Market Update

Freight Market Update: March 4, 2020

Ocean and air freight rates and trends; customs and trade industry news for the week of March 4, 2020.

Freight Market Update: March 4, 2020

As the COVID-19 outbreak continues to spread, the effect is being felt throughout supply chains as they try to get back into swing following Chinese New Year. The key question is whether the revival will come fast enough to head off financial distress. To learn more about the ripple effects on the economy, read our latest blog.

Want to receive our weekly Market Update via email? Subscribe here.

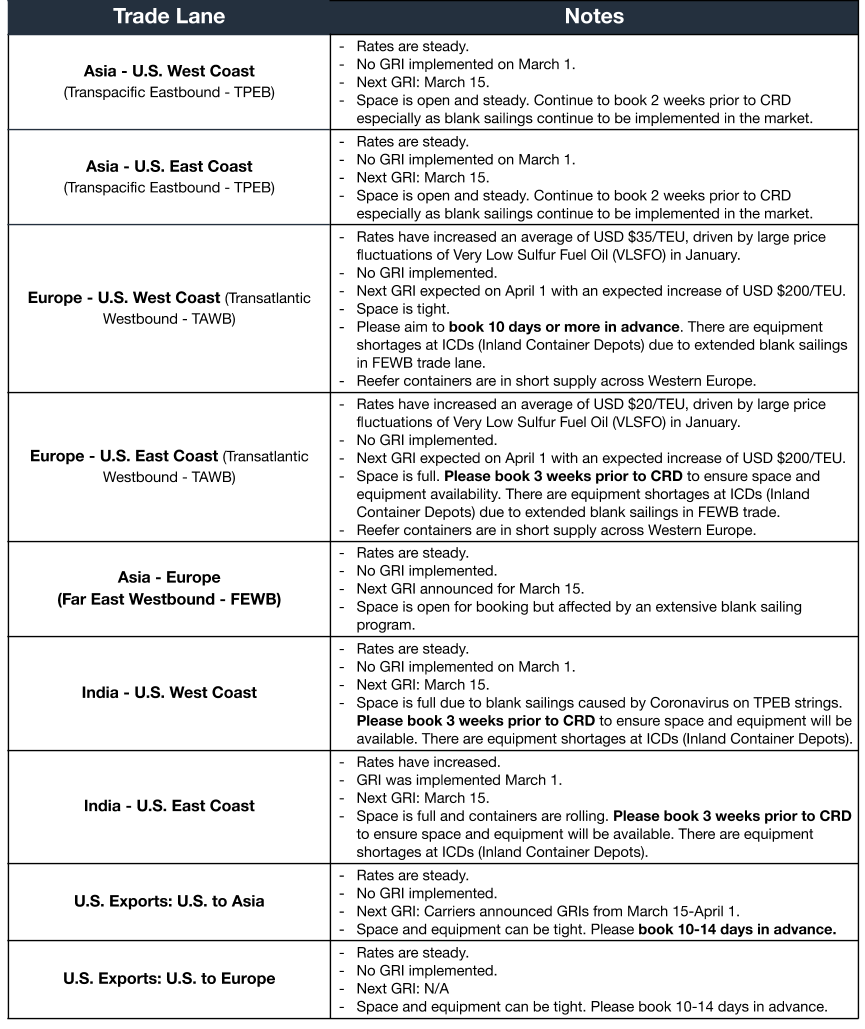

Ocean Freight Market Update

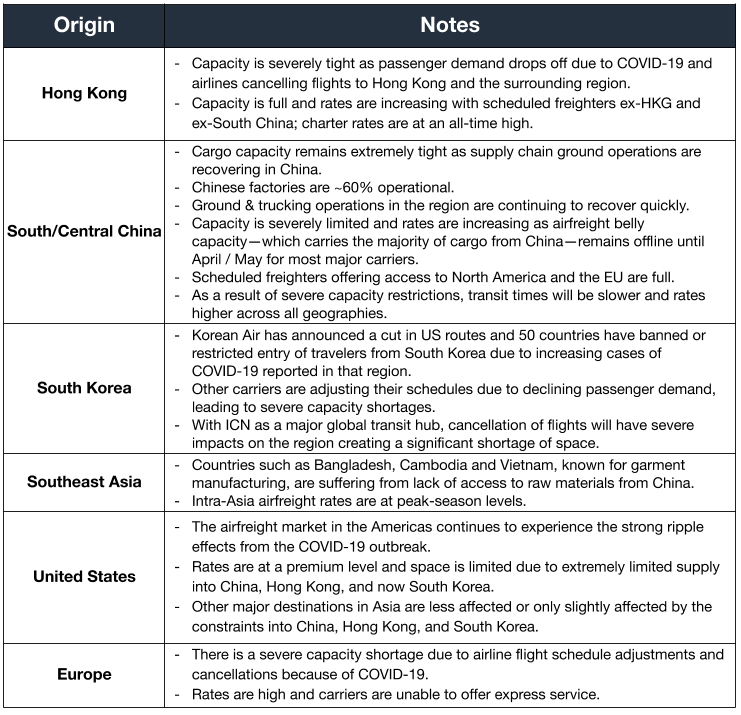

Air Freight Market Update

Freight Market News

Just-in-Time Supply Chains Struggle As Coronavirus effects cascade, US companies that rely on a just-in-time supply chain are feeling the hit. The Financial Times reports cargo volumes in US ports are likely to drop by 20% or more during Q1 2020—an economic impact in the tens of billions of dollars—reducing raw-material and component availability for the apparel, automotive, and electronics industries.

Chinese Fuel Demand Plummets With China’s marine fuel sales down 30-50% in February due to Coronavirus fallout, Asian prices for very low-sulphur fuel oil (VLSFO) have tanked in tandem. The price drop, points out Hellenic Shipping News, is an upset after predictions of a fuel-availability squeeze post-IMO 2020. Chinese refiners have responded by cutting crude throughput.

Meanwhile, this week, Flexport Chief Economist Dr. Phil Levy noted the following economic highlights:

The S&P 500 index fell last week by 11.5%, its biggest decline since 2008 and one of the worst weeks on record. The equity market declines—linked to growing fears about Coronavirus—were not limited to the United States: The main British index fell 11%, German 12%, and Japanese 10%.

Money flowed into safe-haven assets, especially Treasury bonds, where US benchmark 10-year yields closed at a record low of 1.127% (yields fall as bond prices rise).

- The Trump administration reportedly discussed policy options including tax cuts, tariff relief, or pressure on the Fed to cut interest rates, which it did on Wednesday. There are problems with each tactic as short-term economic stimuli:

- Tariff relief would be welcome, but does less if supply chains are not functioning.

- Tax cuts are difficult to enact quickly and are channeled into savings if people are not inclined to spend, providing little economic boost.

- Fed interest rate cuts have historically worked with “long and variable lags” of perhaps 18 months.

- US GDP growth was confirmed at a 2.1% rate for 2019 Q4, though there was a downward revision to consumer spending. At the week’s start, Goldman Sachs cut its 2020 Q1 GDP forecast to 1.2%, with “risks skewed to the downside.”

- A Chinese Manufacturing Index fell dramatically to 35.7 in February from 50 in January, indicating a sharp contraction.

Customs and Trade Updates

APHIS Issues Final Rule for De Minimis Exception on Lacey Act Requirements

The Animal and Plant Health Inspection Services (APHIS) published a final rule which will allow importers with a minimal amount of plant materials in their goods to avoid submitting a Lacey declaration—a formality that serves to collect information regarding the content of shipments, to combat illegal trade in timber and timber products. APHIS settled on 5% or less of the weight of the individual product unless its plant material is over 2.9kg. The rule will be effective starting on April 1, but CBP warns that adding in the de minimus exemption into ACE may take longer than the proposed start date.

Successful Blockchain Testing on IPR

On February 28, CBP issued an announcement that they had successfully tested blockchain use, specifically in ways to help with intellectual property rights (IPR) protections. “This pilot represents great potential for marrying new technology with our traditional trade mission, to protect the US economy,” said Brenda Smith, Executive Assistant Commissioner of CBP's Office of Trade. The test showed that blockchain helped participating parties achieve more security and visibility regardless of the software being used. Adoption of blockchain could potentially optimize efficiency and lower inspections on goods that have used proper channels for acquiring their IPR.

For a roundup of tariff-related news, visit Tariff Insider.

Also, pre-register now for FORWARD 2020, a three-day event that brings together the greatest minds in global trade for ideas and insights to advance the industry.