Market Update

Market Update: February 28, 2018

Ocean and air freight rates and trends for the week of February 28, 2018.

Market Update: February 28, 2018

Want to receive our weekly Market Update via email? Subscribe here!

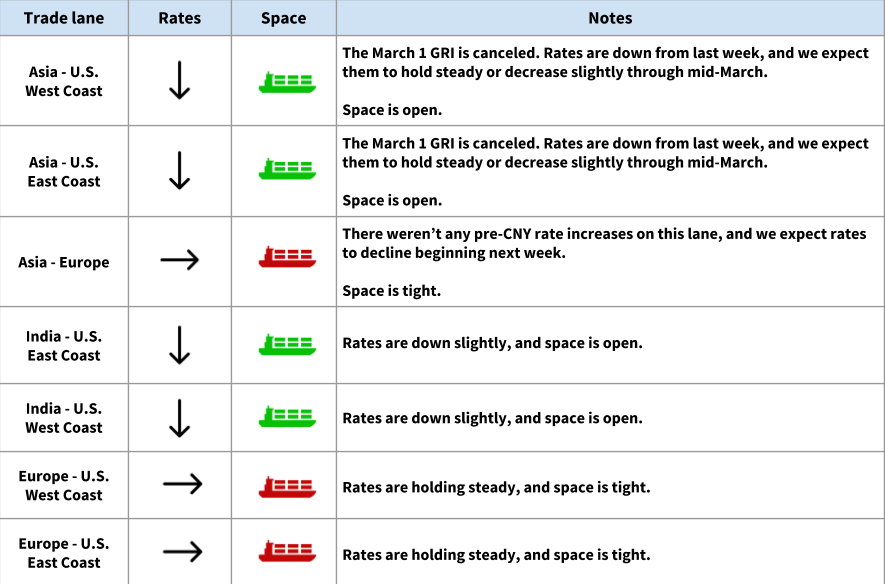

Ocean Freight Market Updates

March 1 GRI is canceled; March 15 GRI postponed to March 18

Carriers have canceled the March 1 GRI, and rates are down from Asia and India to the U.S. The March 15 GRI has been postponed to March 18.

We expect rates to hold steady or continue declining slightly through the middle of the month.

Asia - Europe rates are holding steady, continuing the stable pattern we’ve seen since the beginning of 2018. We anticipate that rates will decline from mid-March.

ONE launches April 1

ONE (Ocean Network Express) will officially launch on April 1. The new line represents the integration of the three major Japanese carriers: MOL, NYK, and ‘K’ Line.

New services will be announced, and we’ll see changes to some strings served by THE Alliance -- different ports of call, and more capacity to the Southeastern U.S.

Stay tuned for more details!

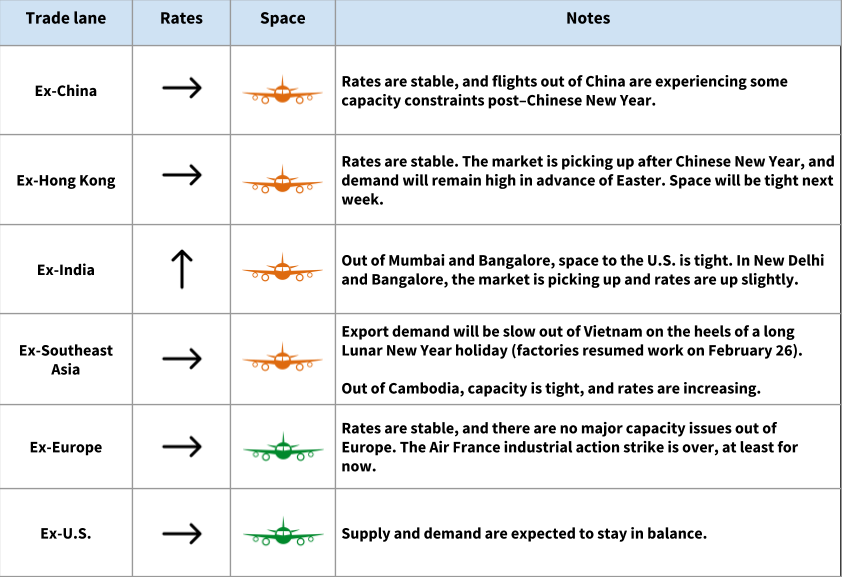

Air Freight Market Updates

Air freight traffic will continue growing, albeit at a slower pace than 2017

IATA reports that global air freight traffic grew 9% year-over-year in 2017 (which will be no surprise to anyone who shipped last year, and experienced the high rates and capacity crunch of the supply/demand imbalance).

In 2018, IATA predicts growth of 4.5% -- slower but still plenty robust.

The Loadstar notes that many airports and air cargo facilities are ill-equipped to handle this growth. “The surge in traffic during the peak season overwhelmed airports, including some of the large gateways, exposing inadequate cargo capacity. As demand is forecast to remain strong, the pressure will only increase in the near future.”

Air freight surcharge out of HKG is up to $0.27/kg

Air carriers are raising the fuel surcharge for cargo out of HKG again, from $0.21/kg to $0.27/kg. They adjust the fuel surcharge periodically, depending on the price of crude oil.

Trucking & Intermodal Updates

Trucking still very constrained in the US and Canada

Several factors have converged to make this a tough season for trucking -- rates are high, and in some markets, it can take days to secure a pickup.

Import volume is up and ports are congested -- and, at the same time, capacity has been removed from the market due to the ELD mandate (which is also contributing to longer transit times). On top of that, there’s a significant driver shortage, and trucking companies are struggling with retention. New capacity is being added, but not quickly enough.

Winter weather throws another wrench into the situation. Snow halted most truckers in Minneapolis late last week, and flooding in Dallas caused road closures and delays.

Even ocean carriers, who have traditionally secured favorable contracts and rates with trucking companies, are feeling the pinch -- some carriers are increasing their inland tariffs, or shying away from store-door contracts altogether.

Drayage in the Midwest is especially tight

Congestion at Midwestern rail ports has led to solidly booked drayage providers and chassis shortages. In particular, tri-axles for heavy loads are in short supply.

Significant delays in Canada

Extreme or prolonged cold causes big problems for trains, which rail lines attempt to mitigate by running shorter trains. Unfortunately, this results in backlogs and delays in many cold-weather areas during the winter months, and right now it’s hitting Canada pretty hard. If you’re routing through Vancouver or Toronto, in particular, you’re likely to experience delays.

‘Unprecedented’ rail and drayage delays in Chicago

This week’s JOC notes major intermodal and trucking delays in Chicago, so severe that “some motor carriers will not accept new customers until April.”