Market Update

Freight Market Update: March 28, 2023

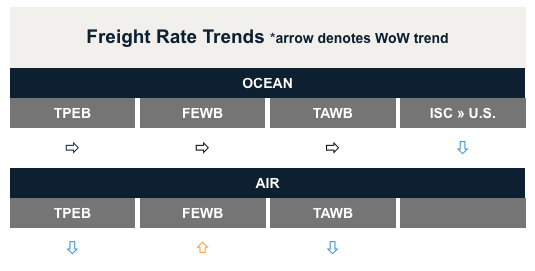

Ocean and air freight rates and trends; customs and trade industry news plus Covid-19 impacts for the week of March 28, 2023.

Freight Market Update: March 28, 2023

Trends To Watch

- [Ocean] Demand on the Far East Westbound (FEWB) lane has been down due to a combination of high inflation, inventory overages, and geopolitical instability—a rebound is expected in early April.

- [Air] Asia-EU routes are continuing to see soft demand, which means rates are down and capacity is up.

- [Air] On Asia-N. America routes providers are adding flights to the schedule, but a true recovery is not expected until Q3 thanks in part to importers still selling through existing inventory.

- [Air] Capacity out of Europe continues to increase, thanks in large part to the ongoing return of regularly scheduled passenger flights.

- Recommendations: For most modes and routes, take advantage of the soft market with widely available capacity and rates mostly in line with 2019 numbers.

Freight Rates

Expert Voices

With the 2023 ocean freight Request For Proposal (RFP) season hitting full stride, we’re expecting to see fixed rates settle, by mid-April, to around 30% higher than current floating rates, which will put them nearly 70% lower than last year.

Overall market conditions in Q2 will dictate which way rates go from there, however we see three scenarios as most likely to take shape. In scenario one, floating rates will remain well below fixed. This could potentially lead to a rash of service cancellations and reductions in capacity as carriers try to close the gap between fixed and floating rates.

Scenario two would see fixed and floating rates coming into rough alignment. This parity between supply and demand would be the closest to what we saw pre-pandemic.

And scenario three has floating rates climbing steadily until they surpass fixed at some point later in the year. This would be the outcome if carriers pull an excess of capacity in response to spot rates dropping too low.

With the end of RFP quickly approaching, our recommendations for those of you still on the fence or without signed contracts has shifted a bit. Keeping in mind the scenarios above, here are six updated suggestions:

- Diversify strategy across fixed and floating contracts. If a portion of your volume stays consistent throughout the year, consider putting that on a fixed contract and playing the spot rate with your more variable volume.

- If you lock rates, choose the most stable corridors with less seasonality, etc.

- If you plan to play the spot market, consider indexed rates. This reduces the headaches of quoting and re-quoting.

- Consider fixed rate levels, seasonality of your product lines, peak season expectations, and commodity type when building your strategy for the year.

- Determine the rate that would hit your financial goals and if the market gets there, sign. If it doesn’t, then decide how to hedge your bets.

- Make sure your rates cover more than 1 shipping line or alliance. Without this diversity you risk seeing reliability that may not be where you want it to be.

For a deeper dive on this and other aspects of the 2023 RFP season, please see our recent blog post Four Winning Strategies for a Successful Transpacific Ocean Freight RFP Season 2023. Or you can watch the on-demand version of our recent Logistics Rewired webinar, Navigating the 2023 Ocean RFP Season.

For more information on how Flexport can help you create a successful RFP this year, please get in touch with our team of experts.

- Nerijus Poskus

Upcoming Webinars

Flexport Platform Demo - North America

Weds, April 12 @ 12:00 pm PT / 3:00 pm ET

North America Freight Market Update Live

Thurs, April 13 @ 9:00 am PT / 12:00 pm ET

The Week In News

Retailers Reaping Big Savings on Ocean Transport Costs

A succinct look at the state of ocean freight contract negotiations this year. Fixed rates have tumbled from last year’s historic highs to near or below 2019’s pre-pandemic rates, leaving many importers to reassess their balance between the reliability of fixed contracts and the potential cost savings of playing the spot market this year. And with many of these importers still swimming in inventory that may have cost them 10x current rates to bring in last year, Kaitlyn Glancy, Flexport’s Head of North America says: “What we’re hearing more and more is the customer is saying, ‘Look, cost is still king for us.’”

Crunch Time for Trans-Pacific Container Shipping Contract Talks

A great write-up of both the current state of ocean freight and the ongoing Request For Proposal (RFP) negotiating season. According to Nerijus Poskus, Flexport’s Vice President of Ocean Strategy and Carrier Development, the next two weeks are critical. And while the final outcome of rate negotiations won’t be known until April, Poskus expects contract rates will be around $300 to $500 per forty-foot equivalent unit above current spot rates.

Read more news summaries like this in our weekly Supply Chain Snapshots

Read More on the Flexport Blog

Four Winning Strategies for a Successful Transpacific Ocean Freight RFP Season 2023

Tariff Engineering: Lower Duties Are Possible if You Can Find the Right Customs Codes

Freight Market Update is a complimentary service from Flexport, the modern freight forwarder. If you're not already a subscriber, we invite you to subscribe here.

Please note that the information in our publications is compiled from a variety of sources based on the information we have to date. This information is provided to our community for informational purposes only, and we do not accept any liability or responsibility for reliance on the information contained herein.