Market Update

Market Update: November 15, 2017

This week's trends in ocean and air freight rates, with extended coverage of peak season and notes about port congestion, chassis shortages, and other freight market news.

Market Update: November 15, 2017

Want to receive our weekly Market Update via email? Subscribe here!

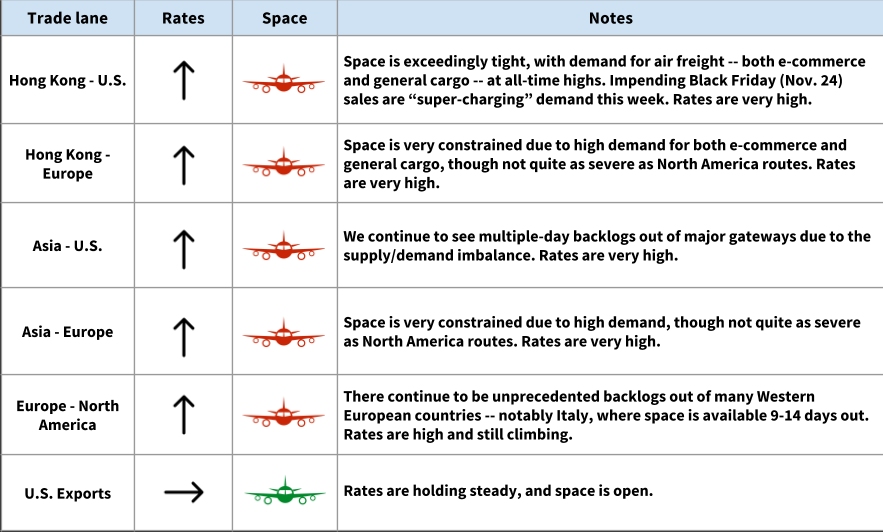

**Air Freight Market Updates **

Demand is High, Rates are High, and Space is Severely Constrained

Black Friday rush is contributing to high prices and space constraints

As we noted last week, capacity issues are severe -- even by peak-season standards. This is continuing a huge year for air freight, in which we’ve seen demand consistently outpace supply.

The issue has been especially bad for the last few weeks, and this week is no different; in fact, it’s compounded by the rush to ship products for Black Friday (November 24). Space is very tight, and rates are high. The latest figures from TAC Index show that average prices from Asia to North America increased by 17.7% year-over-year in October.

Another illustrative statistic, from Cargo Facts: On November 5, HACTL (Hong Kong Air Cargo Terminals Limited) set a new record by handling 102 freighters in a single day, “a figure that most of the world’s airports do not even see in an entire month,” as Cargo Facts noted.

We do expect rates to stay strong next week, but, with so much Black Friday cargo getting pushed out this week, we don’t expect another sharp rate increase before the Thanksgiving holiday.

Uplift delays at major Asia and Europe gateways

Airlines simply can’t keep up with the demand, creating significant backlogs that lead to uplift delays.

Book early, and book direct flights for urgent shipments

Book your air shipments in advance -- at least 10 days before the cargo ready date, if possible.

For urgent shipments, you should also consider booking direct flights. It's more expensive, but direct flights will avoid potential delays at transshipment airports.

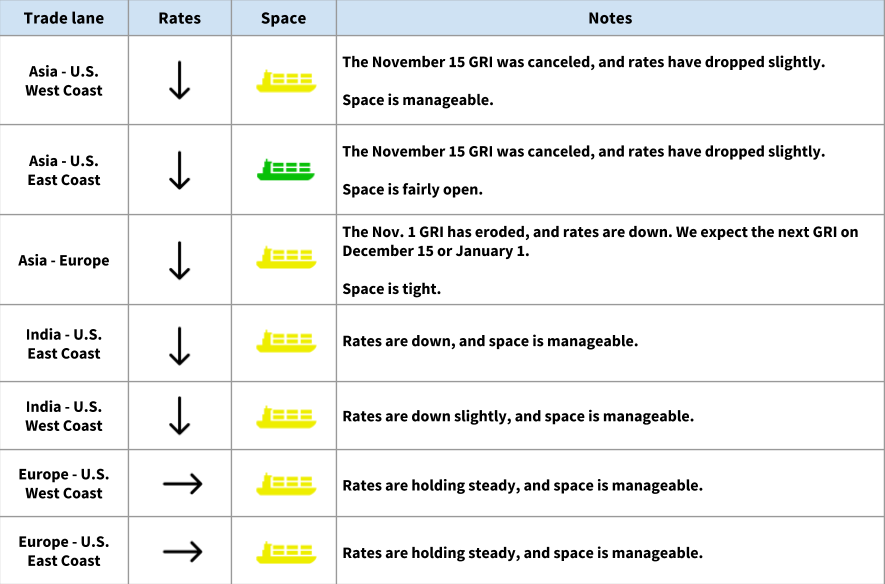

Ocean Freight Market Updates

No GRI for November 15

The Nov. 15 GRI was canceled, and rates to the U.S. are down slightly. Asia - Europe rates are down as well.

Peak season for Asia to Oceania

This is the traditional peak season for Asia to Oceania -- rates are high, and space is very tight. If you’re shipping to Australia, we recommend booking 2 weeks in advance.

Rates will increase in advance of Chinese New Year

Starting in mid-December, we’ll see rates begin to go up in anticipation of Chinese New Year. This will constrain space, too. Expect more GRI announcements for December and January.

Big Q3 growth in container port throughput

The Loadstar reports that global container throughput is up 7.7% year-over-year, the highest growth rate since early 2011.

Other Freight Market Updates

Savannah: congestion and chassis shortage

Savannah continues to see a severe chassis shortage. If your cargo is being routed through Savannah, you may see chassis split fees and/or storage fees if your trucker needs to make an extra trip to pick up a chassis.

The ELD mandate is approaching

Beginning December 18, truck drivers will be required to utilize Electronic Logging Devices (ELDs). This will change the game for long-distance trips, and after implementation, we’ll see a slight increase in rates across the FTL market.

**Fuel tax increase in California **

As of November 1, California has increased its diesel tax to 36 cents per gallon (this is a 20-cent increase). We’re seeing higher fuel surcharges from trucking providers as a result.