Market Update

Market Update: August 15, 2017

Recent news and updates related to the ocean and air freight market for the week of August 15, 2017.

Market Update: August 15, 2017

We publish a market update every week. Subscribe to these updates here!

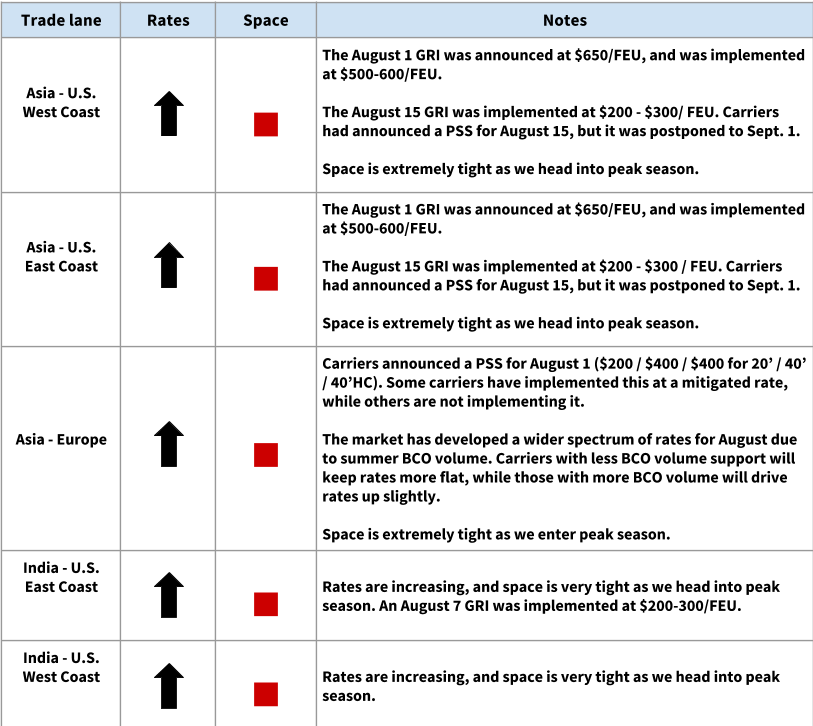

Ocean Freight Rates: August 15, 2017

Peak season is here!

Volumes are up as businesses prepare for the winter holidays, and prices are rising. Space is very tight on all major lanes. As rates fluctuate, keep in mind that Flexport rates are always inclusive of GRI and PSS.

How can I keep things running smoothly during peak season?

- Plan ahead. Book as far in advance as possible.

- Forecast. Talk to your Flexport team about your forecast -- the more information, the better (especially number / size of containers, ports of loading and discharge, and cargo ready dates).

- Spread out containers. Don’t put too many containers on a single bill of lading (this way, if a shipment is rolled, it affects fewer containers).

- Consider other services. Slower or less commonly used services are less likely to overbook, and less likely to roll. (The transit time may add a few extra days, but it’s better than being rolled from a faster service and waiting a week for the next sailing.)

- Be flexible about the port of discharge. If your cargo is traveling inland, consider other options for the port of discharge. This may make for a slightly longer transit time, but it will provide more options when your Flexport team is choosing a sailing.

For more peak season tips, check out our webinar on preparing for peak season.

The Panama Canal has recovered a lot of all-water traffic from Asia to the US East Coast

An Alphaliner analysis shows that Asia - US East Coast traffic through the Panama Canal has increased since the canal was widened last year. (USEC transit times via the Panama Canal are faster than going through the Suez Canal.)

Look for more Asia-USEC services to go via the Panama Canal next year, as capacity continues to increase along this route.

THE Alliance announced a member bankruptcy contingency plan

THE Alliance (one of the three ocean carrier alliances) has created a fund to continue operations (e.g. dock at terminals, unload ships, etc.) in the case of financial insolvency of any member. This safeguard is being put in place to avoid the type of situation we saw last year with the Hanjin bankruptcy.

Air Freight Market Updates: August 2017

Prices are high, and space is tight

As we’ve noted in previous updates, this has been a huge year for air freight -- rates have stayed high and will rise further in peak season. Demand has continued to outpace supply.

The trans-Pacific air market, in particular, is very strong; for example, United Cargo’s revenues were up 22% year-over-year as a result of increased volumes.

Hot weather in Northern China contributes to the crunch

It’s been very hot in Northern China recently, which has resulted in delays and offloaded cargo out of PVG. This contributes to the capacity crunch that has been keeping rates high.

Note: Hotter air is less dense; less density impacts an airplane’s ability to lift. This means that in hotter weather, a plane must be lighter in order to take off, which may result in more offloaded cargo and more grounded flights if temperatures continue to rise.

**China and Taiwan: project cargo is filling up planes **

Back-to-school products and other project cargo are taking up a lot of space in planes out of China and Taiwan. This will keep putting a strain on capacity throughout August.

Rates are expected to stay strong and volatile in Eastern China (including Shanghai). Rates will be a bit more stable out of Southern China.

Hong Kong: still busy

HKG has been operating at capacity, supporting exports out of Southern China. Rates are expected to stay strong out of HKG.

Other Freight Market Updates

Flexport LCL service: new lanes added

In Northern Europe, Flexport’s in-house LCL service has expanded to include Rotterdam and Hamburg (from China base ports). New inland U.S. destinations include Minneapolis and Salt Lake City.

Check out all of the Flexport LCL lanes here!

Los Angeles / Long Beach: Pier Pass fees have increased

As of August 1, 2017, the Pier Pass fee charged by the ports of LA/LB has increased. The fee is now $72.09 per 20’ container, and $144.18 per 40’ container.

Chicago: CN Harvey rail ramp is short on chassis

The CN Harvey rail ramp in Chicago is experiencing a chassis shortage. This will affect cargo that’s routed through Chicago from Vancouver or Prince Rupert -- you may see chassis split fees and/or storage fees if your trucker needs to make an extra trip to pick up a chassis.

Congestion at JFK, ORD, ATL, and LAX

There is major congestion at JFK, ORD, ATL, and LAX, with truckers reporting long wait times to pick up cargo (we’ve heard of wait times as long as 6 hours at JFK). This may mean delivery delays and trucking wait fees if your cargo is moving through one of those four airports -- and we expect the congestion to become more severe as peak season continues.

New Jersey: APM terminal is still restoring service

Last month’s Petya cyberattack caused temporary closures of APM terminals worldwide. The APM terminal in New Jersey is still not 100% operational, so there’s quite a bit of congestion at the port of New Jersey and at that port’s APM terminal specifically.