Big Consumer-Goods Companies

The Coca-Cola Co. North American division reported that freight costs were up 20% from a year ago in the first quarter. This mirrors what manufacturers and retailers across the nation are seeing, as increased transportation costs affect first-quarter earnings.

Why is capacity tightening? Many attribute the limited space to bad weather, high turnover among truck drivers, and the ELD mandate. “It’s really coming from the trucking industry and…the new electronic logging-device rules and driver shortages,” says Hasbro Chief Financial Officer Deborah Thomas.

As shippers compete for a limited amount of trucking capacity, many expect the issue to persist through 2018.

The Electronic Logging Device (ELD) Mandate: What You Need to Know

LA-LB Terminals Agree to Restructure PierPass Program

Agreeing to restructure the 13-year-old PierPass program, Los Angeles-Long Beach marine terminal operators will reduce the traffic mitigation fee to $31.52 per TEU, a 55% reduction.

Assuming the Federal Maritime Commission approves the restructuring, the new pricing will take effect in August 2018.