Market Update

Market Update: January 24, 2018

Ocean, air freight, and trucking rates and trends for the week of January 24, 2018.

Market Update: January 24, 2018

Want to receive our weekly Market Update via email? Subscribe here!

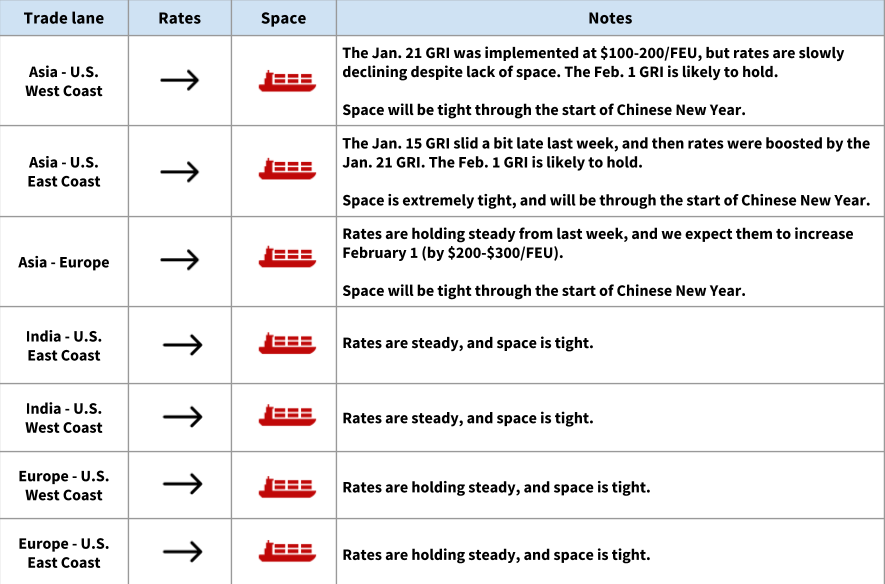

Ocean Freight Market Updates

The January 21 GRI was weaker than expected

Carriers implemented the January 21 GRI at $100-$200/FEU for both USWC and USEC. USWC rates have, in many cases, slid back to last week’s rates (and on some lanes, especially to the Pacific Northwest, rates are a bit lower).

The February 1 GRI will hold; PSS also announced

With demand ratcheting up in advance of Chinese New Year, we expect the February 1 GRI to stick. Carriers have also announced a PSS for February 1.

Space is tight, and will stay that way through Chinese New Year

Chinese New Year will begin on February 16. Factories in China will be closed and/or operating at diminished capacity for at least 4 weeks around that time.

Because of increased demand, space will be more difficult to secure through the start of Chinese New Year.

If possible, share a forecast with your Flexport team so that they can help secure space in a crowded pre-CNY market. For more Chinese New Year preparation strategies, click here.

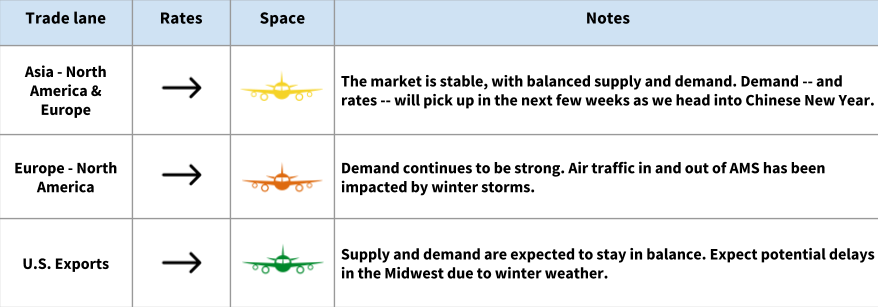

Air Freight Market Updates

Rates are stable this week, but demand is increasing

For now, supply and demand are in balance, but we’re already seeing significant increases in demand for cargo ex-China. Demand -- and rates -- will continue to rise as we approach Chinese New Year.

Capacity will be constrained to both the US and the EU.

As for South Asia, we’re noticing that space is especially tight out of New Delhi.

2017 was a huge year for air freight, and 2018 will stay very strong

Last year, the air freight market had its strongest year since 2010, and momentum has been strong coming into 2018. As e-commerce continues to grow, rates and demand will stay high.

Get ready for Chinese New Year

Share a forecast with your Flexport team, so that we can help you secure space. Air capacity is already constrained, and ocean-to-air conversions will exacerbate the issue as we approach Chinese New Year.

Trucking Market Updates

Trucking rates are up, and capacity is constrained

A number of factors are converging to drive up trucking rates and tighten capacity: winter weather conditions, the recently implemented ELD mandate, growing import volume at U.S. ports, and nationwide driver shortages. This means delays, and often extra fees, for importers.

We recently wrote a detailed account of the drayage situation at major U.S. ports -- check it out here.

Long wait times at Charleston, Jacksonville, Norfolk, and Savannah

Congestion is severe at the ports of Charleston, Jacksonville, Norfolk, and Savannah, with drivers reporting long wait times (in the case of Norfolk, these are stretching as long as 3-5 hours).

Chassis shortages in Dallas, Newark, New York, and Oakland

We’re seeing chassis shortages at the ports of Dallas, Newark, New York, and Oakland. If your cargo is routing through any of these ports, you may experience delays or chassis split fees.