Market Update

Market Update: November 1, 2017

Recent news and updates related to the ocean and air freight market for the week of November 1, 2017.

Market Update: November 1, 2017

Want to receive our weekly Market Update via email? Subscribe here!

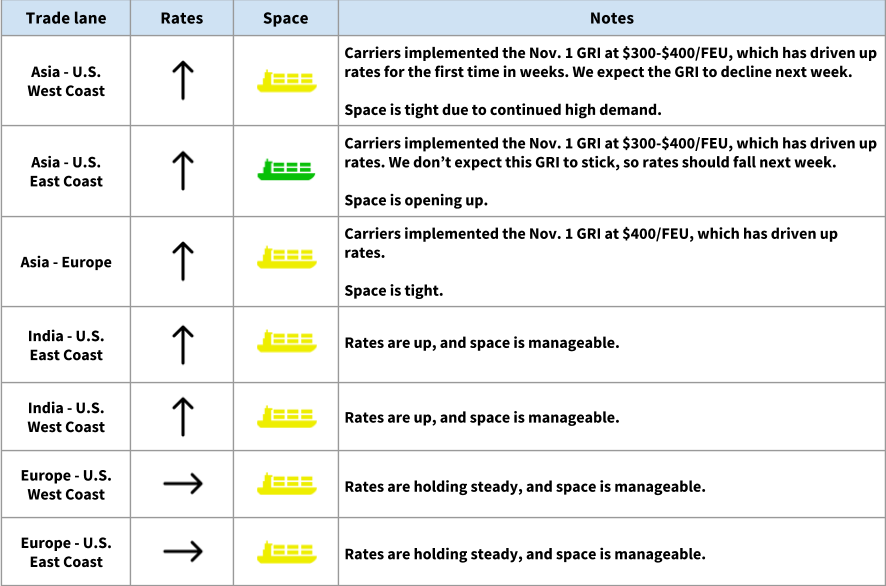

Ocean Freight Market Updates

Rates are up this week

Carriers announced the November 1 GRI at $600/FEU, but wound up implementing it at $300-$400/FEU. This has yielded rate increases for the first time in weeks.

We expect rates to the U.S. West Coast to come down somewhat by next week, and anticipate a more significant decrease to the U.S. East Coast next week.

Rates will increase in advance of Chinese New Year

Starting in mid-December, we’ll see rates begin to go up in anticipation of Chinese New Year. This will constrain space, too. Expect more GRI announcements for December and January.

Congestion and delays at Bremerhaven

Bad weather has caused berthing delays for container ships at the port of Bremerhaven, resulting in a backlog of containers. If your cargo is being routed to or through Bremerhaven, expect delays.

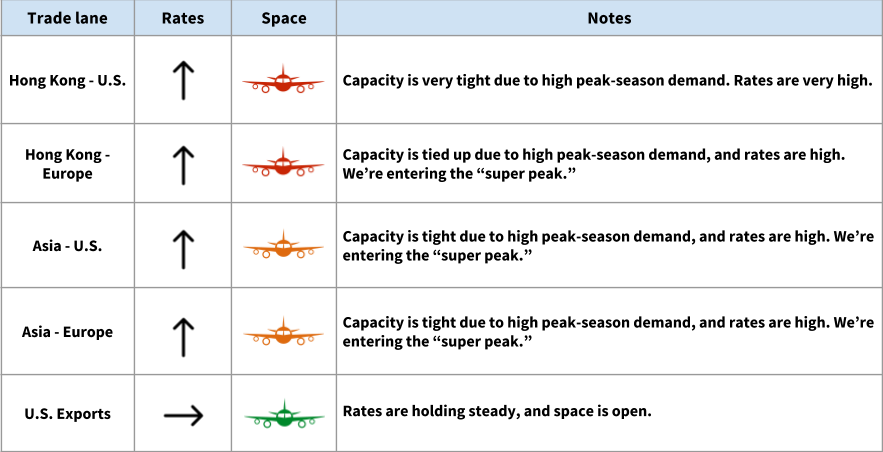

Air Freight Market Updates

The “super peak” is here!

For most of the year, air cargo demand has outpaced supply -- which has kept rates high and capacity tight. With demand even higher during peak season, we’re reaching a “super peak” with extremely high prices and space that’s even more difficult to secure.

Book early, and book direct flights for urgent shipments

Book your air shipments as far in advance as possible! For urgent shipments, you should also consider booking direct flights. It's more expensive, but direct flights will avoid potential delays at transshipment airports.

Another fuel surcharge increase for cargo out of Hong Kong

Air carriers have implemented another fuel surcharge increase for cargo ex-Hong Kong. As of November 1, the fuel surcharge is $0.16/kg, up from $0.09/kg.

Other Freight Market Updates

Customs exams are on the rise in L.A.

We’re seeing a spike in U.S. Customs exams in Los Angeles, due to extra peak-season scrutiny. If your cargo is selected for a hold or exam, you may experience delays or extra fees.

Chassis shortage in Savannah

For cargo being routed through Savannah, you may see chassis split fees and/or storage fees if your trucker needs to make an extra trip to pick up a chassis.

**Fuel tax increase in California **

As of November 1, California will increase its diesel tax to 36 cents per gallon (this is a 20-cent increase). We expect FTL and LTL providers to increase their rates as a result, and we may also see an increased fuel surcharge rate for California drayage providers.

Driver shortages will bring higher costs

In an effort to retain drivers, many larger FTL carriers are increasing driver pay. This will increase costs overall if you’re moving cargo with large FTL carriers.

The ELD mandate is approaching

Beginning December 18, truck drivers will be required to utilize Electronic Logging Devices (ELDs). This will change the game for long-distance trips, and after implementation, we’ll see a slight increase in rates across the market.