Market Update

Market Update: January 10, 2018

Ocean and air freight rates and trends for the week of January 10, 2018.

Market Update: January 10, 2018

Want to receive our weekly Market Update via email? Subscribe here!

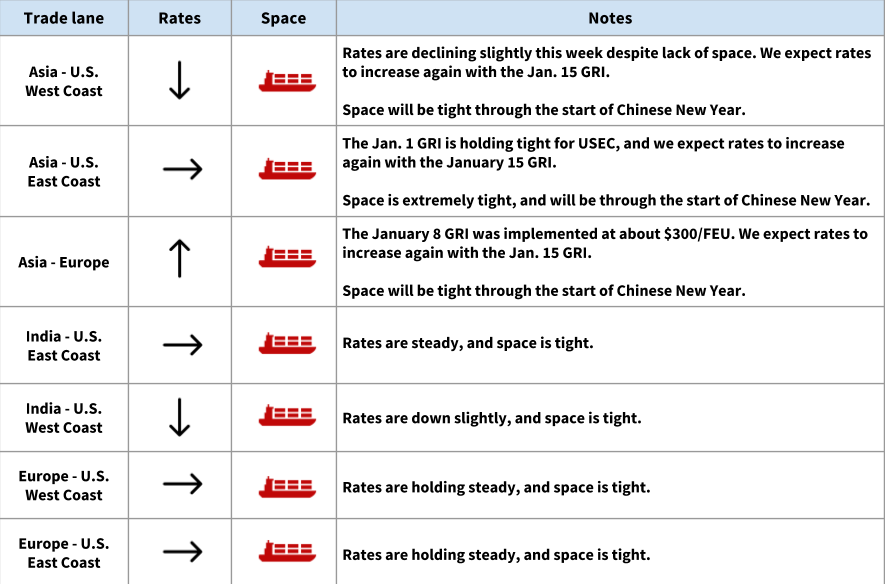

Ocean Freight Market Updates

The January 1 GRI is holding for USEC, eroding slightly for USWC

The January 1 GRI was implemented at $400/FEU for Asia <> US East Coast, and it’s holding steady. Space is extremely tight to the USEC.

Despite the lack of space, rates are declining to the US West Coast. The January 1 GRI, which was implemented at $300/FEU, has slipped a bit this week.

Expect increases with the January 15 GRI

The January 15 GRI has been announced at $1,000/FEU. We will be monitoring the level of implementation closely.

Carriers have also announced a GRI and PSS for February 1.

As Chinese New Year approaches, space becomes more constrained

Chinese New Year will begin on February 16. Factories in China will be closed and/or operating at diminished capacity for at least 4 weeks around that time.

Because of increased demand, rates will stay up and space will be more difficult to secure -- both trends that will continue through the start of Chinese New Year.

Prepare for Chinese New Year

These strategies can help keep your supply chain moving in advance of Chinese New Year (CNY):

- If possible, share a forecast with your Flexport team.

- Book your shipments at least three weeks prior to CNY.

- Follow up with suppliers on the Cargo Ready Date -- these can shift frequently since factories are running on maximum capacity.

- If you’re shipping multiple containers, split them among several bills of lading (to reduce impact if your shipment is rolled).

- Consider a service with a longer transit time, which is less likely to be overbooked.

- If your cargo is traveling inland, consider an alternate port of discharge -- this will allow for more options when choosing a sailing.

Check out more ways to prepare here!

Air Freight Market Updates

Ex-Asia, supply and demand are in balance -- for now

There’s plenty of momentum for air heading into 2018, thanks to steady demand for e-commerce products and Chinese New Year. However, for now, rates are down slightly, and we aren’t seeing the severe space constraints that characterized the latter half of 2017.

Demand -- and rates -- will pick up as we approach Chinese New Year

We expect to see higher rates within the next week or two, as demand gets a boost from Chinese New Year (which begins on February 16 this year).

Space constraints out of New Delhi

We’re seeing high demand in New Delhi, and space is tighter than usual.

Get ready for Chinese New Year

Share a forecast with your Flexport team, so that we can help you secure space. Air capacity is already constrained, and ocean-to-air conversions will exacerbate the issue as we approach Chinese New Year.

Other Freight Market Updates

Winter weather delays

Many trucking companies in the Midwest and East Coast are still backed up from last week’s bout of severe weather. There will be more to come -- winter weather is always hard on trucking operations, as it causes mechanical, service, and capacity issues in impacted regions.

CN Rail delays in Canada and the US Midwest

CN Rail has reported severe delays and capacity constraints as a result of severe weather. Trains moving from Toronto through Prince Rupert / Vancouver, and from Chicago into Winnipeg and Prince Rupert / Vancouver are moving more slowly than usual and are running with fewer trains.

If you have cargo routing through any of these areas, expect delays (your Flexport team will keep you posted).